Palo Alto | Q1-24 Earning & Call

Palo Alto didn't disappoint, at least not me. Yet, once again, the market reacted violently to what I'd still call good results. It'll be a tough quarter to decipher.

If you don't now Palo Alto networks, you can start here.

Overview.

EPS. $1.25 | $1.32 | +5.6% beat

Revenues. $1.97B | $2B | +1.5% beat

$500M of buybacks.

When you just look at the numbers, it's hard to find anything wrong although of course, growth slowed down and the market punished it. I consider this another opportunity- feel free to disagree.

Just a heads up before we jump in: Q3-24 is what I call Q1-24. Companies report differently, but I always write the calendar quarter - the first quarter reported in 2024 for $PANW, hence Q1-24. Makes it easier for me; don't get confused by it.

Business. It's hard to say business is bad for Palo Alto, but business is changing.

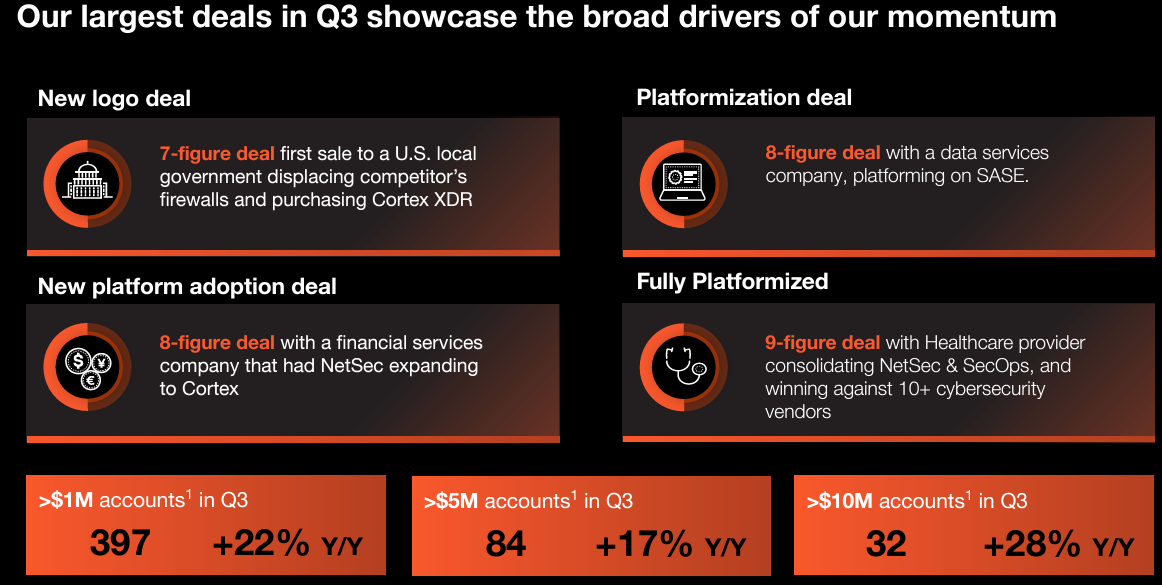

Some slides are like a sales pitch and only meant to prop up the company with big words, but numbers don't lie. What I see here is double-digit growth on accounts, the strongest growth being in >$10M accounts.

Not many companies open >$10M accounts right away; those are clients expanding their ties with the company. That's retention.

Platformization. We need to speak about this as it is the main issue investors have with Palo Alto. They simply don't believe in this new strategy. They don't. And it baffles me.

Network security companies typically sell hardware and software tailored to specific needs. Companies buy packages that address their particular security requirements and Palo Alto is trying to change this system with its "platformization."

A new tool regrouping each of the company's security needs, optimizing the entire workflow as everything will be integrated vertically (assuming they buy Palo Alto's products), solves lots of configuration issues and network complexity. One platform to rule them all, if you will. A simpler solution for complex infrastructures.

A double win: the service is better for the end client, easier to manage the entirety of its networks and to integrate/configure anything. In return, this is more expensive and sold at higher margins by Palo Alto. It makes perfect sense to me.

This is Palo Alto's focus now, and I like it. It's a long-term view and a new design for cybersecurity, but these products take time to be sold to clients as they require lots of work to set up and train engineers to use them.

This will be what matters to value the company: Are they able to convert their actual users to this new architecture / way of working? Numbers aren't bad so far, and feedback seems good.

"I'm delighted to report, despite the concerns around our platformization approach after our last quarter, the customer feedback has been nothing but encouraging [...] If meetings were a measure of outcome, they have gone up 30%, and a majority of them have been centered on platform opportunities."

This is Palo Alto's future. They need to convert their customers to this infrastructure, and once done, this means higher revenues, margins and growth.

Personal take. Once again, I'll share a personal insight here, working on these products daily. Changing a network security infrastructure is not easy nor rapid - nothing less than a year -so it requires careful consideration and the question: Is it worth it?

The answer is always yes; it simply takes longer for some companies to accept it and move than others. But they have to upgrade eventually.

Second take: if you understand how hard it is to upgrade an infrastructure, you have to understand it is multiple times harder, longer, and more expensive to change your technology - from Palo Alto to Fortinet, for example. The switching costs are enormous, and that's where lies the opportunity for Palo Alto: Most clients will stick with it because it still is one of (if not the) best in the market.

