PayPal | Q2-24 Earning & Call

Can the market still burry his head in the sand?

The investment case for PayPal was simple and detailed here.

A growing company, pivoting to new & more efficient services leveraging a strong and growing user base with a beaten stock as the market doesn’t expect anything anymore.

The last quarters were correct and showed improvements but the market didn’t care and found excuses. Seems like it will be harder to find new ones after this one.

Overview. Things aren’t just getting better, they’re getting good.

EPS. $0.89 | $1.19 | +33.71% beat

Revenue. $7.14B | $7.89B | +10.43% beat

$1.5B of buybacks.

"We delivered our best transaction margin dollar growth since 2021, and we are making steady progress on our strategic transformation, while investing in innovation and operating more efficiently."

Business.

Let’s start with usage as once more, data shows the company’s apps are used more & more. Active accounts are back to growth but again, this doesn’t really matter as what we want are users spending, not just users transferring money to their friends. The number of transactions grew big time YoY and reached its second highest value - just under the Christmas quarter, which is an unfair comparison. TPV is strong, growing double digit to a new ATH above $400B for the third quarter in a row.

But the most significant data for PayPal’s usage is the Transaction Per Account which is also at a new ATH with almost 61 transactions per user. PayPal and its applications aren’t dying, far from it, and this part of its business is what makes it unique while many competitors only focus on payment processing - this is what allows PayPal to leverage its data, data that no one else has.

“However, I do not want to lose sight of what makes PayPal truly differentiated, our two-sided network of hundreds of millions of consumers and merchants worldwide. The data insights and compounding network effects, give us an incredible advantage that we are now just beginning to harness fully.”

We could have expected stronger growth in terms of TPV but we start to see the first signs of weaker consumers lately, as mentionned in the last weekly with the banks earnings. The high-interest period we’re living in combined with stronger inflation leaves less money for pleasures, which translates into fewer expenses for the lower income class.

This trend should continue over the next months as even if inflation is back to normal, it should take some more months to lower interest rate and ease the burden of those extra costs on families.

Margins. On to the second most important data for PayPal’s business.

A pretty good new as we’re back to QoQ growth here after a year of decline - although we’re still down 19bps YoY. This should (and has to) be the bottom as Alex announced the “end” of the fee war even for lower margin services like Braintree - and announced tons of new services & products which should raise margins over the next quarters.

“Braintree is now meaningfully contributing to transaction margin dollar growth for the first time in over two years.”

This is going exactly as he said when he took over the company.

New Products. Those results are mostly thanks to an improvement of PayPal's core business and not because of the new products the company is working on or has already released. The main one, Fastlane, will be globally released in August in the U.S.

“I'm pleased to announce that in August, we are delivering on that commitment and making Fastlane generally available to merchants in the US. This includes merchants on Braintree and PPCP, as well as through partners, including Salesforce, Adobe, and BigCommerce.”

Alex also confirmed once more that we’re talking about an 80% conversion rate compared to an industry average around 50% - that is, with their test pool. But it isn’t the only new product to launch, and other tests, like with in-app advertisements & promotions, are doing well so far.

“In the second quarter, we launched in-app offers with major brands including Best Buy, Priceline, Lyft, Instacart, Ticketmaster, Walmart, and Nordstrom. We are seeing positive trends in consumer engagement with gross merchandise volume driven by one of our offers nearly tripling in June compared to March. And while still early days, the initial interest from advertisers is encouraging.”

I think it’s right to expect that PayPal will do even better once those are globally released and when management is focused on monetization - few quarters from now.

Revenues.

There isn’t much more to comment here besides stable expenses & lower share count thanks to massive buybacks.

$1.5B this quarter and $5B on a trailing 12-month basis, which means a -6% weighted share count YoY which is simply massive as the stock kept trading around the same value during the period. And the tendency should continue.

We close this quarter with another strong balance sheet of $6.1B of net debt and an FCF of $1.4B.

