Palantir Q2-25 | Earning & Call

Excellently boring.

If you guys are interested, you’ll have 15% discount on FiscalAI subscriptions through my referral link. FiscalAI is the tool used for KPIs on all my write-ups, really powerful, valuable data & great UX.

https://fiscal.ai/?via=wealthyreadings

Everything you need to understand Palantir’s bull thesis is here.

“We set the battle cry of ‘must go faster,’ and boy, have we. In fact, we’ve been using the term ‘a Palanir unit of time’ - and that represents when we’re driving value in less than an hour.”

This comment comes from Dr. Michael Ash, President & COO of Nebraska Medicine. I don’t know how exaggerated that comment is, but this is Palantir’s bull case: internal optimization of any environment & sector possible.

Business.

There isn’t much to say… The bull thesis shared more than a year ago is playing out, we had the confirmations we needed two or three quarters ago and now it’s only continuation. Largely above expectations, but nothing unsurprising.

Let’s try to go over the data a little bit.

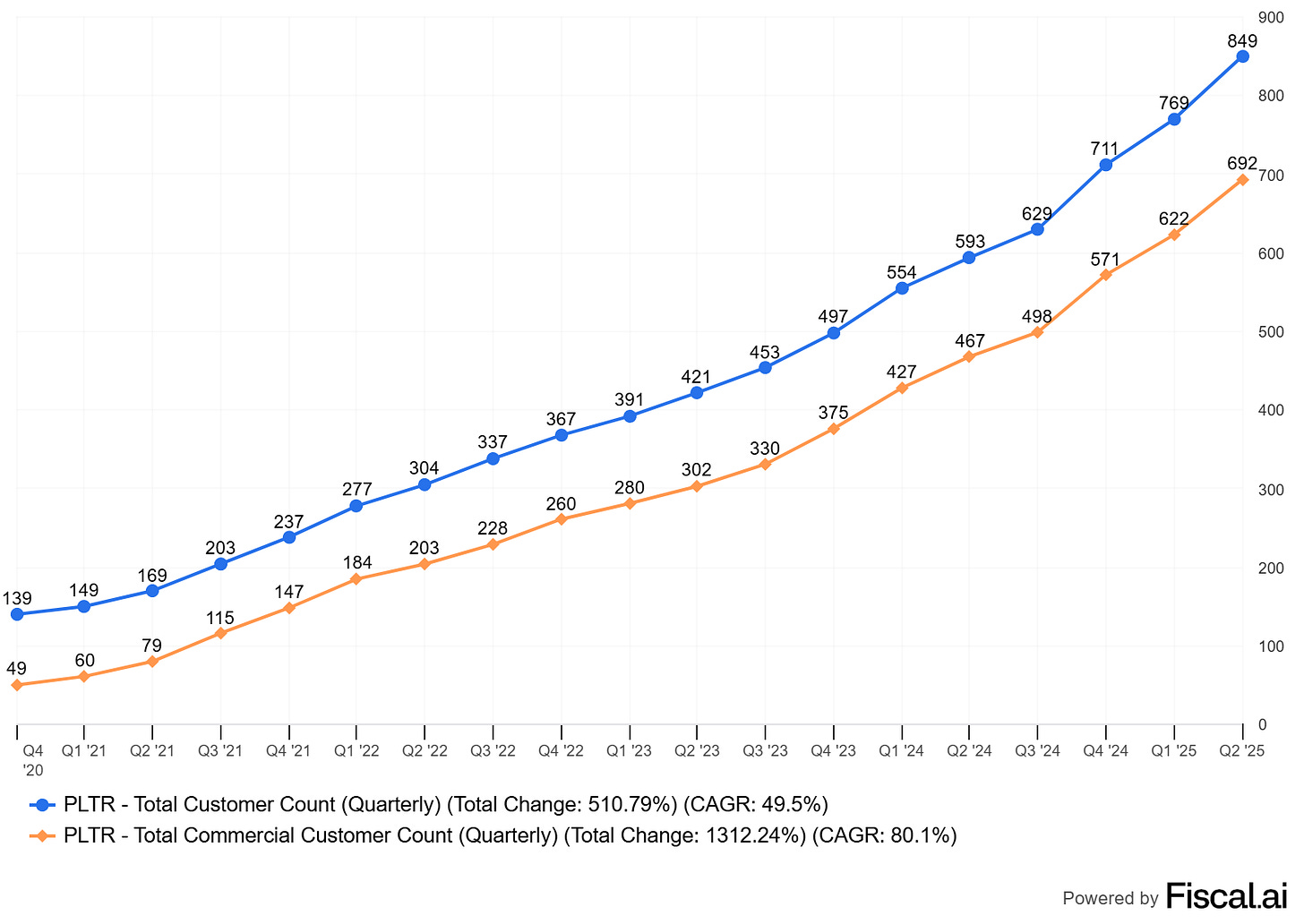

My bull case has always been about the commercial portion of the business and it is indeed the fastest accelerating source of revenue, starting by customer counts where growth simply doesn’t slow down.

Most are of course from America as the rest of the world - Europe notably, continues to ignore the obvious revolution and is slowly left behind. And as Palantir is all about optimization, its companies will also be left behind.

Here are some comments from clients.

The impact our software is delivering for our customers as they cross the chasm is ever widening their advantage over the AI have- nots.

Citibank shared that the customer onboarding process and relevant KYC and security checks that once took them 9 days now takes seconds.

Fannie Mae recently announced they're working with Palantir, decreasing the time to uncover mortgage fraud from 2 months down to seconds, saving the U.S. housing market millions in future fraud losses.

Lear Corporation recently signed a 5-year extension. Over the past 2.5 years, they have leveraged foundry and AIP to support over 11,000 users and more than 175 use cases, including proactively managing their tariff exposure, automating multiple administrative workflows and dynamically balancing their manufacturing lines. Their CEO highlighted that their enterprise-wide adoption gives them, "A first-mover advantage in the automotive industry, which will be difficult to replicate."

A few words on the governmental portion of the company, which is really healthy as well, growing 50% YoY. Palantir’s Maven platform has been increased which is great news as it will also serve as advertising for Europe.

Maven adoption continues to grow, with usage doubling again since February. Last quarter, I mentioned that usage doubled in the first 9 months of 2024 and doubled again in the subsequent 5 months. This is on top of that.

