Netflix | Q3-24 Earning & Call

Getting used to excellence.

I have been one of the skeptics around Netflix and its need to spend always more to create value but I clearly have been proven wrong. The company is doing wonderfully and getting better quarter after quarter.

Overview.

EPS. $5.12 | $5.40 | +5.47% beat

Revenue. $9.77B | $9.83B | +0.56% beat

$1.7B of buyback.

"Engagement, our best proxy for member happiness, remains healthy. Through the first three quarters of 2024, view hours per member amongst owner households increased year over year."

The overview is excellent and the call & information given made the quarter even better.

Business.

Let’s start by some global information, starting with user engagement which remains very healthy.

“This year, we've maintained very healthy engagement, about two hours of viewing per member per day.”

Pretty understandable with the programs released & expected to be released later this year, and the pace at which they do. The live programs coming up will also increase viewership with NFL games, the Tyson-Paul fight & more… I’ll be curious to see the statistics afterwards but I have no doubts these will be big hits in the U.S.

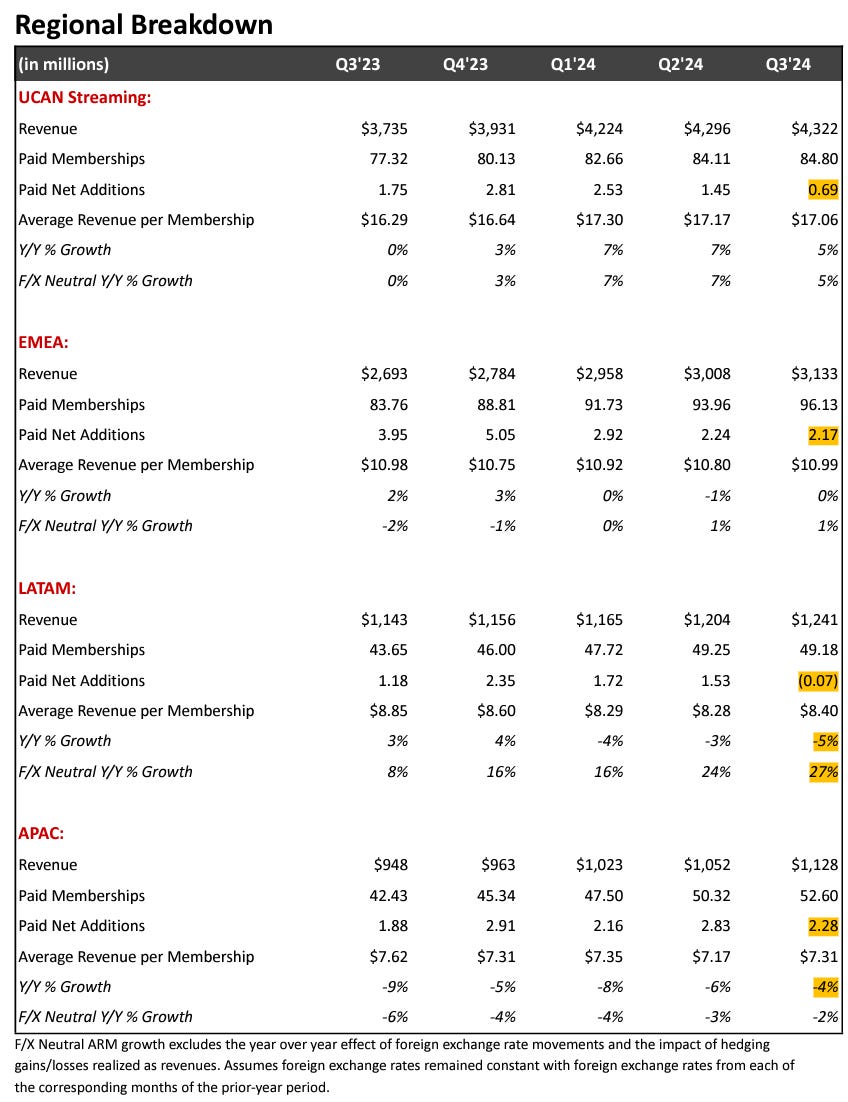

Geographies.

In terms of user base first, Netflix added a bit more than 5M users compared to last quarter.

The breakdown a slowdown in UCAN and an actual decline in LATAM, mostly due to timing.

“On Q3 membership specifically, the slight decrease you saw was primarily due to some recent price changes in some of our bigger LatAm markets, which always dampens near-term member growth. But the good news is we're already seeing a nice rebound so far in Q4.”

The same already happened in Europe some quarters ago. Local programations are a real strength for Netflix with lots of fresh content coming in LATAM soon, which the management expects to be big hits, attracting users.

