On Running | Q2-24 Earning & Call

The Swiss Class.

If you do not know about On Running, everything you need can be found here.

Overview. I’ll spoil it already, but we’re looking at a very correct quarter for the brand today.

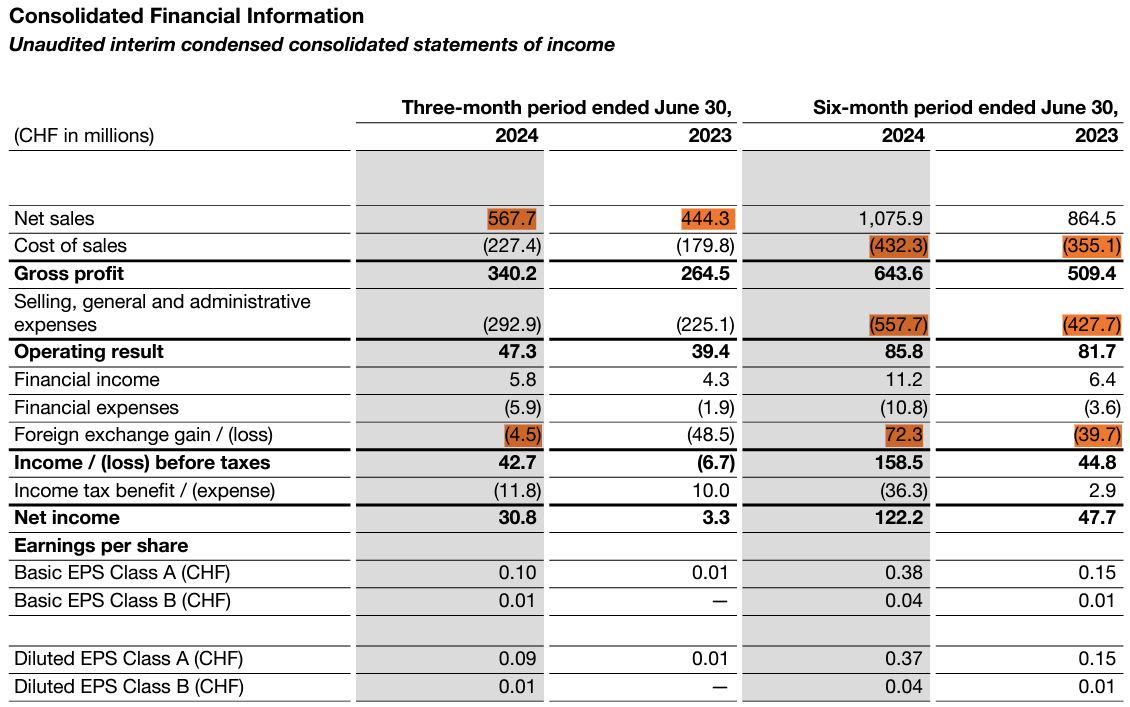

EPS. $0.18 | $0.15 | -16,6% miss

Revenue. $648.28M | $630.25M | -2,7% miss

"The past weeks and months have been filled with exciting brand moments for On and it is clear that we have laid the groundwork for what we believe will shape On for many years to come."

Numbers are good without being great, but the quarter doesn’t have anything bad.

Currencies.

Before going into the usual categories, I’ll talk about currencies once more. On Running is a Swiss company, and Switzerland is probably the only country in the world to be negatively impacted by selling… everywhere else, U.S. included - the inconvenience of having a well-managed country & currency.

What is called exchange rate is the ratio between one currency and another, you should have noticed it if you traveled abroad. When you give 50 of your own currency to convert it into the currency of the country you are in, you never receive 50 back; you receive more or less.

These ratios are constantly changing, and in the financial mess of the last years, almost all of them lost value against the mighty dollar, all except… the Swiss Franc, which actual took value against than the dollar.

When you export products and sell to countries with a different currency, you then need to convert your sells to your local currency to pay your employees, charges, etc... And as the rates constantly change, you end up with more or less depending on the exchange rate when you perform the operation.

This is On Running’s “problem”: they work with a strong currency, stronger than all others, while the market & analysts often do their own projections and analysis in dollars - which, in On’s case, makes them rapidly obsolete as the exchange rate will be different next year.

