PayPal Q1-25 | Earning & Call

Better than it looks.

The undervalued trade on PayPal is detailed here, and is still true today.

Alex Chriss resumed it again.

“PayPal is transforming from a payments company to a commerce platform.“

Overview.

The quarter is better than it looks as PayPal is going through a transformation which can’t really be seen in the data yet - although many wish it would.

Revenue. $7.84B | $7.79B | -0.63% miss

EPS. $1.16 | $1.33 | +14.66% beat

$1.5B of buybacks.

As I said, it is better than it looks - as it doesn’t look anything special.

Business.

This quarter, the last one & probably the next ones can be resumed by management’s wish to focus on their best assets, even if it means losing some volume.

“As we’ve discussed throughout the past year, the shape of this growth is intentional. We are prioritizing healthy, quality growth within our Braintree business and have made deliberate choices to shift away from unprofitable volume. Shifting away from this volume pressures gross revenue but is accretive to transaction margin dollars and should result in more than one point of TM benefit this year. We continue to expect this benefit to build over time as we drive more value-added services.”

This explains the numbers above: A lower TPV growth & a decline in transactions per account - worth noting that TPV was impacted by the strong dollar. Data seems to point towards a decline in usage but it is a bit more complex than this: a growing usage on some part & a complete loss of volume on others.

Branded solutions’ volume are growing healthily while Braintree’s volume is declining which ends up balancing itself in the global overview.

Braintree would be included in the third line, which is clearly decelerating while the rest seems to be stable at best, some accelerating. The process will take time and numbers won’t look perfect until it is done.

Their new branded products are starting to be rolled out massively with 45% of their U.S. checkout now done through them & the plan to expand them all in Europe - U.K. & Germany which are two large user bases, this year. By new product, we are talking about their new checkout design, Fastlane, advertising business, cashback etc… What PayPal is now entirely focusing on.

Their card business is growing an almost triple-digit in terms of debit card demand.

“Adoption is strong and growing with approximately 2 million first-time PayPal and Venmo debit card users in the quarter, an increase of nearly 90% from last year […] Venmo debit card monthly active accounts grew nearly 40% and penetration has increased to 6% of Venmo MAAs.”

Lots of room left.

It is part of management’s global strategy to offer to their users payment methods for everything. Online, offline, BNPL etc… And create a positive halo between all of their services. A halo which starts to show up.

“we are encouraged to see signs that both consumers and merchants are expanding how and where they use PayPal [...] What’s exciting is, though, that halo effect, so we’re starting to see that debit card users have a 5.5% to 6% lift in transaction activity and over 2x increase in average revenue per active user, versus just a checkout only.”

This should snowball as those services continue to be deployed.

In brief, the entire branded suite is very healthy, users seem to love it & do not reduce their usage, merchants are convinced & adopt new tools and everything is growing well. No fireworks, but healthy growth.

“In Q1, we delivered our fifth consecutive quarter of profitable growth with transaction margin dollars growing by 8% […] In Q1, branded experiences TPV grew 8% excluding last year’s leap day.”

&

“Starting with win checkout, online branded checkout TPV, including PayPal and Pay with Venmo, grew nearly 6% this quarter. We’re proud of this growth and expect it to increase over time as more traffic flows through our upgraded experience.”

And it shows in the margins.

This quarter brought the biggest YoY growth in percentage as the focus on profitable business is working. Less total volume & higher margins ends up with flat growth. It will just take time to find the threshold where focus on profitable business will push PayPal toward a better company, and the numbers won’t look very good until then. But once done, the snowball could be interesting.

Rapid word on their stablecoin business which as you know, I am structurally very bullish on as I believe stablecoins will become an alternative to Visa & Mastercard. Although I prefer Circle & am waiting for their IPO, PayPal is the only publicly traded company proposing those services for now.

They are working on growing adoption by paying yields to holders of the PYUSD and working with crypto platforms to make it available to most. It is early & not showing results yet, but important to monitor.

More rapid words on the economy, tariffs & co. Many comments about a stable & strong consumption, without any change in behaviour, except one which is terrifying me - but I might be biased on simply European & have a different perception.

“What we’re seeing is that as we improve the presentment of the BNPL and checkout, it’s being selected more often. In Q1, the BNPL volume grew more than 20% and monthly active accounts grew 18% YoY […] As a reminder, the BNPL users spend 33% more on average and conduct 17% more transactions.”

Alex clearly said that BNPL was more & more used and part of the reason for stable consumption. I personally do not call that a stable consumption & users do not use BNPL because it’s fun, they use it because it allows them to buy things they couldn’t afford otherwise, pushing their funding problem to next month.

This, to me, isn’t what a healthy economy & consumption looks like.

