Palantir Q3-25 Detailed Review

When success bothers

If you guys are interested, you’ll get a 15% discount on FiscalAI through my referral link below. FiscalAI is the tool I use for KPIs in all my write-ups - powerful, data-rich and with great UX.

https://fiscal.ai/?via=wealthyreadings

Everything you need to understand Palantir’s bull thesis is here.

By any normal or even reasonable standard, these are not normal results. These are not even strong results. These aren’t extraordinary results. These are arguably the best results that any software company has ever delivered.

I wish this report could be lengthy with lots of details but it won’t be. The numbers are excellent and the call was, as usual, management bragging about their success.

Don’t get me wrong: I love success, and I believe bragging is important. Only those who succeed can brag, and Palantir does both in excess. But it doesn’t give me new material to share.

If you want that, you should read my investment thesis. Everything I wrote there more than a year ago remains accurate and this is where the value lies.

Business.

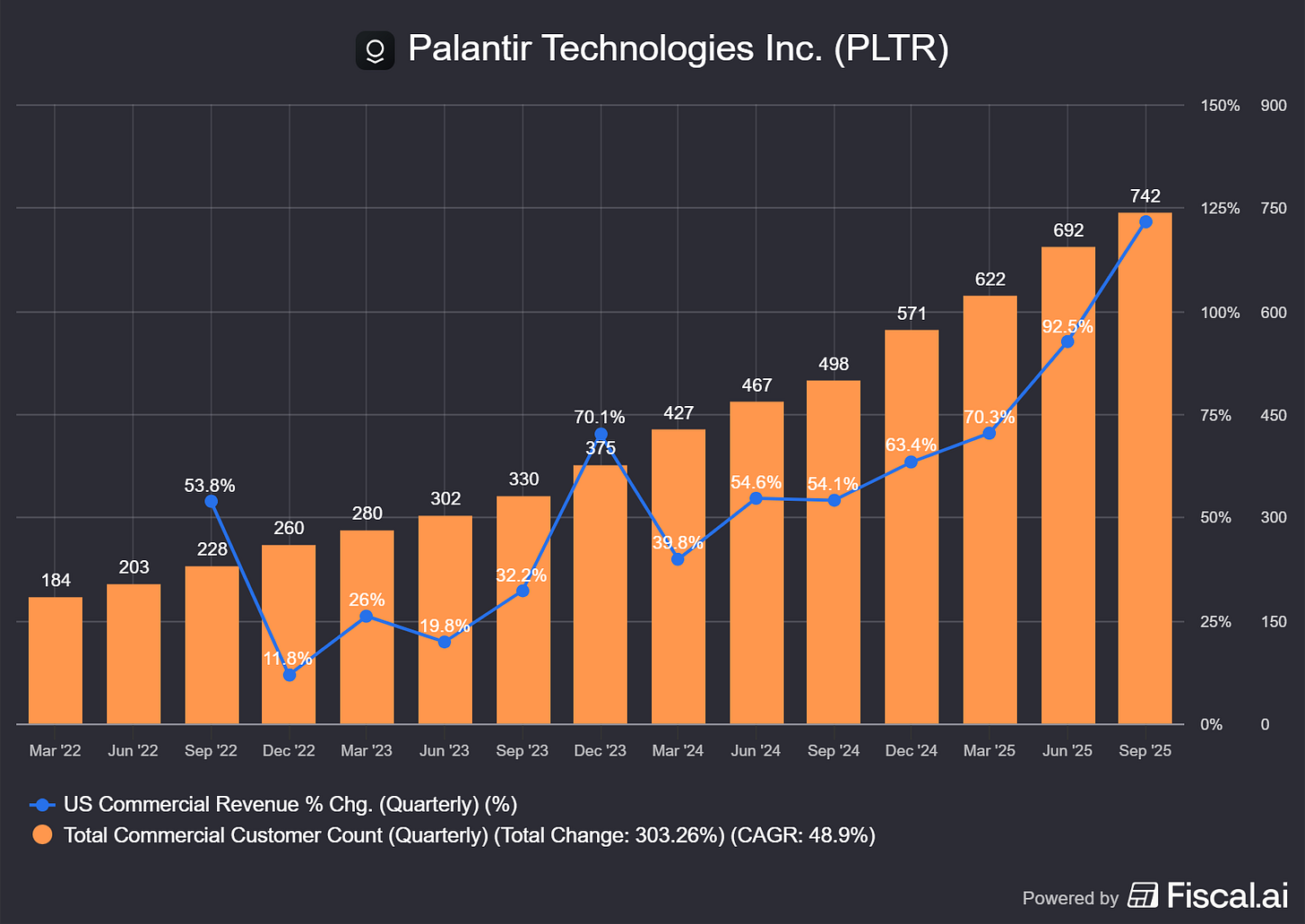

As usual, my base case relies on growth in the commercial side of their business and on the disruption AIP brings to companies worldwide in terms of efficiency. This quarter proved my thesis again, though it was proven long ago.