This is a complex subject that would need a deeper explanation, but tons of content is available online to understand the currencies games & export/import dance. What matters is when dealing with stocks & companies, we have to deal with their local currencies.

And On’s results are pretty correct doing so, while a bit less good in dollars.

Business.

Management got me with their opening statement of the earnings call.

“Over the last weekend in Paris, it struck me that the Olympics do not measure the performance of athletes in a yearly cycle as other tournaments do or even over quarterly cycles. The Greeks knew 2,800 years ago that big dreams require a longer period to train, evaluate and prepare. This is why I want to speak to you today about how ON's unique ambition to dream big over long cycles leads to extraordinary achievements, breakthrough innovations and ultimately durable growth.”

It might be a bit theatrical, but who doesn’t love a bit of attitude? More importantly, this introduction showed passion, long-term thinking, and strong willpower. Many could overlook it and just look at the numbers, but I really enjoyed and think it important.

Back to the report, D2C sales are outperforming wholesales, an important point. The difference isn’t in the numbers but in the relation between the customers & the brand. When you go to order on On’s website directly, you know what you want, you want this brand and these shoes. While some people sometimes just stumble on a pair they like at a global shoe-seller. The end is the same: a sale for On Running. The intention isn’t, and it is valuable to know that more and more people choose to go to On Running directly - this is brand awareness.

“In our ecom business, we had seen some softer demand in the 1st days of the quarter, followed by a reacceleration of growth in the second half, helped with record high traffic on our website. This includes a very strong start for some of our recent digital channel expansion.”

On also owns its own stores and opened one in Paris recently while all of them are apparently doing pretty well.

“Our New York City Lafayette store remains a vibrant hotspot, attracting some of the highest traffic levels among all our retail locations this quarter. We're excited to open our 2nd store in Manhattan in a few months, where visitors will have even more space to immerse themselves in the full on experience. Just a couple of weeks ago, we also opened our first ever store in Hong Kong, which we celebrated with some of our closest partners and taste makers in the region. Despite the early days, the store has clearly exceeded our internal expectations.“

In terms of geography, there is a short-term slowdown in EMEA for this first semester at least - although this trend could continue.

Growth has been very correct this quarter in the other regions, especially in Asia-Pacific, which still is a pretty small part of the revenues but rapidly growing - as it should because this is where the money & growth source is at the moment.

“From the continued strong momentum in China, daily queues in front of our store in Japan, record sales in very nascent markets such as Indonesia or the Philippines and of course, the already mentioned success of our new store in Hong Kong. Current demand is clearly exceeding supply.“

As for EMEA, it’s hard to know the reasons but I’d once more blame it on the macro & the state in which our countries are economically - 150€ shoes are accessible to fewer & fewer consumers in the region.

In terms of product mix, nothing new, shoes being the biggest source of revenues above 95% of the company’s revenues with, once more, apparel & accessories growing very rapidly. This is how sportswear companies do it, this is how Nike did it. Shoes are what they sell, while the rest is simply “bonus” - although it sure can become a big fat bonus over time as brand awareness grows, which it is.

“in Paris, in our new Paris store, every 4th piece sold already being an apparel piece.”

We won’t dive into the warehouse transition to Atlanta but it is important to be aware of it. On is building a better & automated warehouse there, but the logistics aren’t easy and are apparently impacting inventory, resulting in some products being unavailable - and sales being canceled.

“While we are fully focused on improving the situation, we expect a continued impact in the second half of the year. But this transition is essential to scale our distribution capabilities in the U. S.”

Let’s see how this goes during the next quarter, but management is apparently saying that without those constraints, On would have raised its guidance, so surprises could come in both ways and we could expect more in the future once those issues are fixed.

Revenues.

I only have one thing to talk about in this statement, but it isn’t even a big deal.

Let’s take things in order though.

Revenues are good and growing well, with an acceleration above 28% YoY this quarter while we were stagnating slightly above 20% the last two quarters. This might be the result of a good marketing strategy, and I would say that we’ll continue to see higher growth in the next quarters as a result of their campaign with Zendaya or the publicity done in the movie Challengers.