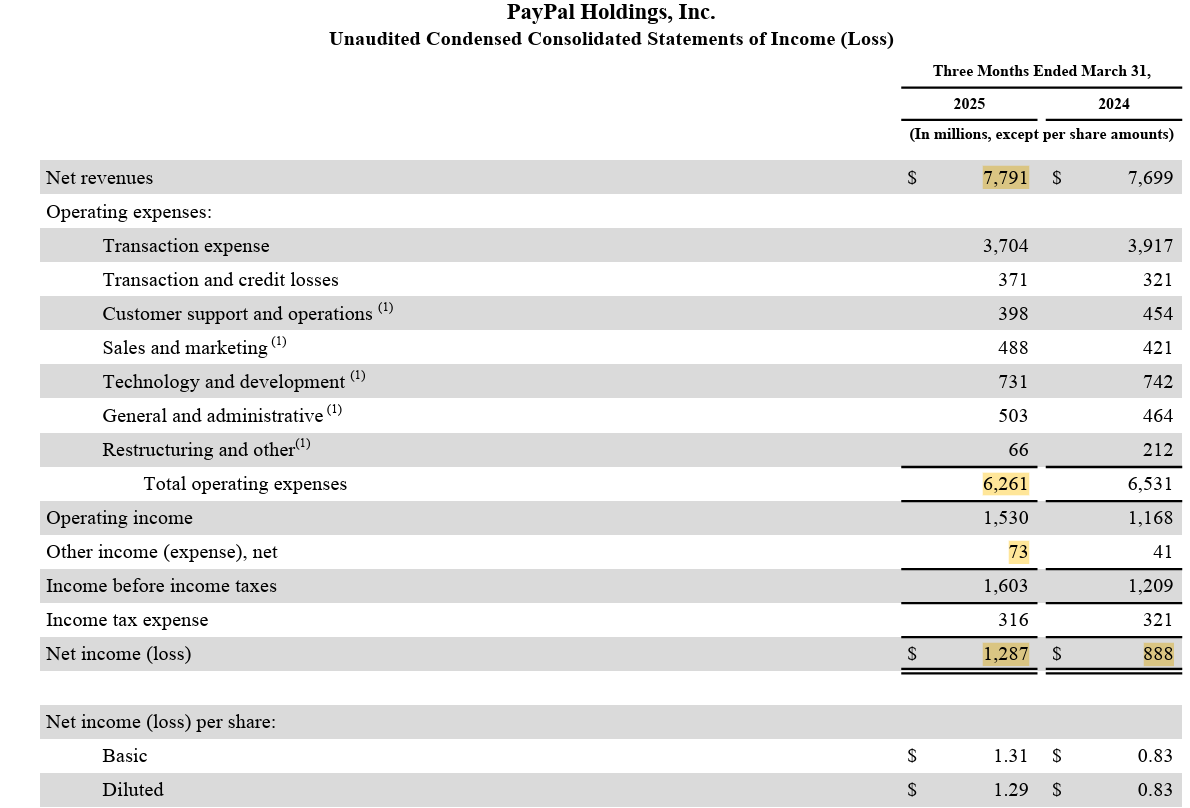

Financials.

Not much comments to do here.

Revenue grew very slightly due to the loss of volume from Braintree - up only 1% YoY, but the pretty big expansion of transaction margins YoY & some rerduced expenses did make a huge different with operating income up 31% & net income up 45% YoY - also helped by the restructurating expenses comp. This, combined with their $1.5B of buyback brought a strong EPS growth.

In term of cash, the company remains very healthy with $3B of net debt & $1B of FCF.

Guidance.

Lastly, no change on the outlook.

Single digit growth, although the dollar weakness could help the company with better comps during this transition. As I said, it will take time.

My Take & Valuation.

This quarter wasn’t bad. It was the continuation of a long-term plan made months ago by management to refocus the company. Profitable business, valuable services for both users & merchants and expansion toward new activities.

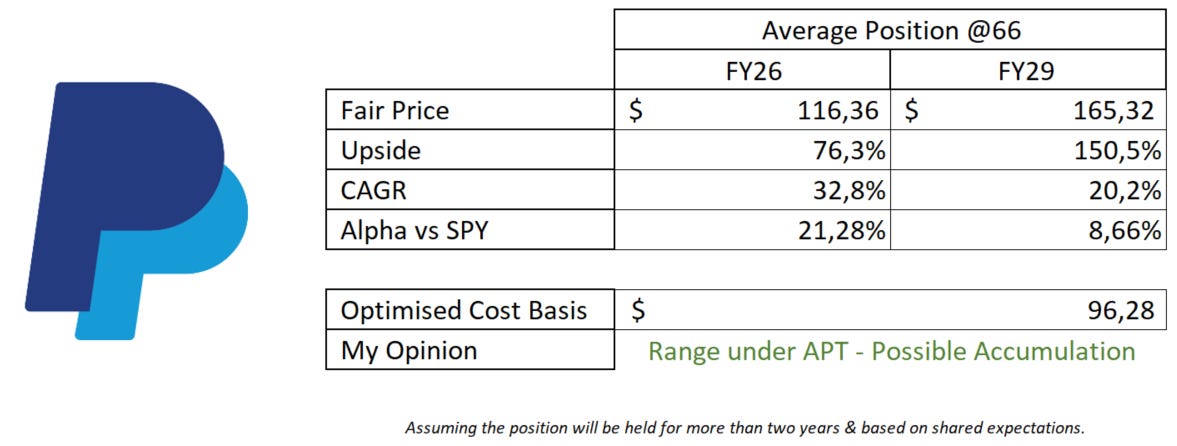

This makes it hard to value PayPal but I have no doubts it is still undervalued if only because of their buyback programs & cash generation. Their new focus & services could snowball in time & I wouldn’t be surprised to see a weak growth during the next two years slowly accelerate afterwards.

This model assumes a 4% & 5% CAGR growth until FY26 & FY29 respectively, 15% of net margins & 6% of returns to shareholders.

The return to shareholders won’t remain that high for that long, but even dividing it by two would give comparable results. The market continues to doubt PayPal with a degree of reasons as the numbers aren’t showing up yet.

I personally am not a buyer. I will remain patient & continue to closely monitor the company, but as I said, it will take years to play out and it still might not happen. I understand those who buy in. But PayPal isn’t a fundamentally strong enough name for me to buy & forget.

But if the opportunity presents itself & I have cash aside, or if fundamentals start to be shown in financial data, I will be there to buy it in the active portfolio.