In terms of average revenues, we can clearly see here the damages from currency mix as the YoY growth is lower than the organic one. This cannot be controlled but we see that demand is strong & monetization is being optimized.

Ads plan.

This is one of the big subjects for Netflix’s future to my & many others’ opinion. We know how profitable ads business can be with companies like Google or Meta. And Netflix wants a share of it, with a clear plan.

Attract more users. You need a huge user base to attract advertisers, none of them will bother for a few thousand users. A few million on the contrary… Things are going well on this end.

“Q3, we mentioned in the letter, ads plan accounted for over 50% of sign-ups in our ads countries.”

Optimize monetization. Following the lead of the two giants we talked about above.

“our goal over the next 5 or 10 years is to combine the best of digital advertising. So, this is all the things that we know from that targeting, personalization, relevance with the best of TV advertising.”

We’ve seen that targeting technologies have gotten better & better and Netflix will have the data to target users but also to cross-match their personalities with what they are actually watching.

While Meta targets you based on the knowledge they have of you, Netflix has the same-ish knowledge but will also be able to stimulate you while you are watching your show. Users will be more responsive to clothes ads if they’re watching Emily in Paris than if they’re scrolling on Facebook.

This will take time but the first data shows a very strong potential.

“And while ads won't be a primary driver of revenue in 2025, because we're still scaling that audience and that inventory faster than our ability to monetize it, we definitely see already the momentum growth in the monetization and our opportunity to close that gap.”

YouTube.

I talked already about the "competition" YouTube is in my Google IC and Netflix’s management has the exact same view.

“When I look at YouTube specifically, I'd say look, we compete directly with YouTube for people's time, for the time they spend on that TV screen. But we have very different strengths.“

Two complementary services and although I still believe YouTube can steal some attention from Netflix with their movies selection, I still don’t think Netflix really steals any attention given to YouTube.

Either way, these two aren’t direct competition in terms of service and we love both.

Revenues.

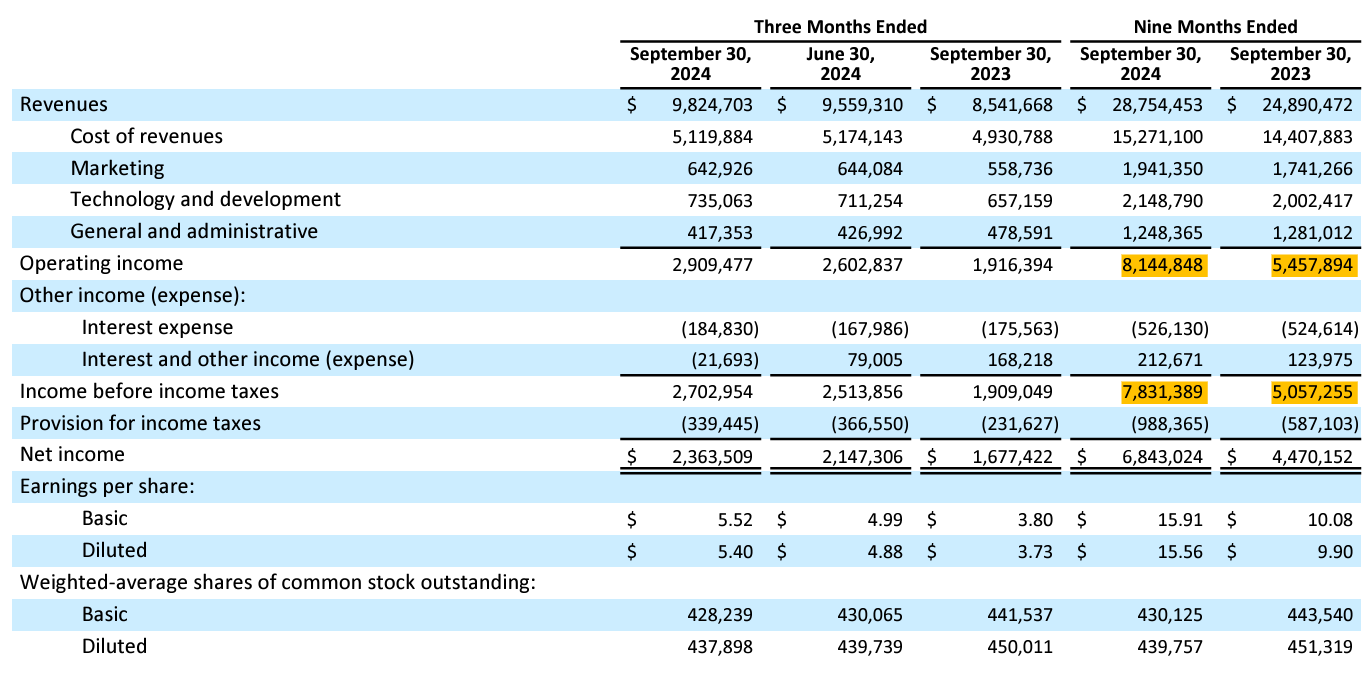

As you understood, business & management are doing great so without any surprises, financials are excellent.