Palantir continues to grow its commercial customer base but more importantly, revenues are growing faster.

This means users are deepening their partnerships and increasing their spending, the ultimate confirmation of AIP’s market fit.

Revenue from our largest customers continues to expand. We are seeing that AIP, again and again, is the only platform delivering transformational impact in this market.

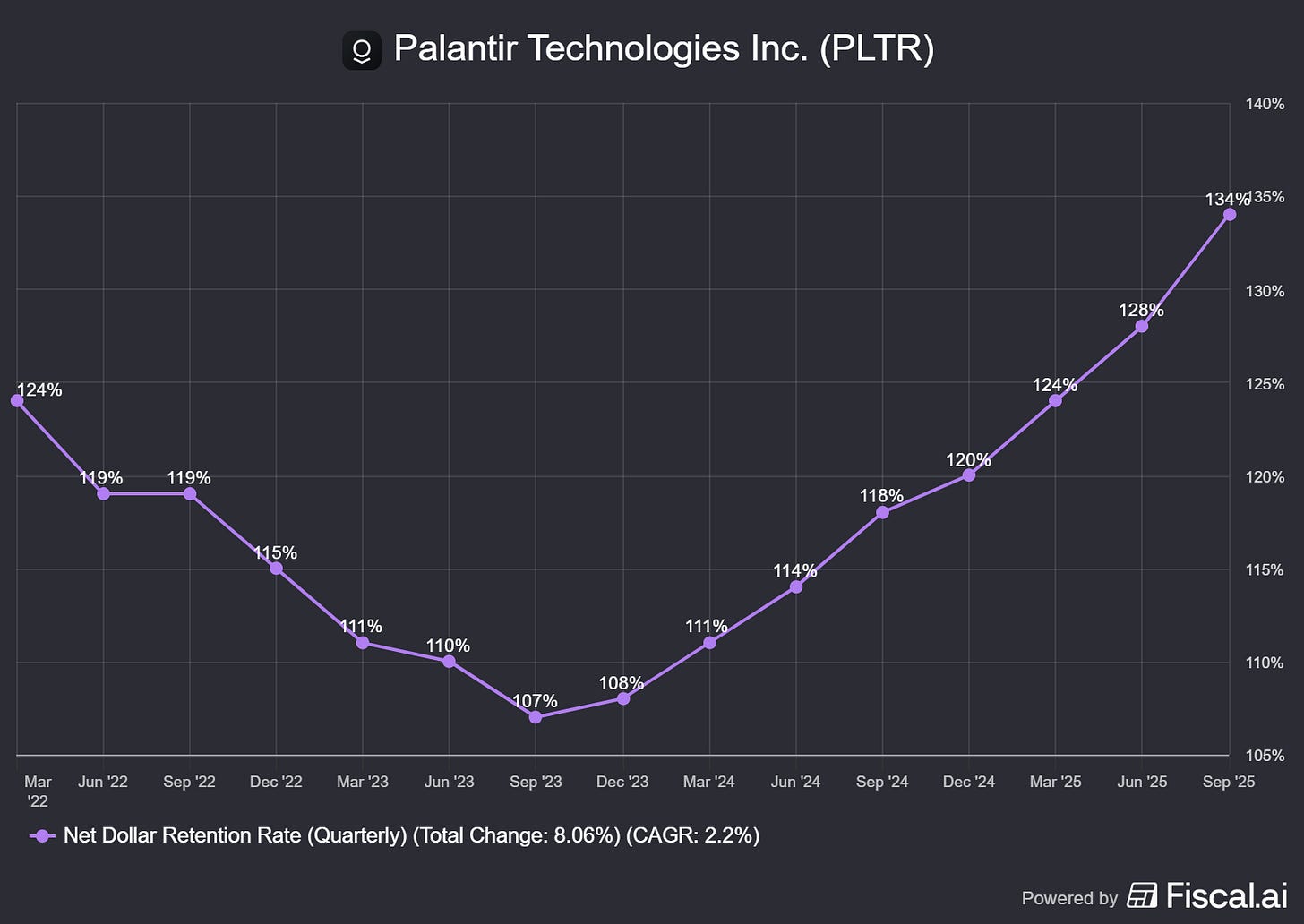

If you need data to confirm this, Palantir’s retention rate continues to accelerate.

