Netflix Q3-25 Detailed Earning Review

The market focuses on the wrong data.

If you guys are interested, you’ll get a 15% discount on FiscalAI through my referral link below. FiscalAI is the tool I use for KPIs in all my write-ups - powerful, data-rich and with great UX.

https://fiscal.ai/?via=wealthyreadings

I do not have an investment thesis written on Netflix yet.

Business.

Overall, a strong quarter with very positive results. The market’s reaction makes sense, Netflix has been expensive for a long time and even small imperfections get punished at this valuation. That said, there were no real imperfection today, just the optics of it, fundamentals remain strong with the same massive potential as before.

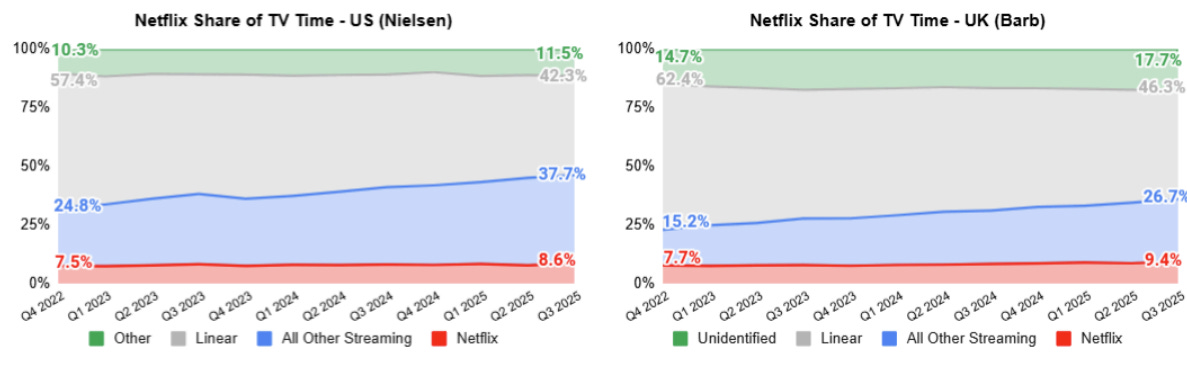

We continue to have a massive opportunity since we’re only about 7% of the addressable market in terms of consumer spending and only about 10% of time spent on TV in our biggest market.

Netflix is part of a very large and rapidly growing industry, streaming demand is rising for all platforms - I’d suspect for some like YouTube more than others. The good thing is that these platforms are taking shares from older methods rather than cannibalizing each other.

