Palantir | Q2-24 Earning & Call

The best software of the world.

We are used to hearing about AI nonstop in earnings calls, but not with Palantir, where we hear much more about PowerPoint than AI.

Overview. This quarter marked a turning point for Palantir.

EPS. $0.08 | $0.09 | +12.5% beat

Revenue. $652M | $678M | +4% beat

$26.7M of buybacks.

"Our growth across the commercial and government markets has been driven by an unrelenting wave of demand from customers for artificial intelligence systems that go beyond the merely performative and academic."

Everything is great.

Business.

The most important takeaway from this quarter is that the company’s product is market fit - which wasn’t that obvious a few months back. This is a very important confirmation as an investor, as it means Palantir will be a fierce competitor in this rapidly growing market - a market the company could even dominate in the coming years.

“As noted by Sequoia, the revenue expectations from the AI ecosystem's infrastructure build-out have grown from $200 billion to $600 billion per year in just nine months.”

No more doubts and this is confirmed by different metrics, starting with a re-acceleration in both commercial & governmental revenue growth and customer counts - while boot camps are slowing down.

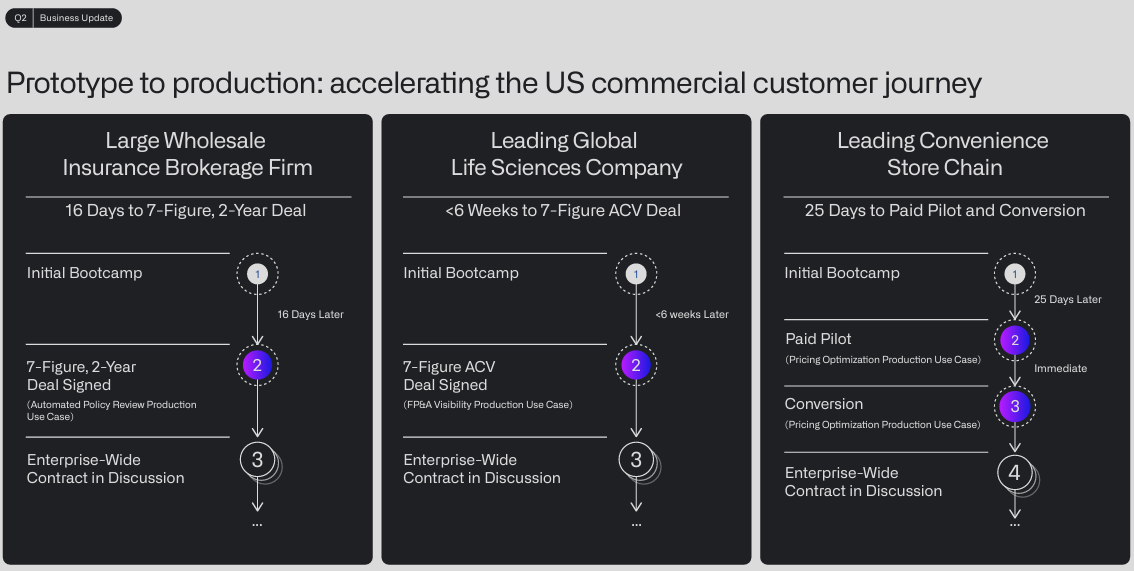

Bootcamps & conversion. I started out disappointed when I saw the very small number of boot camps this quarter - 6 times less than last quarter - but my conclusion after listening to the call is very different than my first take. The truth is here:

“We plan to leverage this combination of boot camps and pilots with a focus on moving toward high-value production use cases to continue landing new customers.“

They also have a slide about it.

The focus of Palantir’s team is now to help companies transition from boot camps to production & deeper commitments. This requires lots of resources and it is logical for the company to focus their manpower on growing tighter relationships with good clients rather than trying to attract new ones. It’s better to do both, but companies need to focus resources.

Boot camps are the go-to-market strategy, but they aren’t enough by themselves. The company then needs to keep clients and make them extend their commitment to Palantir - and that is what we’ve seen this quarter.

More than 28% of the company’s new deals were above $10M, while 52% were above $5M - compared to 17% and 48% last quarter, respectively. This shows a strong demand to expand partnerships with Palantir and confirms the need & market fit of their software. The call confirmed this with very specific examples.

“Tampa General signed a seven-year expansion, deploying AIP to deliver a care coordination operating system, where we've helped them reduce patient length of stay by 30%.”

“Panasonic Energy of North America signed a three-year expansion using AIP across finance, quality control, and manufacturing operations.”

“These are just a handful of the significant expansions last quarter into production with AIP, and the magnitude of expansion is notable. A major North American industrial company started working with us in late 2022, expanded to a $5 million run rate in 2023, and further deepened engagement to a $20 million run rate this year.”

Everything is falling into place as the new biggest priority over the next few years is going to be optimizing business, as expected.

Commercial branch. This is the most important branch for the company and the one I watch most closely because that is where growth comes from, and that is what will transform Palantir into a trillion-dollar company. Without any surprises, the U.S. is the biggest source of growth as U.S. companies understand the value of these tools - and once more, Europe doesn’t.

“… and a 1% sequential decline as a result of continued headwinds in Europe.“

Palantir added 39 new customers, 33 of them from the U.S. commercial branch.

Another proof of a perfect market fit in this sector.

“commercial business continues to see unprecedented demand, with AIP driving both new customer conversions and existing customer expansions in the U.S.”

Revenues.

A great business logically translates to great income statements.

A software company that logically grows margin as revenue growth is much stronger than costs growth, while Palantir continues to execute perfectly with controlled expenses. We already have a much bigger net margin than I would have expected, and this trend should continue through the next quarters.

Margins aren’t the only thing that surprised me; growth rate was also high above my expectations and we can see a strong re-acceleration in revenues - hard to know when this will stabilize.

In terms of balance sheet, Palantir is still very, very strong with $4B of net debt, which is very reassuring in the current macro conditions. The company closed the quarter with $148M of FCF, including $142M of share compensation.

Once more: great.

Guidance.

Outlook follows the same pattern.

A Q3-24 growth expectation around 23% and a FY-24 guidance raised to a 23% revenue growth with strong profitability.

My Take.

There is nothing to complain about, on the contrary. Everything I wrote about in the investment case and everything I was hoping for is happening as Palantir is executing perfectly, growing its commercial branch and converting more & more clients to their software.

The different data from this quarter show a positive turning point for Palantir. The company has found its market and is now tightening its relationships with its current partners, converting their interest and needs into revenue.

This is the kind of quarter that makes me reconsider my price target, as Palantir clearly stepped up and showed they will do better than we could have expected yesterday.

This is where we stand today, and I honestly wouldn’t consider Palantir highly overvalued given the confirmations we had - again, products' market fit, a growth acceleration & stronger margins than expected. It’s hard at this point to imagine where net margins will settle, but we could go much higher than my projections while I hardly see why they would drop much below 20% over the long term.

In term of revenues, growing 22% until 2029 would bring $7.34B of revenues on a market estimated to reach more than $800B by 2030 - Palantir would represent less than 1% of it. Those are only projections and will certainly be entirely wrong but it gives an idea of how small $7B of revenue actually is. We could also reference ourselves to Google which generated $282B of revenues in 2023 so Palantir would be 2.5% of today’s Google by 2029. Does this seem unreasonable?

Investing depends on everyone’s timeframe, my personal price target would be around $25 at the moment with a small margin of safety. I won’t raise my average above this value but I will continue buying Palantir over the next few weeks.