This excludes clients with contracts from less than 12 months. Even more impressive.

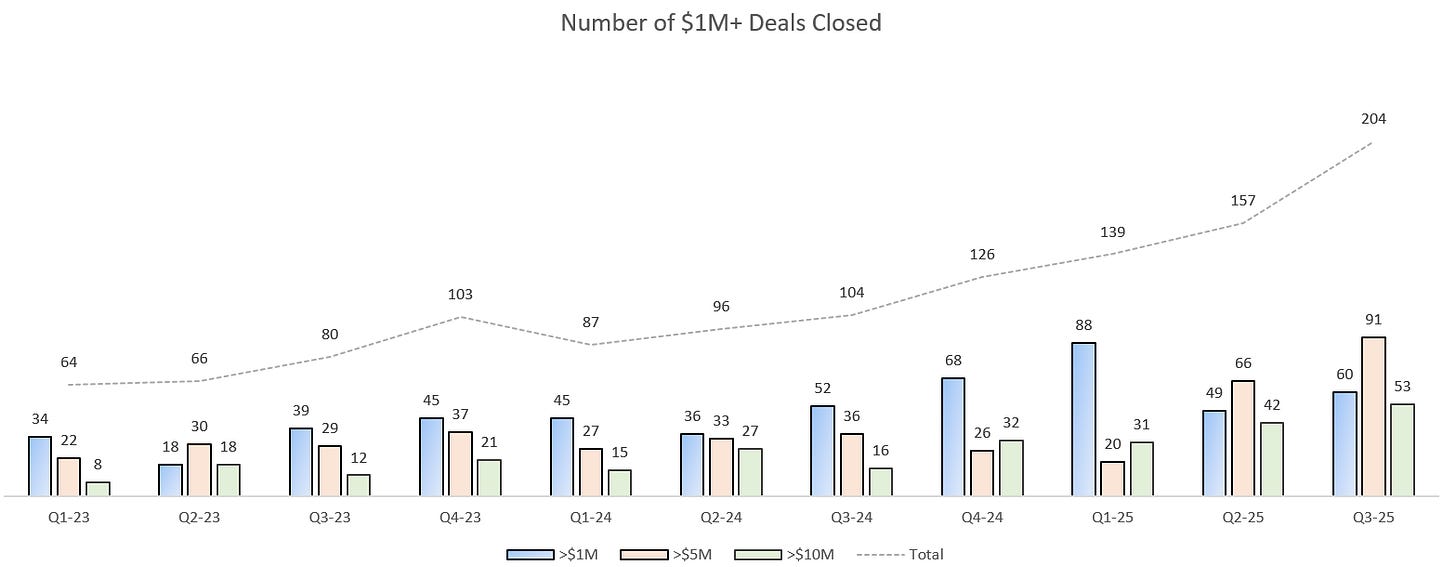

Another key metric: the number of deals closed continues to rise in both volume and size, reflecting growing demand for their software - this is across both commercial & government contracts.

And honestly, that’s about it. It’s more important to understand why Palantir is such an exceptional and dominant company than to spend hours dissecting quarterly results. They are exceptional, with a confirmed demand for their products.

One day growth will slow, but it isn’t today. And when it does, the concerns will be about valuation and investment not the company’s quality.

A few words on the government side: it’s as strong as the commercial business. Large deals, growing demand & results showing up in key areas, especially national defense. The same dynamic you see in commercial exists in government contracts.