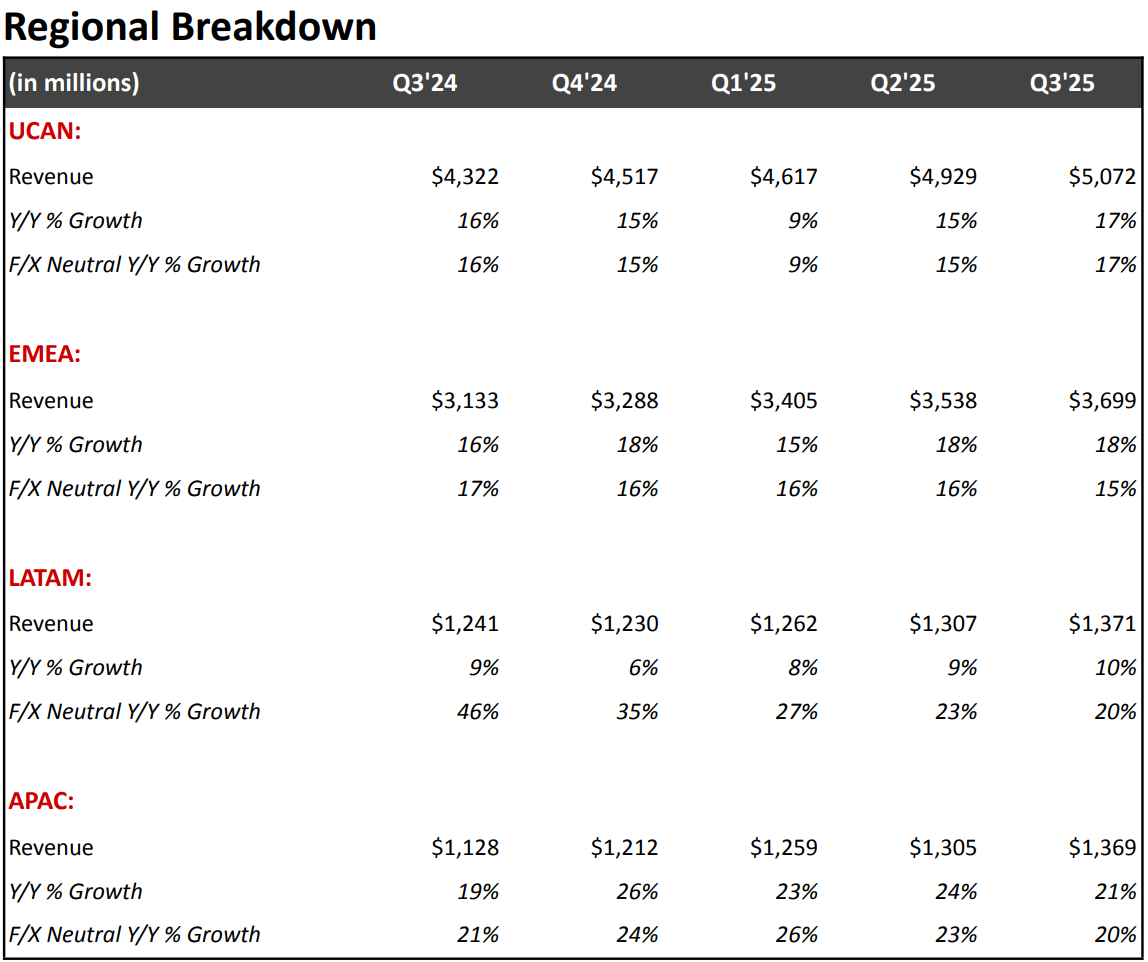

Demand for Netflix comes from all continents with stable growth in neutral currency, and irregular growth in dollars due to its fluctuations lately.

This was a great quarter. Growth is steady, demand is strong, conversion & retention remain solid... Fundamentally, there is nothing to be concerned about here.

The Brazilian Taxe.

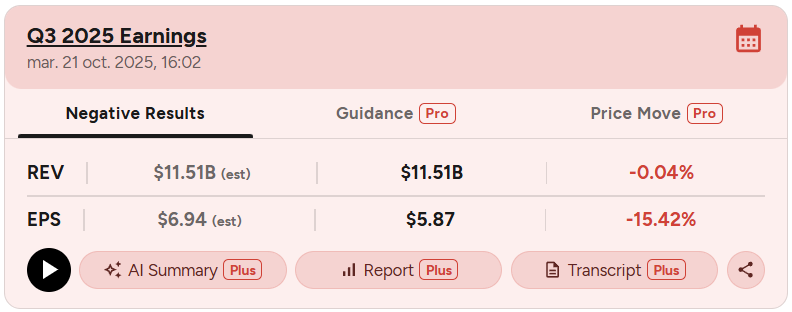

This is what created a bit of chaos and gave the optic of a “bad” quarter.

Brazil introduced a 10% gross tax on outbound service payments. Originally meant for tech services & products, it was expanded to include platforms like Netflix, retroactive to 2022.

