On Running | Q3-24 Earning & Call

Christmas but in October.

If you don't know anything about On Running, everything you need to learn about the company, its products & the brand is here.

Overview.

Let's start by saying that the EPS isn't really a miss; it is entirely due to currency mix as we'll see later.

EPS. $0.23 | $0.17 | -26.09% miss

Revenue. $704.58M | $734.52M | +4.25%

A very good quarter altogether.

Business.

A casual start for an earning call.

“Congrats on your New York Marathon finish, Martin.“

I’m pretty sure those guys are where they’re supposed to be.

On's brand awareness is growing rapidly & healthily, especially after the Olympics which gave a real boost to it, coupled with great marketing campains with Zendaya & Federer, two important icons.

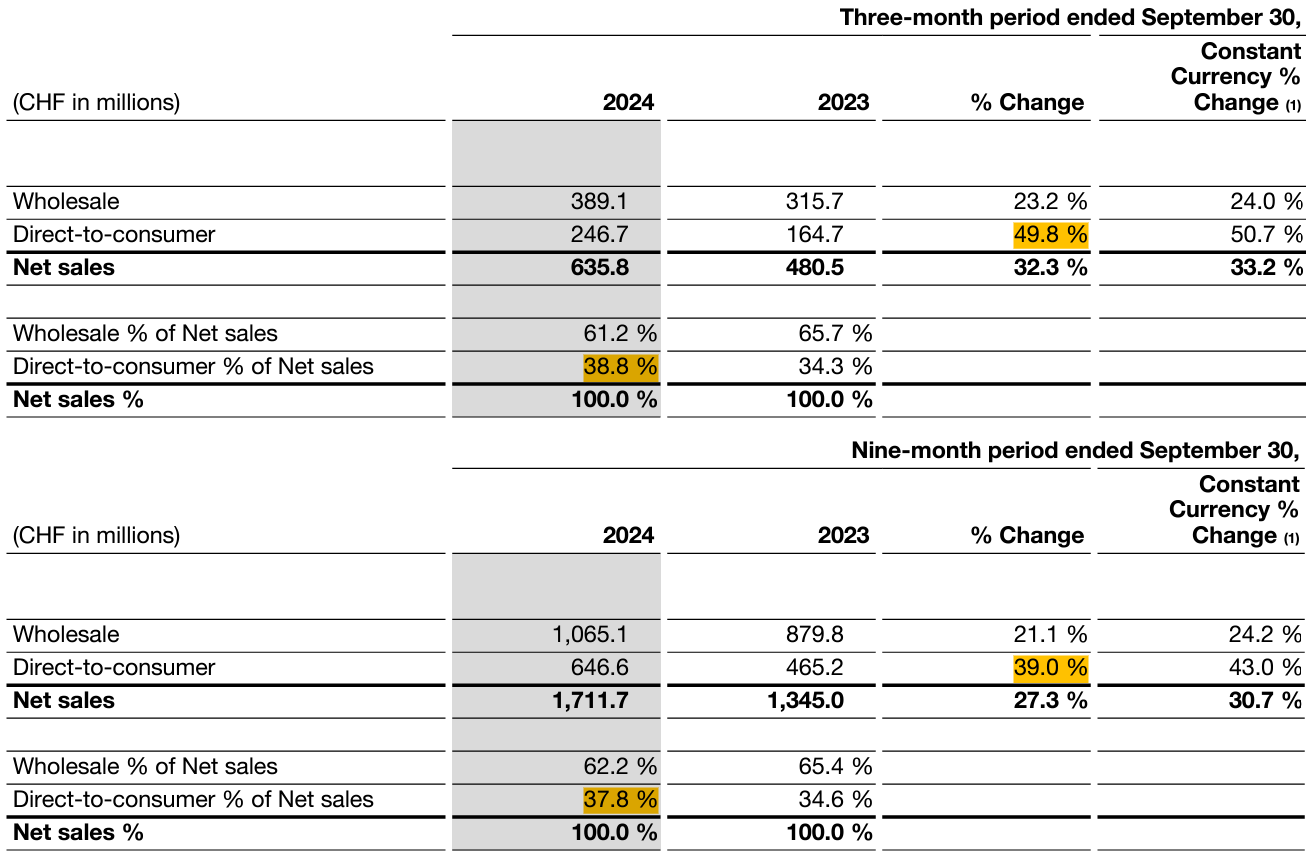

The most important data is the Direct-To-Consumer channel which is growing rapidly & taking a bigger & bigger proportion of total sales each passing quarter.