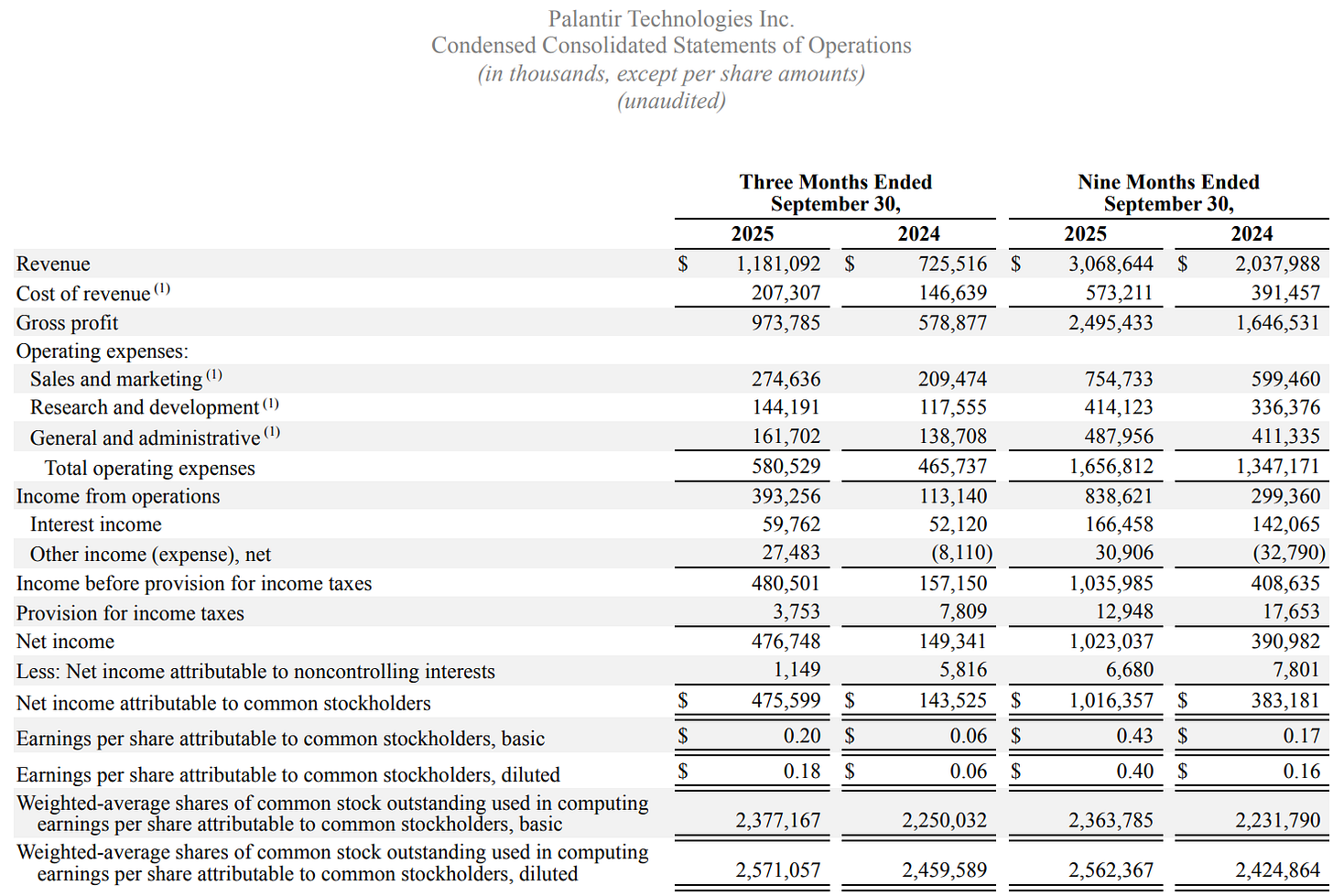

Financials.

No surprises here - the financials are simply perfect.

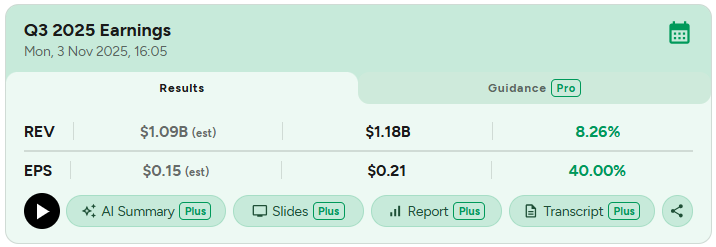

Revenue grew 50.6% YoY YTD and 62.8% for the quarter. Gross margins are expanding as the company leverages AIP’s efficiency, reaching 82.4% this quarter. Operating margin hit an all-time high of 33.3%, even while including stock-based compensation as expenses.

The company ended the quarter with over $6B in net cash & $540M in FCF impacted by $172.3M of SBCs. Yes, SBC is a big portion of Palantir’s cash generation, but the undeniable truth remains: this company is incredible & capable of generating massive cash flow in the future - with or without it.

Palantir also bought back $56M of shares this quarter. Not the most optimal use of cash in my opinion, but they don’t have much else to do with it besides parking it in short-term treasuries. So these buybacks are essentially free money to offset SBCs & we shouldn’t complain about that.

