On Running | Q4-24 Earning & Call

Faster than their runners

If you do not know On Running & their awesome shoes, you'll have an idea of the company here - but you'll need to try the shoes yourself.

Overview.

Business is just getting better & better.

Revenue. $594.49M | $691.47M | +16.31% beat

EPS. $0.18 | $0.38 | +111.11% beat

Small reminders that my numbers here are in CHF not dollars - hence the differences.

Business.

The most important data for any brand to my opinion remains to control the demand for itself. There always are a demand for products but what matters is where & how customers go get it. If you need shoes you might just go buy some at the closest sportswear shop. But if you want specific shoes you find a way to get them.

And this is what shines to me with On Running. The demand isn't for running shoes but for On's products with a constantly growing Direct-to-Consumer revenues.

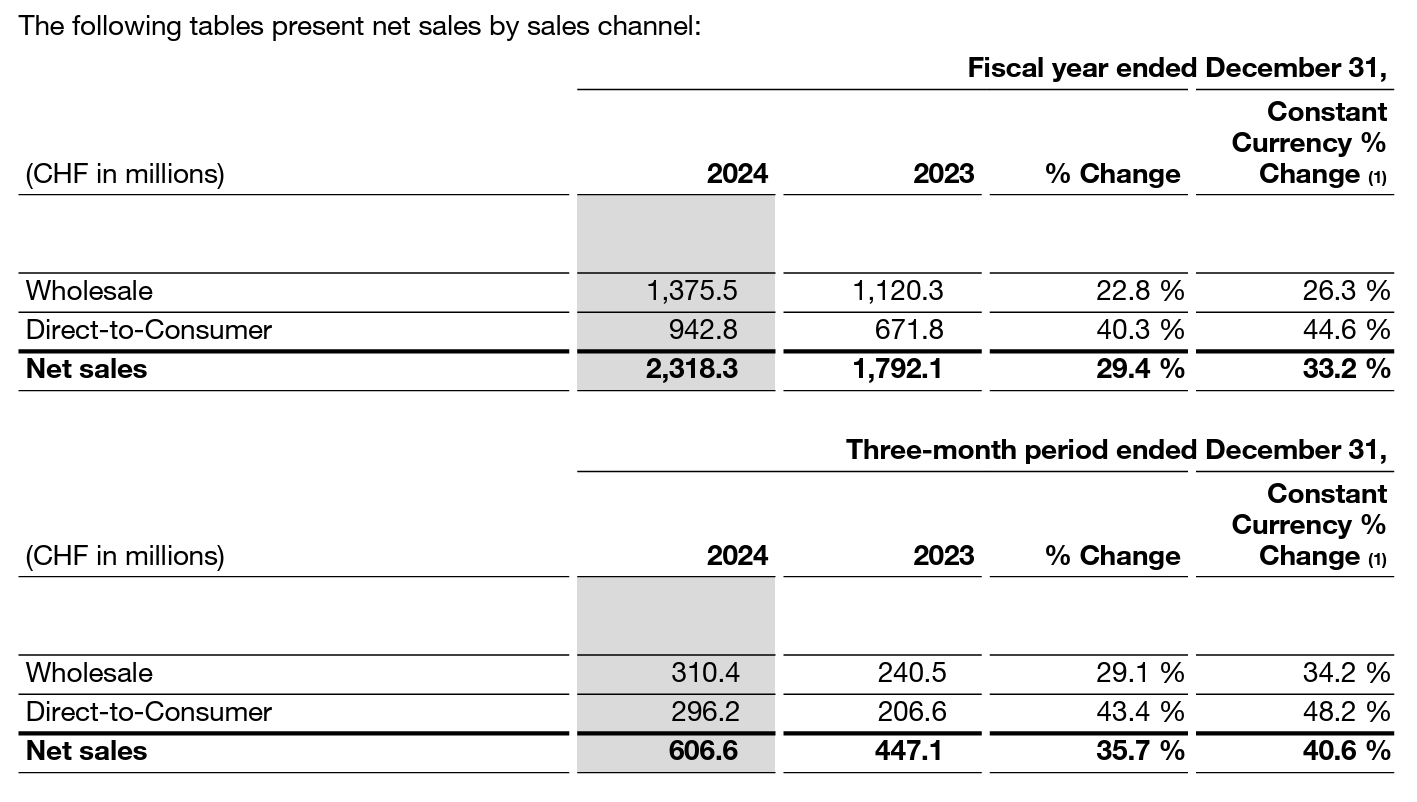

At the end of the year, we are talking about 40.6% of their sales done DTC while it was only 37.5% in FY23. The growth doesn't seem huge but it really is significant. We also have to talk about the results coming from the physical stores which have been really positives. Most physical locations are struggling now but when the goal is to become a dominant & premium brand, you need stores at the best locations. On opened 15 new ones this year for this purpose. It's about image, nothing else.