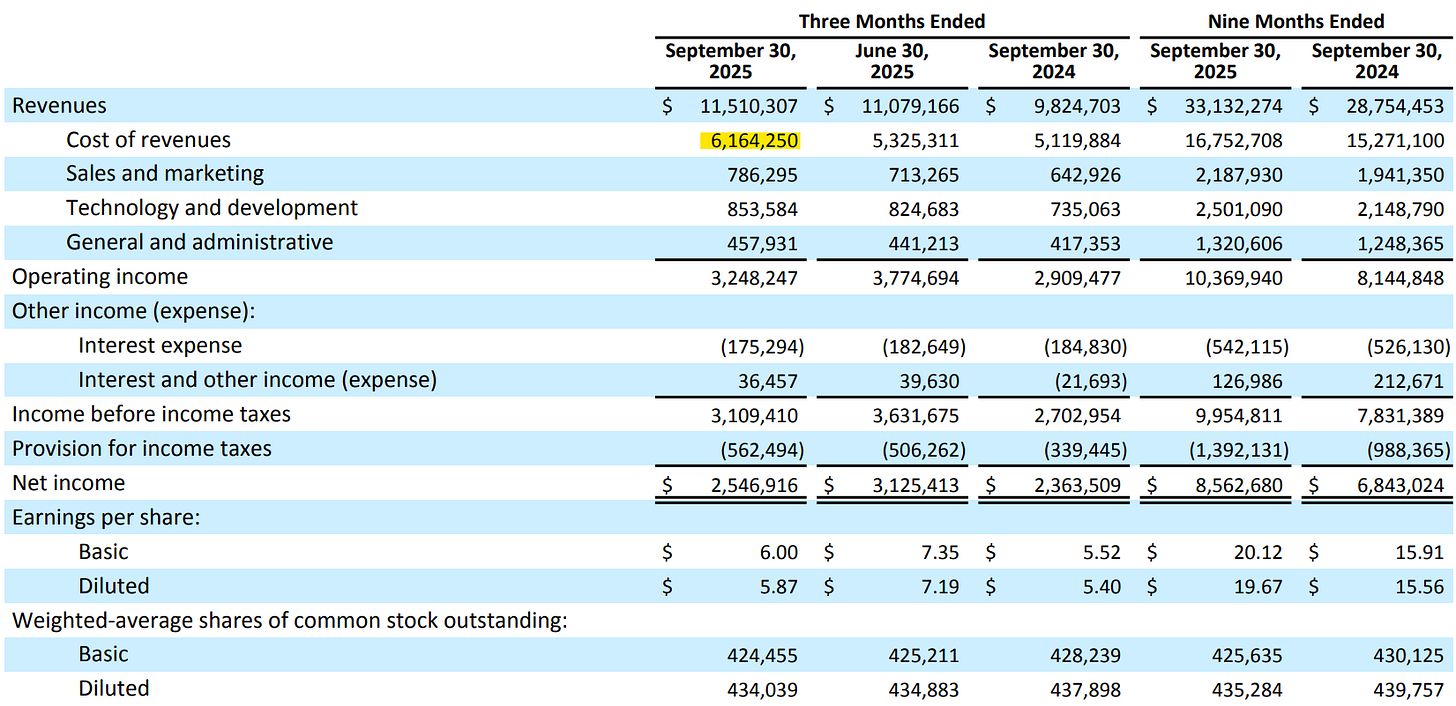

This one-time cost of $619M caused Netflix to miss expectations but the business itself is healthy and would have beaten them without it.

Our operating income would have exceeded our forecast absent the Brazilian tax matter. We’re also seeing good progress against our key priorities. Engagement remains healthy. We achieved record share TV time in Q3 in both the U.S. and the U.K. We recorded our best ad sales quarter ever. We are now on track to more than double ad revenue this year.

Advertising Business.

Netflix’s advertising business continues to improve, with more options for advertisers, better targeting, stronger conversion and therefore is more interesting for advertisers.

What are driving those results? Advertisers are excited about our growing scale. We’ve got a highly attentive and engaged audience.

More ways to buy, more data for targeting and media planning capabilities globally, more modular and interactive ad formats with enhanced AI capabilities, and more measurement functionality in all of our markets. In 2027, we get to pivot to make more focused investments in data capabilities such as machine learning-based optimization, advanced measurement, advanced targeting. I would say we’re getting, we’ve got our legs underneath us.

There’s still lots of room to improve it.

Artificial Intelligence Impacts.

I am part of those who repeat over and over that AI is a great tool but won’t replace everything overnight. This is true for film making but also for any kinf of software - you probably know what I’m talking about.

Netflix’s CEO shares this view.

We’re not worried about AI replacing creativity, but we’re very excited about AI creating tools to help creativity.

For what we do, it takes a great artist to make something great. Writing and making shows and films well is a rare commodity, and it’s only done successfully by very few people. AI can give creatives better tools to enhance their overall TV movie experience for our members, but it doesn’t automatically make you a great storyteller if you’re not. If music is a leading indicator of all this, AI-generated music has been around for a long time, and there’s a lot of it, and it’s a pretty small part of total listening.

We’re confident that AI is going to help us and help our creative partners tell stories better, faster, and in new ways. We’re all in on that.

Video Games.

Without surprises, management is keeping video games a priority to boost retention.

We’re rolling out this holiday season a slate of party games on TV. It’s great for the whole family. When you’re in front of that TV, all you need is the TV and your phone as a controller. It’s like Boggle Party, Pictionary Game Night, Lego Party, Tetris. We’ve got Party Crashers, which is a social deception game. It drives retention and therefore supports the business. Looking ahead, we’re going to ramp our investment in this area judiciously based on demonstrating that we’re ramping returns to the business. We’re extremely excited about, you know, the progress we’ve got ahead of us.

