Olo | Q1-24 Earning & Call

Olo is probably less known for many and I still didn't write an updated & clear investment case here so I'll simply repost my X review which is already very complete so you can familiarize with the company & business. It's just a different format.

https://twitter.com/WealthyReadings/status/1759628211044966768

If you want a rapid sum up to continue with the earning report, Olo is a company which provides a technology platform that enables restaurants to digitize their operations. They offer different services priced differently - some based on the restaurant's performance - such as online ordering, payments, delivery or marketing & data analysis/management. It's a win-win tech meant to optimize and digitalize restaurants' daily activity.

Overview. Up to the review on a great quarter for the company.

EPS: $0.04 | $0.05 | +25% beat

Revenue: $64.29M | $66.51M | +3.45% beat

$15.2M of buybacks | New program of $100M without expiration date.

One rapid add, the decline of active location is due to the contracts closed by Subway which were using only a very small part of Olo's offerings. Numbers look bad but it's actually not been an issue for the company's global growth nor to find new restaurants to partner with.

The takeaway is pretty rapid. Business is growing in term of location & ARPUs which means more revenues per restaurant from more restaurants. Business is well & it shows on the finances.

"With omnichannel guest data at scale and the AI and machine learning solutions to leverage it, we believe Olo is uniquely positioned to help brands deliver more personalized guest experiences that increase sales and grow guest lifetime value."

Business. First of all, shame on me as I didn't cover it but Olo announced its Spring release with some very interesting new products & ameliorations. It's all available here and should boost Olo's future - especially the Olo Pay with card-present payments and Smart Cross-Sells.

https://www.olo.com/quarterly-release/spring-2024

There are much more innovation but I honestly cannot keep up the pace... Lots of things and those are going fast.

I won't have much more to comment here as the quarter is self-explaining. Growing active locations means the services sold are attractive to restaurants and growing ARPUs should be a mix of two things.

First, their clients tend to subscribe to more & more services after confirming the quality of the first one - this is only an example but most probably starting with Order to then add Olo Pay & maybe some features from Olo Engage. When a company allows you to manage the entire restaurant's menu, on-site & online orders, deliveries, payment & marketing while giving you access to your own data to optimize it all... Well, you subscribe.

"Customers love our road map presentation, the hands-on demos of our three suites, and our announcement to integrate OLO Pay and Engage's guest data platform with Qu."

And clients seem to be satisfied with NRR above 120%.

Second, those restaurants are simply earning more since they started using those tools because that's why they are for after all. Olo delivers tools to help restaurants do better. They end up doing better and both profit from it as some billings are based on performance.

"In a recent OLO test, Smart Cross-Sells accounted for 10% more basket value on average than static cross-sells."

Triple win as the end customer also ends up having a better experience.

Revenues. There won't be much more to say about revenues as things are as clear as business-wise.

Except for one subject which is the decline of the gross margin as costs rose faster than expenses due to the integration of Olo Pay which is a more complex service with lower margins, although this shouldn't continue.

"In terms of gross margin, we now expect the sequential decline will be less pronounced."

It's hard to complain about those gross margins declining as they're simply due to a new service which will help grow market share, integration & growth - the service should grow to a $60M revenue this year according to management, pretty significant.

"By running all their payments through Olo Pay, we enabled honeygrow to improve their financial performance and their guest experience. And they are generating significantly higher ARPU than our platform average."

Providing payment solutions is kinda necessary when you propose on-site & online ordering at restaurants.

On the contrary, expenses declined almost everywhere but with S&M - and we don't really want those to decline. At the end of the day, we see net margins growing.

We're still not profitable but we're close to it. I wouldn't be surprised if we were to reach it very soon as the company is now focusing on buybacks, which will consume the war chest faster than usual. This is only my opinion but this cash is meant to pay for the expenses as business grows, so using it for buybacks hints than cash might flow in very soon - profitability & positive FCF.

But that's only my assumption.

To talk further about the balance sheet or the war chest as I called it, we're with a net debt of $336M, an OpCF of $6M - positive thanks to the shares program - and an FCF of $2.8M.

Global Market. We didn't have any information about this in the report but an interesting question has been asked during the call about the market health of restauration.

"One is labor pressure, the higher cost of labor [...] food costs and the inflation in food costs leading to restaurants taking price."

It doesn't mean the entire industry is struggling but we see things happening, and Olo can help with that.

"helping the restaurant be more efficient in their use of labor, putting more of the ordering and payment in the hands of the guests [...] helping you do more with less"

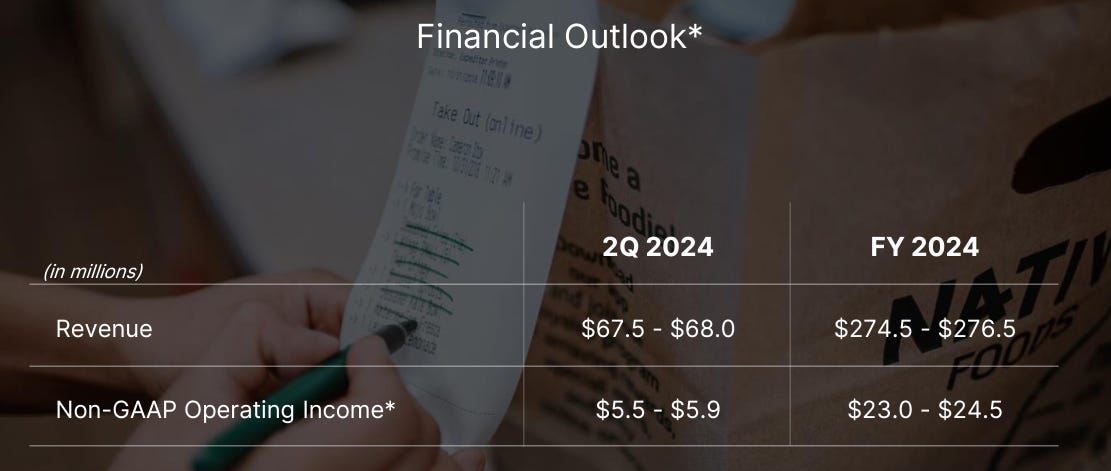

Guidance. Quarter gets even better when we reach a raised FY-24 guidance.

We're talking about more than 20% growth YoY for Q2-24 and FY-24. Might have a slower growth than last years but this is the lower point of the guidance so let's see how the next quarters will go.

Conclusion. It's hard to be negative about anything here, business is growing and proving that the solutions proposed by Olo are pleasing restaurants and helping them in their daily operations - we had plenty of testimony and proofs of that.

I won't go deep into valuations but we're talking about a company growing revenues more than +20% YoY and guiding to FY-24 revenues at $274.5M while having an EV of $420M...

But that's only my take. You guys do you!

Thank you for reading it all! If you like it, please consider subscribing to receive it all directly in your inbox and not miss a thing!

Everything I share here is free but if you found the content valuable enough, you can always leave a tip!