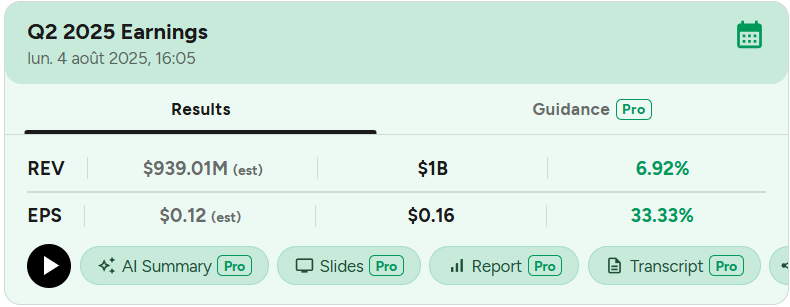

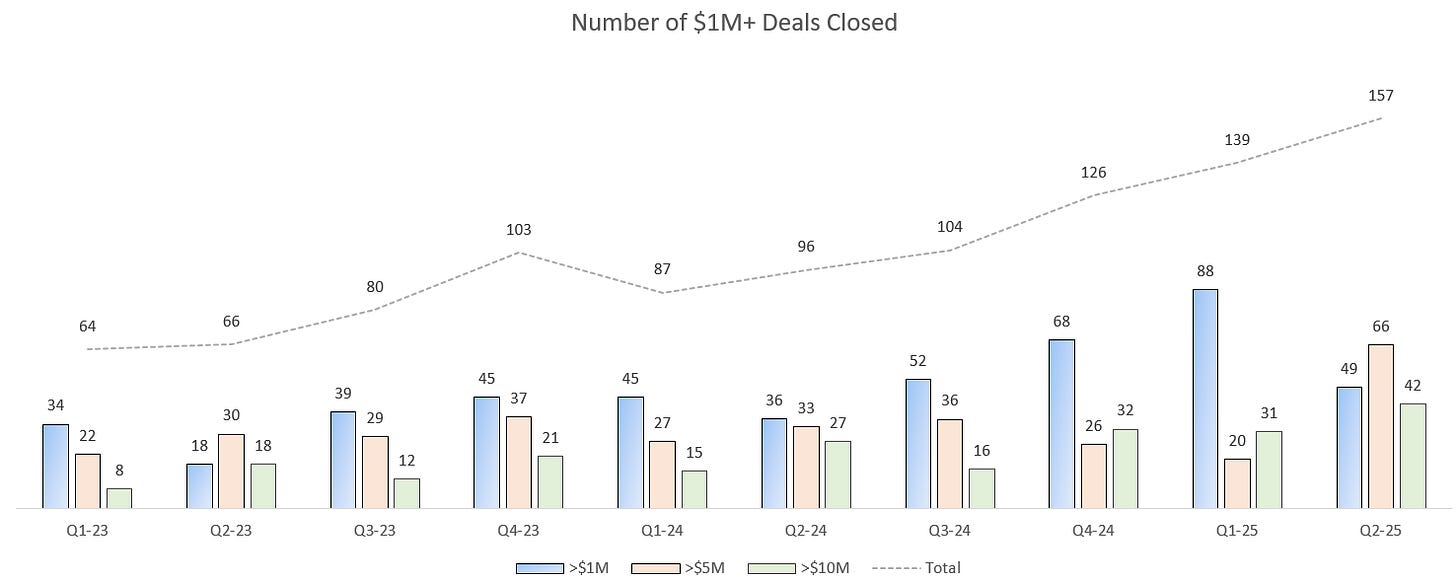

In terms of contracts, Palantir closed 157 deals, 66 of which were at least $5 million, 42 of which were at least $10 million.

Palantir is nothing but acceleration, except for the $1M or so deals which are left aside as companies understand the value of AIP and accept to spend more. Spending $10M on Palantir’s software is either way saving you much more in efficiency or accelerated growth, maybe both. So why go small?

We continue to see expansions with our existing customers as our top 20 customers now average $75 million a year in trailing 12- month revenue, up 30% from a year ago.

This represents a really small part of total revenues which highlights the massive client base Palantir now has… And their satisfaction as retention is through the roof at 128% without including new customers. Another highlight of growing commitment from clients towards Palantir’s software.

And… That’s it. As I said, prefection.

Financials.

The same comments as usual for their financials.