This is an indication that consumers go directly to On's selling points to get their products, not wandering around and finally picking up On after comparing it with other brands. No, consumers want On, and most of this quarter's & nine months' ending growth come from this kind of consumer.

Secondly, On is growing its shares in the younger consumers market according to management, a key component as many runners & sportives usually grow with a brand - that’s also true for lifestyle products.

In terms of geographies, we see the same tendency as with many other retailers; Europe is slowing while Asia at large is growing rapidly.

At this rhythm, Asia might be a bigger portion of revenues than EMEA by ‘27, especially as growth in this region is accelerating & On is pushing hard there, with very good feedback.

“we have massively increased our APAC business and are ahead of our plan, growing over 85% on a constant currency basis in the 1st 9 months [...] The vast majority of our new store openings this year have been in China, and we continue to accelerate the rollout given the broad based success of our store formats, allowing us to dream bigger, so much so that we have decided to bring our proven and larger global flagship formats to at least 2 premium locations in China next year. In China, we are further reaching a notably younger and mobile first consumer, visible in the meaningful e-com share from livestream channel.”

On realized its "all time China single day sales record during the 1st peak of the event" during the 11/11 holidays in China. This will be included in Q4's financials so we can expect some good numbers then.

The brand is also going to push into new markets like Indonesia & the Philippines. I'll do a small parenthesis here to talk once again about Asia, which is the biggest & sole source of growth for some bigger retailers - not On's case, and 100% of them are focusing aggressively on the region with massive investments & stores opening. That's surely a sign. Closing the parenthesis.

There are no real changes in product mix, with shoes still more than 95% of the total revenues although both apparel & accessories are growing faster but from a much lower base. Shows that consumers tend to add something in their baskets after buying shoes but that's about it.

Lastly, rapid news about the Atlanta warehouse, estimated to be delivered & optimized around spring '25 which would give On two warehouses on both of the U.S. coasts, hence better cost control.

Revenues.

Lots to say.

Firstly, we see very healthy growth in terms of revenues for both periods, up +32% for the quarter & +27% for the nine months ending with stable gross margins around 60%, which is the company's goal, and operating margins slightly decreasing but sticking around 10%.

Now the big subject, as always for foreign exporters: currency mix - which isn't something On can control as I explain every quarter. The company lost 42.6M CHF only by converting U.S. dollars to Swiss Franc as the forex market is still very excited lately with geopolitical news & more…

“While we continue to take measures to reduce the sensitivity of our results to FX fluctuations, the significant drop in Swiss francs per U. S. Dollar between the end of Q2 and the low point at the end of Q3 led to considerable unrealized FX loss during the period of CHF 37,200,000.”

The entire quarter has been terrible for Swiss exportations as their local currency kept gaining value against the dollar, their biggest geography in terms of revenues.

As you can see, this tendency switched at the end of the quarter and Q4-24 should be much less impacted by the currency mix, especially if the dollar continues to gain strength going into Christmas.

Either way & once again, On cannot control the rate change.

My Take.

Everything is pretty good in my opinion & the only thing one could complain about is the net income & margins which are as they are due to currency exchange rates, nothing to do about it. Brand awareness is growing, growth is accelerating for the fourth quarter in a row which is pretty impressive & confirms the strong demand for their products.

Growth could continue to accelerate through 2025 but for now, I will keep my average price target around $35 as I see no real reasons to upgrade it too much with current data. On might be a bit pricey at $50 but with growing brand awareness, accelerating growth & excellent marketing strategies… Seems entirely deserved.

Holding strong but I don’t plan to buy much more at today’s price.