Growth is real and this shows how good they actually optimized the business as total costs are really flat-ish YoY, only up +6% while revenues grew more than double, up +15.5% YoY while being hurt by currency mix.

Companies capable of doing that are few & deserve to be called excellent.

Nothing new in terms of balance sheet, Netflix closes the quarter with $9.2B of cash for $15.98B total debt and $7.8B of OpCF. A negligible debt compared to the cash generated, knowing that this debt is the leverage needed for the business to create content, hence necessary.

A strong position.

The CFO also confirmed their priority on how to use cash. First, growth & business investment. Second, keep liquidity. Third, return to shareholders through buybacks and fourth, potential M&A. Nothing crazy but it’s a good reminder and it was also meant to tell shareholders that no, they won’t get dividends.

Guidance.

The company is expecting a 15% YoY growth for both Q4-24 & FY-24 negatively impacted by currency mix as they’d expect around 17% organic growth and cherry on the top, Netflix is also expecting to expand its operating margin. Strong demand & excellent execution. What a combo.

The guidance didn’t stop there, management also talked about their views for FY-25 during the call. They expect between $43 & $44B of revenues or another double-digit growth YoY with once more, growing margins.

A future growth driven mostly by user base increase which means they still see room to attract new users while pricing optimization & the growing ads plan will do the rest. And when you hear comments like this, you understand they still have lots of room to grow.

“And it's worth noting that our share of viewership in even our biggest countries is still less than 10% of TV time.“

They told the market that they expected a growing & healthy business going forward, and that’s something investors like.

“So, overall, healthy double-digit revenue growth, more balanced across multiple drivers, and strong outlook.“

My take & Valuation.

Netflix continues to transform itself from a crazy idea & and a cash burning machine to a profitable, growing institution which everyone uses. Perfect execution & vision made this happen and it’s hard to doubt the company by now.

This quarter was once more excellent with great business improvements and management is confident in the future. It’s hard to say the contrary and I personally still have my subscription, impatiently waiting to see the second season of Arcane and I’m sure most of us are waiting for one or more shows that will be released on their platform.

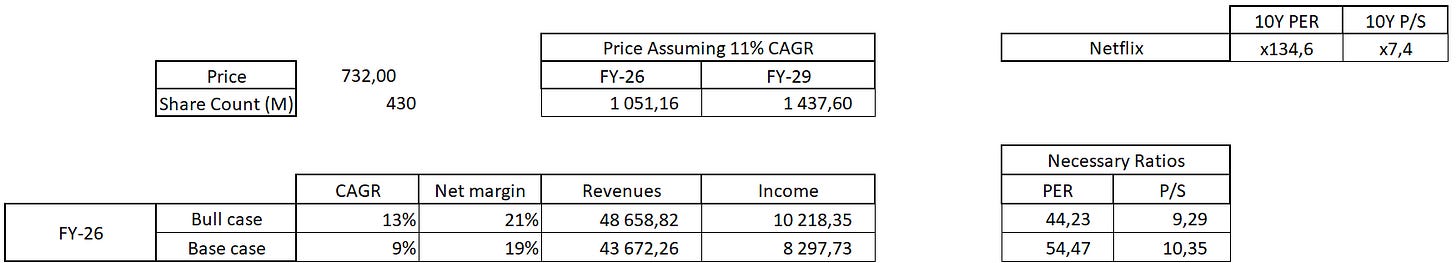

In terms of valuation, if the company grows 14% YoY & 10% YoY at least FY-25 we can expect a double-digit growth up to FY-26 with stable margins. We won’t focus on Netflix's historical P/E as it has been an unprofitable company for long so let’s just look at P/S and assume that with a slower growth than historically, I wouldn’t buy with projections above historical P/S.

Useless to say that today’s price is expensive to start a position, at least for me. If I were to find a middle ground between the two scenarios to have a FY-26 trading at x7.5 sales, I’d have to wait around $550 ish to buy in, a pretty big 25% drop from today’s price.

Wonderful quarter & company, great outlook, expensive stock. I wouldn’t buy but I’d hold dearly on my shares if I had any.