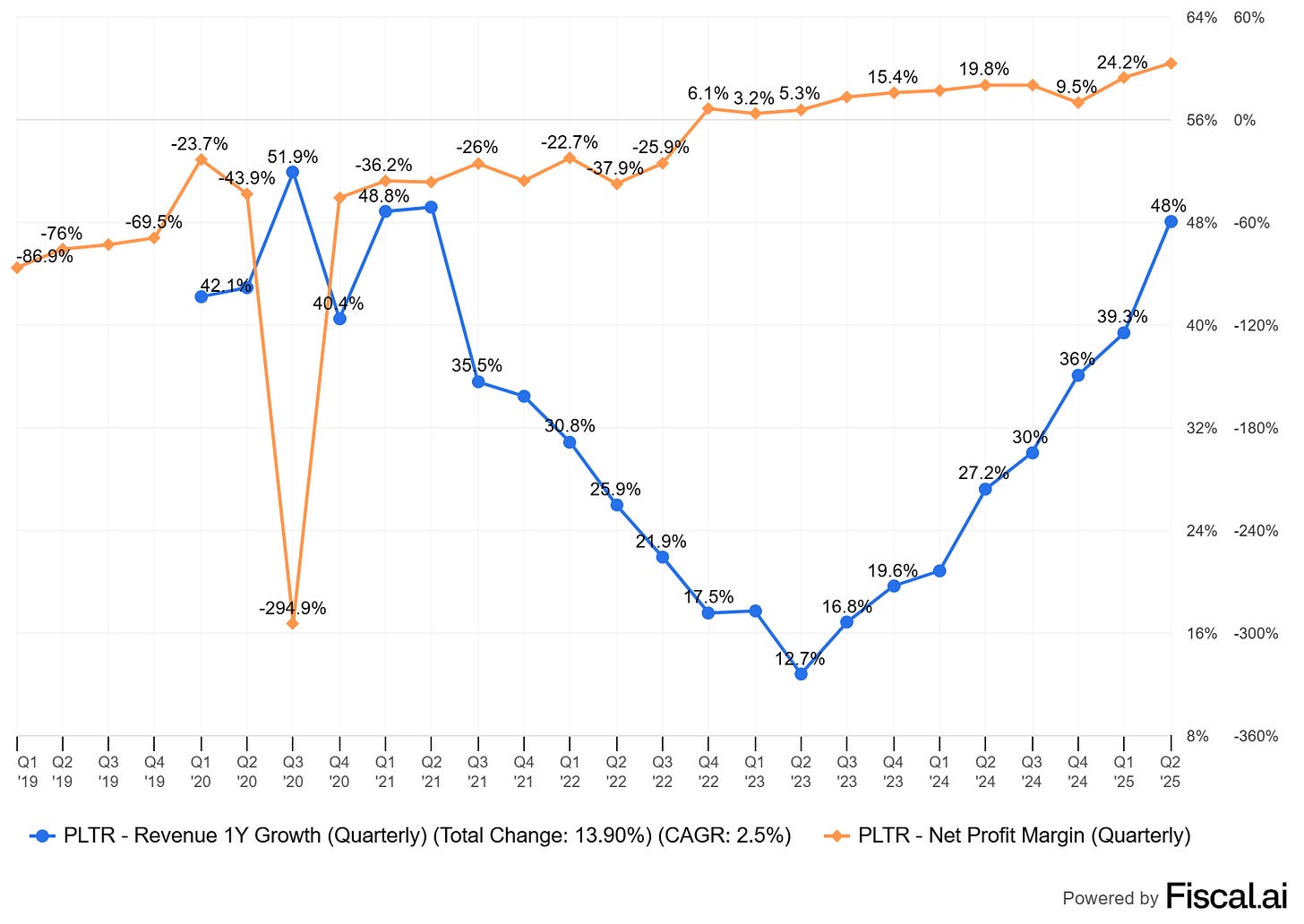

Revenues are up 43.8% for H1-25 with another quarter of accelerated growth. Margins are stable like most software companies as costs do not really go higher while scaling but where Palantir excels is on its expenses, only growing 22% YoY including SBCs, as the company continues to massively reward its workers. All of this cumulated ends up with climbing net margins, up to 29% from 18% a year ago, which ends up in huge cash generation helping build a massive balance sheet of $6B net debt - which helps incomes with $107M of interest earned this semester.

Guidance.