Financials.

Outside the Brazilian tax, results were strong.

Revenues grew 15.2% YoY for the first nine months. Margins were affected by the one-time tax, which also impacted cash flow, but the business remains healthy. once again, this is more about optics than business issues.

In term of cash, Netflix generated $2.66B in FCF & has $5.1B in net debt. The company also bought back $1.8B in stock this quarter.

Guidance.

Management expects $11.96B in revenue next quarter, roughly 16% YoY growth, in line with market expectations. FY25 revenue is projected to grow 15.6%.

Investment Excecution.

Another solid quarter, with bad optics and a capricious market.

I have noted for months that Netflix was expensive above $1,200. The stock needed a breather, and we’re seeing it now, but the reason for the pullback is not related to the business, which remains strong. Nothing to worry about for shareholders.

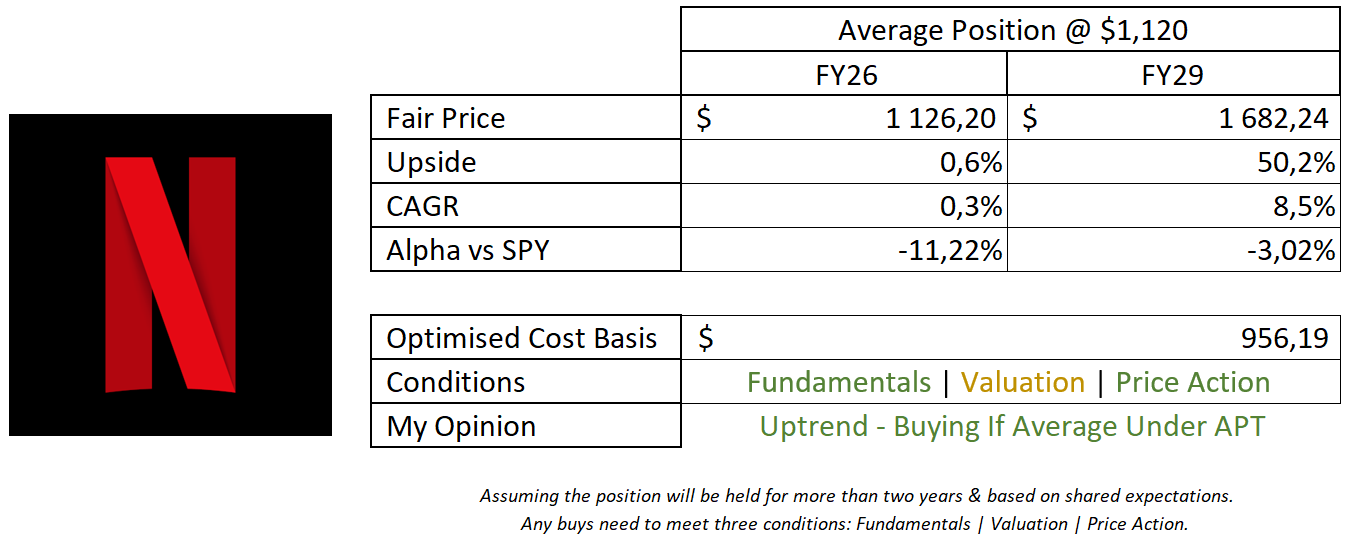

This model assumes a 15% & 12% CAGR growth until FY26 & FY29 respectively, 26% net margins, 1.5% return to shareholders, and a P/S & P/E at x7.7 & x45 respectively.

This raises my OCB compared to previous valuations. I used to have doubts and used lower multiples than its average because of my bias, but Netflix continues to prove it is the leader in streaming with clear bullish data & great initiatives to increase loyalty and onboard new users. Personal bias are less important than real data.

In terms of price action, the stock is on its daily 200 and approaching its weekly 50, an important bullish supports for bull trends. The stock never closed below since the bull trend started late 2022.

There is also strong support around $1,100 making this a great accumulation zone, slightly above my personal OCB. The business remains excellent, the stock needed a breather and that’s where we are. Luckily this breather comes from optics and not fundamental issues.

Leaves it up to each of us to take advantage of it. Or not.