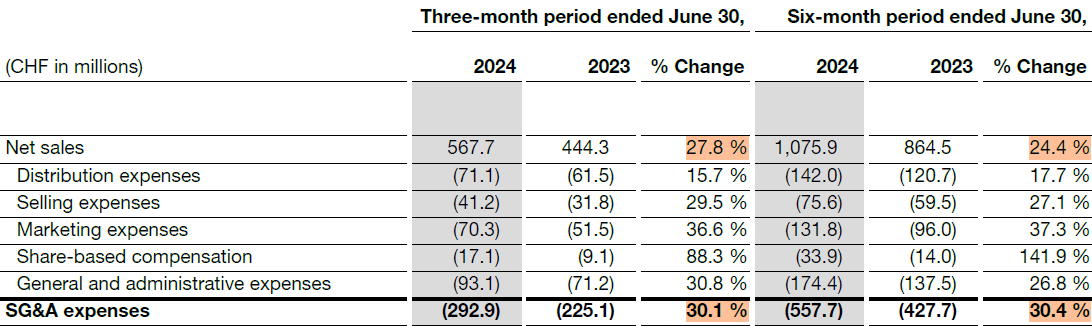

Expenses, let’s talk about them because they are my “issue” with this report.

Cost of sales is growing less rapidly than revenues which is good for a sportswear company as it means they are able to optimize costs (be it shipping or manufacturing) while demand & sales grow.

Expenses are a different story, growing more rapidly than revenues for the quarter & semester - in terms of value as it is flat-ish in terms of percentage of revenues. It is normal as these include marketing, and a sportswear company needs to grow its marketing costs to build brand awareness.

It’s simply not perfect to see them growing more rapidly than revenues but it still is a necessary step, for now at least - hence the quotes on “issue.” These expenses already yielded returns and should continue to do so.

“we further boosted them with significant marketing investments across all our channels. And it's clearly working. The brand is maintaining its incredible momentum based on direct customer feedback, continued sell through strength, our brand awareness tracker, a strong increase in Google searches and millions of media impressions.”

The foreign exchange losses are also shown in this statement, and is what I detailed earlier about currency swaps - you can see that On is losing a few million on this, which makes a difference.

Guidance.

The guidance is good, in line with my personal expectations, with FY-24 growing 30% in constant currency, as it is impossible to predict the future exchange rates. We’d be talking about 2.26B CHF of revenues at the end of the year while staying profitable with a gross margin around 60%, and a net margin probably around today’s or a bit higher - between 7% & 10%.

A rapid word on the consumer strength, on which On is pretty optimist on.

“So we I think we confirmed an already strong guidance and we wouldn't do that if we didn't have confidence in the consumer. We see very positive signs over the last couple of weeks.”

On is a premium brand, selling expensive products, and the weakness in the consumer observed by many companies or banks over the last months came from the lower-income households, which aren’t really On’s target. I wouldn’t be surprised to see On continue thriving as long as higher-income households’ buying power isn’t too much impacted.

My Take.

As I said at the beginning of the write-up: a correct quarter. Nothing shining, and management is doing what it should do to grow brand awareness & revenues for the future. This quarter just confirms the good trajectory on which the company already is.

I stick to what I said in terms of valuation as well - just keep in mind every number is in CHF here, nothing in dollars except the stock price which isn’t available in CHF and is converted to the currency with today’s exchange rate.

Expectations didn’t change. The company is planning to grow 30% YoY FY-24 and this seems achievable as growth is accelerating, but I prefer to stay conservative in my assumptions as it will still be hard to keep this growth for three years straight.

Between 24% & 27% is very doable - assuming we won’t hit a recession, and the proper average price to accumulate would still be around $30-$34 with a correct margin of safety.

As always, this is considering today’s data; things change, and I’ll change if I need to. As of now… I plan to continue buying as long as my average price sticks around $30/$32.

Thank you for the feedback, support and kind words 🙏. It's nice to know, always hard to have feedback on other regions!

Hope we'll make some bucks from this one.

Thanks for the quality work. Can certainly attest to the growing popularity of the brand in Asia - more and more people are wearing their shoes, which reminds me of the hype on Lulu during its early days! The valuation is very helpful too.