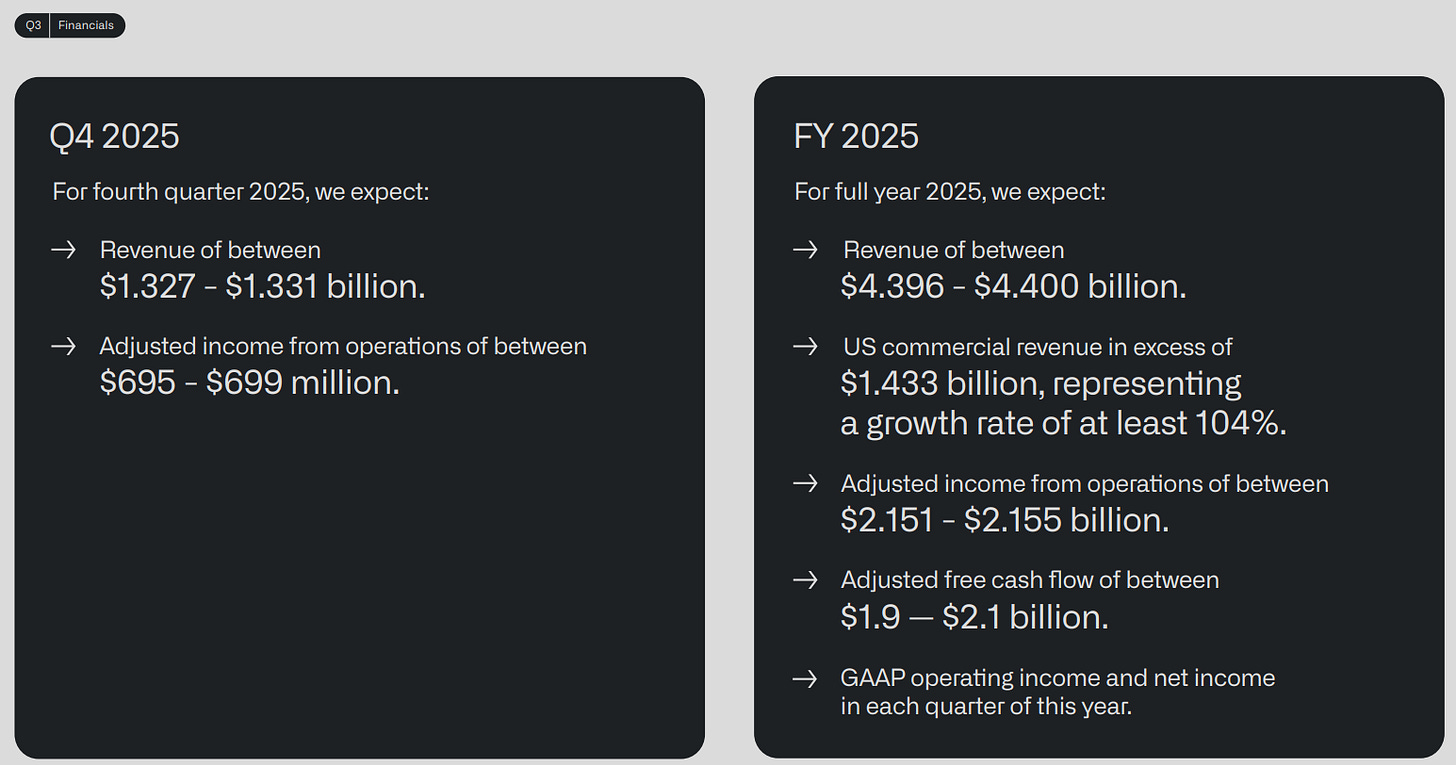

Guidance.

No weakness in sight.

The momentum we’re carrying into Q4 is extraordinary.

We are raising our U.S. commercial revenue guidance to an excess of $1.433 billion, representing a growth rate of at least 104%.

We’re also raising our full year 2025 revenue guidance midpoint to $4.398 billion, representing a 53% year-over-year growth rate and 8-point or $252 million increase over our full year 2025 revenue guidance last quarter.

Although Q4-25 could be the first quarter without sequential accelerating growth since June 2023. Guidance points to 60.5% YoY growth, compared to 62.8% this quarter.

Does that signal a ceiling in growth? Maybe. Maybe not. It’s too early to draw that conclusion.

Investment Execution.

I’ll conclude as I usually do with Palantir: excellence is boring. This company is the best on the market right now, as transformative as Microsoft was a decade ago, and its trajectory will likely follow its path.

Palantir is, in my opinion, a must-own.

But as always, everything has a price. I’ve said many times that you can’t put a price on accelerating growth. And we can’t this quarter either, as growth continues to accelerate. When we finally can, it will mean the growth ceiling has been reached, whether that’s 60% or more, and the market will punish the stock.

Until then, there’s nothing to do.