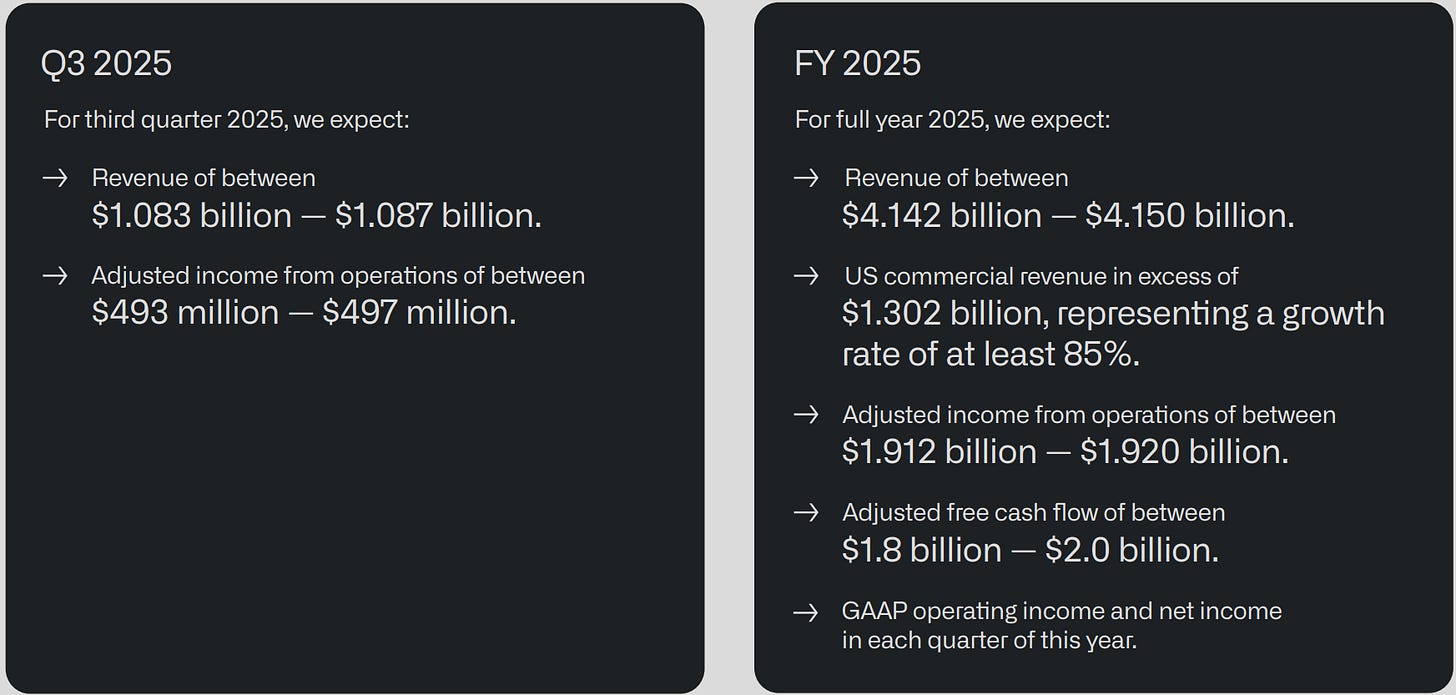

Because perfection wasn’t enough, Palantir raised literally every guidance point for its full year, now expecting 44.5% YoY growth at worst.

Management also talked about multiplying revenues by 10 during the next five years, which is obviously not guidance & more of an optimistic bet, but speaks volumes on the confidence & demand for the product.

Investment Execution.

So yeah… You rarely see this kind of quarters. I believed Nvidia last year pulled the best quarter I have ever seen, but this one might be even better.

It still isn’t possible to value or work on Palantir’s valuation. As long as the company accelerates revenues, raises guidance and grows margins, the sky is the limit. Plus, management is talking about 10x revenues in five years so you can imagine that this boosts optimism. Will they make it? No idea, but after seeing this quarter… Why not?

So, to those screaming that Palantir is ridiculously overvalued, show them this and remind them that valuation doesn’t matter during both growth acceleration and deceleration periods.

I shared why I trimmed Palantir a few days ago - trimmed not sold, and I continue to believe it is important to follow our methods and to take profit as my average cost remains around $20.

But this name is really special, Nvidia-like special. I continue to believe that the fall will be as impressive as the rise, but we are not there yet & it is very hard to imagine when it will happen, and at what price.

Until then… Palantir is nothing but perfection.