"So it's a good thing because our customers say, I don't have to go somewhere else and get something add on and go make that happen because I expect Palo Alto will have it in six weeks' time. So I'm just going to wait for Palo Alto."

So, if the best, with whom you've been working for years, proposes you a new infrastructure, more efficient, easier to configure and manage... You at least listen, but most probably try it out and end up migrating to those new tools.

The market underestimates the switching costs & the actual complexity on cybersecurity. Things simply take time.

Revenues. In terms of revenues, I am personally satisfied with what Palo Alto showed today, with a +15% growth YoY. I'll start with the positive here.

The company's execution is great; expenses are barely moving YoY. We're talking about $600M growth while revenue grew $900M. This is a lot of money at the end of the day, and it shows on gross margin being stable QoQ and growing YoY, and net margin, reaching its highest value at 14%.

Investors were annoyed by the fact that we won't have 20%+ YoY revenue growth every quarter anymore. This is true and normal for a company reaching these levels of capitalization and revenues. But this chart surely scared a lot of people.

Every company's YoY growth rate slows down; it's mathematics and entirely normal. What many struggle with is the billings dive. Although as management said:

"As we have articulated earlier, we don't see the billing metric as a true indicator of business trend. It continues to be impacted by payment terms where more and more customers prefer annual billing plans."

Billing vs Remaining Performance Obligation. I tend to agree that many focused on this metric because it's always been there and is easy to use. But finance moved on, and things changed. Billings are what have been paid but not yet delivered, while RPO includes everything agreed upon, not yet billed nor delivered.

"We have a lot of business that we're signing, and the way it gets reflected is in RPO. It depends on what we choose to either take as annual billings or to take through PANFS, right, which shows up in billings. What we choose not to take ends up in future or deferred payment plans or deferred billing."

True, billings growth is lower, but RPO actually ticked up QoQ which really means that there are lots of conversations with their clients and that those still have the wish to work with Palo Alto, and sign for it.

We're in a transition year. With great financials & a focus on profitability.

Guidance. But it doesn't please investors, at all, and a guidance with "only" +10% YoY growth isn't what investors want to see.

However, this guidance is better than expected as they raised most of the FY-24 expectations. The only "deception" comes from the EPS being reduced, indicating net margins won't stay that high.

This isn't a bad guidance, the market is short termist.

"Consistent with what we noted in February, we expect that [platformization's headwinds] will persist through fiscal year 2025, as we anniversary the rollout of these programs and resulting in lower billings and to a lesser degree, revenue. Beyond this period, we expect to grow faster than we discussed in August and sustain this growth for longer."

I believe this was the confirmation the market wanted to sell off, although it is clearly said that strong growth will be back. A bird in a hand is worth two in the bush I guess.

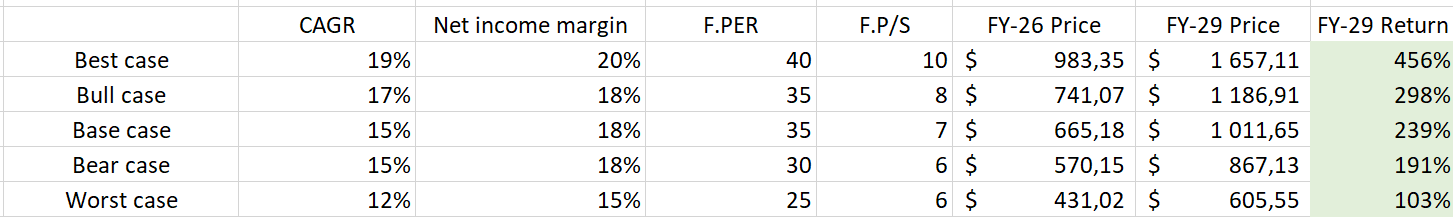

Valuation. Everything is about valuation at the end. I kept the same model with the same assumptions because nothing really changed as I already had a conservative guidance and growing margins.

I still believe these assumptions are fair and close to what the company is guiding, at least up to 2026, with potential surprises if their platformization shows results earlier than expected.

Conclusion. Palo Alto is becoming a complex subject, I believe we're in a situation where many investors have very different opinions. I feel like I'm in the minority. I could break these down into three groups.

The hypergrowth addict. Invested in hypergrowth stocks and annoyed because the guidance isn't +20% growth YoY minimum. This isn't enough for them, and they assume the stock doesn't deserve a premium anymore. Nevermind the potential, nevermind the switching cost advantage over competition, never mind the focus on profitability.

Just nevermind the rest.

The nay sayer. Believes platformization won't work, end of story. Network security always worked the same way, and there's nothing to change. Innovation won't work because companies like it safe when talking about their network's security.

There's some truth. But security always evolves and those who don't usually learn the hard way.

The optimist. That's me, who sees a strong company being beaten down to valuations that don't even reflect their actual performance. I believe in making cybersecurity simpler and think Palo Alto can deliver top-tier products and services. Why doubt them now? I accept a year of slowdown, especially at today's valuation which brings me enough safety margin. I believe hypergrowth can be back in the second half of 2025 with their new solution, which will be much better than the competition.

I don't understand why the market is so convinced platformization won't work and will kill the company's growth. I think otherwise. I simply accept the lag.

I'm still a buyer at < $300, but that's just me. You guys do you!

Thank you for reading it all! If you like it, please consider subscribing to receive it all directly in your inbox and not miss a thing!

Everything I share here is free but if you found the content valuable enough, you can always leave a tip!