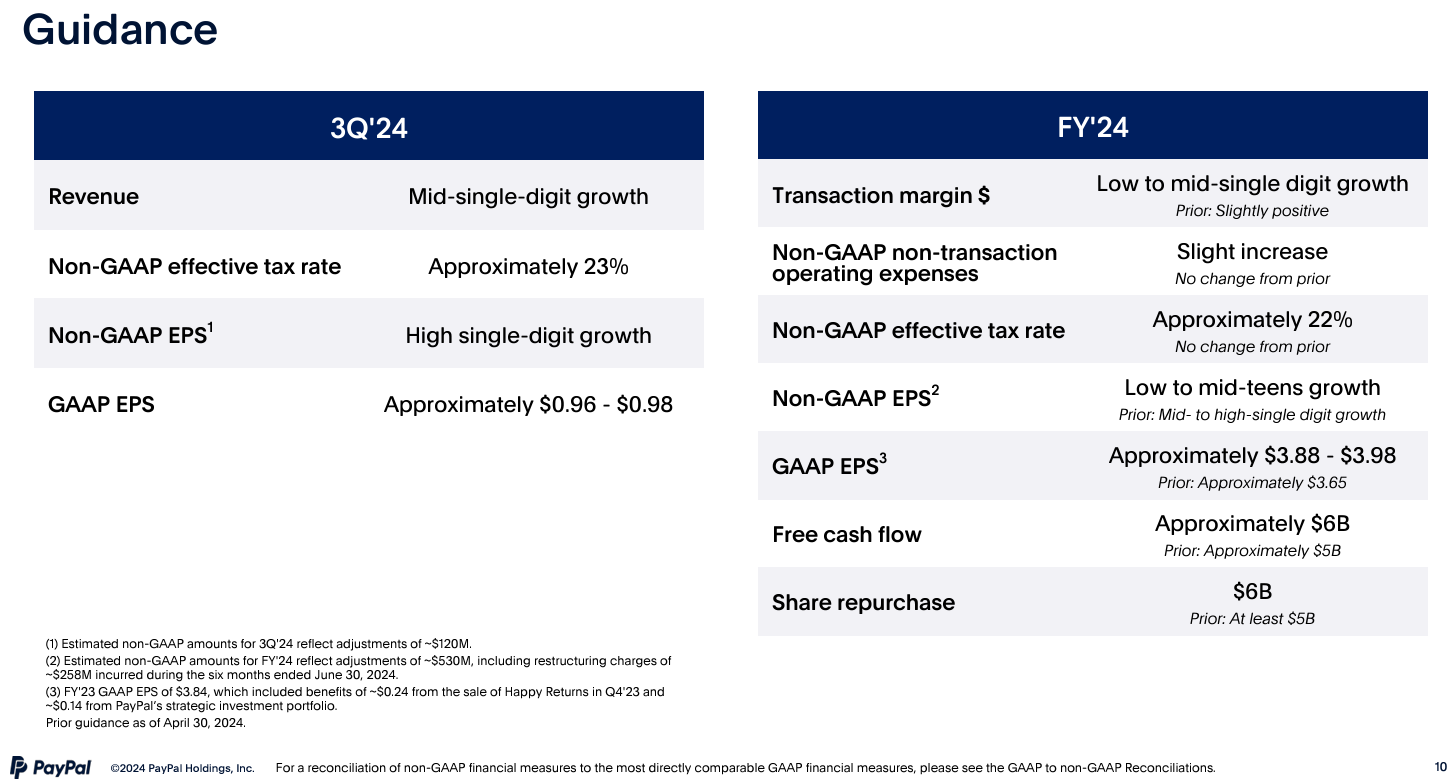

Guidance.

A good quarter wasn’t enough, PayPal is also raising FY-24 guidance with growing margins YoY - meaning above 45.8%, higher EPS and more importantly, a bigger cash flow & buyback plan - both around $6B.

The Q3-24 guidance is in line with most expectations with correct and constant revenue growth coupled with a stronger EPS growth due to stronger buybacks for the period.

Besides guidance, Jamie & Alex did some comments during the call about future expenses, notably a focus on marketing during the second semester which would, of course, impact operating margins while the roll-out of their new products could also incur some unexpected costs - which is why no impacts are included in the guidance from those products.

My Take.

It’s very hard not to be satisfied with this quarter and it will get harder for the market to continue telling itself that PayPal is a dead company without any future.

This quarter showed that the company’s applications are still used and attractive, that the core business’ margins were an issue but that this is fixable with a strong hand and good execution, and that the company had lots of tools that it could leverage to develop new services - which once more, were not yet really impactful this quarter nor even included in the guidance. PayPal will be a better business when those are live and running while its core services will continue to be optimized.

I will let Jamie conclude this review as she concluded the call because I think her words were pretty good and summarize the situation perfectly.

“Thank you all today, and thanks Steve. Just to close the call, company is energized. We are proud of what we've accomplished, just to again, sort of step -- set the context of where we are. We are really six months in. We've got a new leadership team. We are getting stronger every day. We've returned the company to transaction margin growth. We've returned the company to a consumer user growth.

We significantly improved profitability at Braintree, and we are accelerating Venmo. And so I just feel really proud that we are stronger today than we were six months ago, and we will be stronger six months from now than we are today. And we are executing against our game plan. This will be measured in quarters and years. So it will be a long game, but six months in, we are on the right trajectory. So thank you all for today and see you next quarter.”

What’s the excuse now?