“In cities like Paris and Milan, we've seen a significant increase in regional awareness, proving that a physical presence drives digital momentum.“

Expansion will continue in FY25 with new plans in Asia, Middle East & more, through both resellers & brand owned stores. More geographies equal more growth for an healthy & demanded brand.

In term of products proportion, most revenues - 94.18%, come from their shoes while the rest is growing rapidly - around 50% YoY, but is still insignificant for now. On still has room for growth in the shoewear market but ultimately, the next spur of growth will need to come from apparel & accessories so it's important to keep an eye on it.

The second important metric to look at is geography & On Running is also doing well on all front, with a weaker growth coming from Europe for many reasons we already covered while Asia is catching up really fast & will very probably become the second biggest market soon enough.

We still have 63.8% of revenues coming from the U.S. which is a good thing although tariffs are obviously going to impact this portion of their business - like they will impact everything else so I will treat about those on another write-up.

The take away is that the brand is really growing in term of demand & awareness, with icons like Zendaya & Federer on board for the long term.

“And you're only seeing the beginning of this partnership they're in for the long haul.“ & “The year will see continued collaborations with talents to inspire across generations, include the launch of Zendaya's first co created footwear and apparel.”

Those two names are a net positive for the brand with their huge & young fanbase. You usually grow with brands because of your idols. Youngsters coming towards On because of any of their partners create a real strong bond between the customers & the brand. People loved Nike for Jordan & stayed years or decades because of him.

Revenues.

Obviously, numbers are great!

We're talking about a 29.4% YoY revenue growth & growing margins with net margins expanding from 4.4% to 10.4% including currency mix, which is always hard to deal with in valuation or comps as by definition, currencies fluctuate…

What was a big loss last year - and gave us great opportunities, became a significant tailwind this year. If we were to exclude them, we'd be talking about an operating income growth of 17.4% YoY, much lower than the net income growth represented here & the difference could be explained as On continued to grow its SG&A.

This doesn't take away anything to the results which are nothing but good to great while the brand continues to grow.

In term of cash, we're talking about 576.7M CHF of net debt - including leases, for 450M CHF of FCF with less than 1% YoY dilution, very comfortable.

Guidance.

And this should continues although again, we have lots of uncertainties in the market lately due to the tariffs & trade war going on which would obviously impact exporters like On.

Management didn't talk about it but is still guiding to continuation with comparable numbers in FY25 to FY24. A continuous growth rate from higher value is a really strong guidance to my opinion.

We can also add that the company is guiding to continuous profitability & stable margins which, in the case of sportswear companies, means growing cashflow with not much to do with. I'm not saying we'll see buybacks or dividends as management might prefer to continue investing in the brand itself & marketing strategies but ultimately, it will happen if things continue on that very bullish trajectory.

My Take & Valuation.

Excellent quarter & year for the company. I bought more than a year ago at fair value thanks to the market misunderstanding the currency impact & held 100% of my share up to today. And I don't intend to sell.

I thought at first I would take profits but I don't see the point anymore as more & more, the brand looks like a sleeping giant ready to take over the world. Everywhere I go, I see more & more On & results just shows a growing demand. No point selling a winner.

As for valuation, we certainly are slightly expensive but the uncertainties will take care of this soon enough, or tariffs will do it otherwise.

On deserves higher ratios than Nike or its industry as its brand is very new & growing rapidly - faster than both, as for ratios that higher… Hard to say, it could be fair but I wouldn’t open a position at that price. Although we are talking about a very long term position here so if things continue that way & the intend is to hold for half a decade at least… Sure, I could call this fair price.

So it's all about timeframe & the actual uncertainties between currency mix & tariffs - although those aren't very long term concerns once again. I'd personally be much more comfortable around $45 or so - which isn't that far.

Altogether, a really great quarter, great brand, great growth, great everything… I'll look to buy more for the long term when price becomes really attractive as I believe they can become a global world brand in the next years.

And I'll let management conclude.

“On to the next fifteen years.”

Seeing On shoes more and more on the streets in Asia. My parents got their first pair and they loved them. Great long-term hold candidate. Thanks for sharing!