Netflix | Q2-24 Earning & Call

When excellence gets boring.

Overview. We can start with the conclusion: This is a good quarter, certainly pleasing shareholders but isn’t bringing anything spectacular to the table.

EPS. $4.74 | $4.88 | +2.9% beat

Revenue. $9.53B | $9.56B | +3.2% beat

$1.6B of buyback.

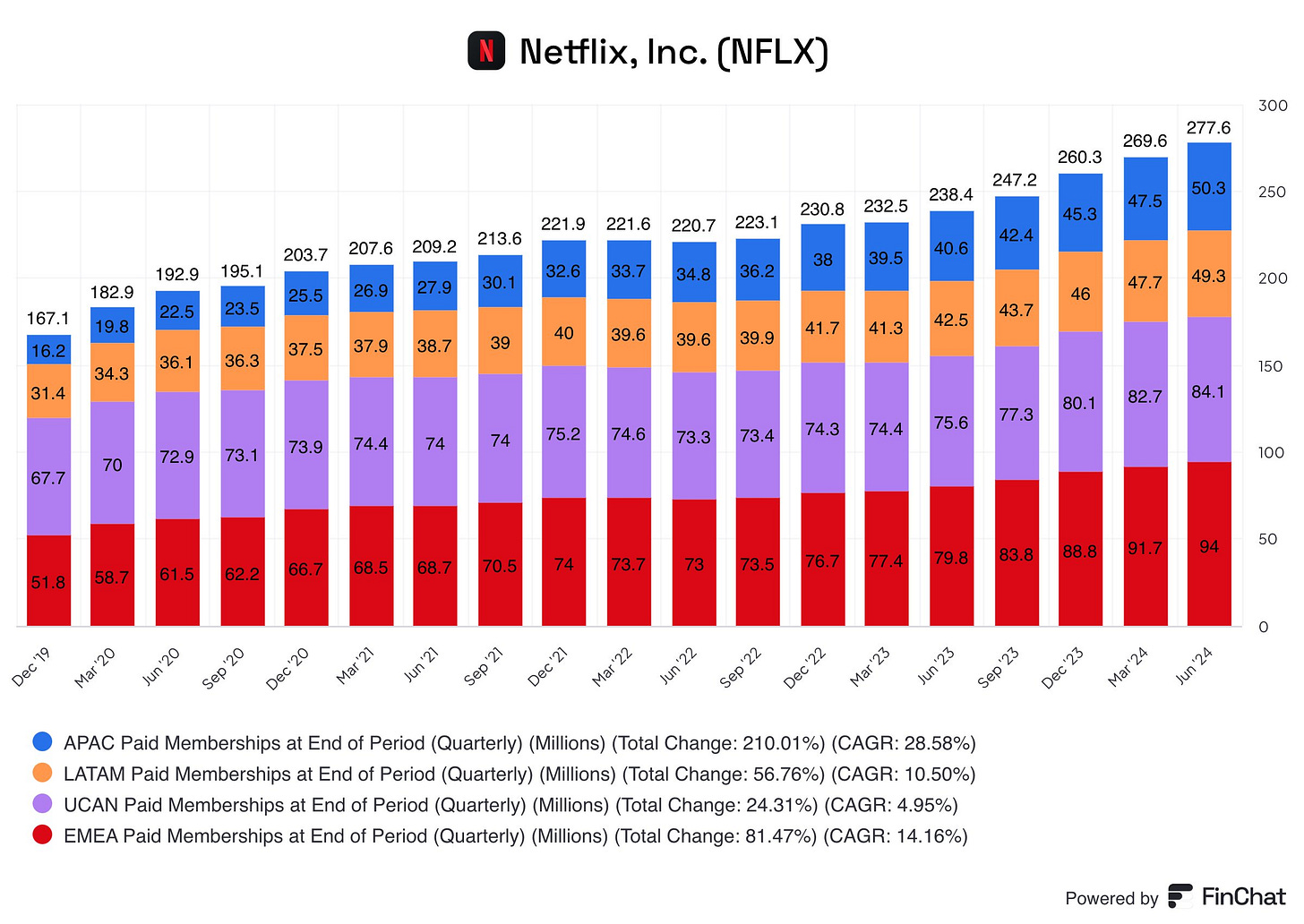

Business. It is impressive to see Netflix adding more & more subscribers with a spectacular 17% YoY growth - the strongest in recent quarters. This follows two key decisions management took last year: restricting or better monetizing screen sharing and starting an ad-supported subscription plan, which grew +34% QoQ.

“the quarter was primarily driven by a stronger acquisition, a little stronger than we expected, but also very healthy, continued healthy retention in the quarter. And that's across all regions.“

Netflix’s growth never stops.

Adds Plan. Netflix is focusing on this new plan which should become a significant part of revenues by 2026, according to management. Important brands like McDonald’s, L’Oréal, Coca-Cola and Ford are interested in advertising on Netflix but the company isn’t fully ready to partner with them yet.

“One is our go-to-market capabilities. So, we're adding more sales folks, we're adding more ads operation folks, building our capabilities to meet advertisers. A big component of that is giving advertisers more effective ways to buy Netflix.”

The main issue is that companies want advertising solutions Netflix currently cannot offer. They are working on this, building their own datacenter and technical stack to do so. This will take time, but considering how well advertising works for Meta and Google, it’s hard to see it not working for Netflix.

Engagement. I won’t go over the statistics of their different shows but will talk about two important points of the call, the first one about watch time.

“That's close to the approximately two hours of viewing per member per day across all the plans that you can calculate globally from our engagement reports.”

Which is… Pretty impressive.

The second about the company’s execution in creating & finding content for different regions and meeting local demands, with a great example from India.

“We had this great show, "Heeramandi." Sanjay Leela Bhansali, SLB, is one of the most celebrated filmmakers in India, and he took on this incredibly ambitious series and brought it to the screen on Netflix, directed every episode, and it's our biggest drama series to date in India.”

This ability to create local content and export it globally if it works well is unique to Netflix. Every region serves as a sandbox for their worldwide programming, and they know how to do this perfectly.

YouTube & Market Shares. Different reports, mainly from Nielsen, continue to show the lead of Netflix & YouTube when it comes to streaming market share and the question always comes back as to how the company plans to eat YouTube’s.

Thing is: they don’t. They compete for users’ attention but offer different services. Netflix knows this.

“So, really, what we're focused on here is focusing ourselves on that other 80% of total TV time that isn't going to either us or YouTube.”

The two giants can and will coexist; the question is whether others can keep their shares.

Revenues. Flourishing businesses always transform into impressive revenues. Netflix is no longer a cash-burning business and is now turning to profitability and cash generation, and doing it very well. Revenues are rapidly growing thanks to the company’s focus on monetization, making this quarter the second most profitable for the company.

This chart is the best way to summarize Netflix, and is probably the shareholders’ favorite.

Business is growing with more subscribers, growing revenues and allowing Netflix to spend more on creating & buying the content their subscribers want while now focusing on growing their incomes & cash flow, meaning growing margins. A tendancy which should not stop.

“we’re commiting to grow margins each year.“

This results is strong cahs flow statements as the company ends up this quarter with -$7.3B of net debt & $1.2B FCF - and a TTM FCF of $6.8B, more than enough to amange its debt. Cash which is mostly coming from the business and going to shareholder value through buybacks or short term investment, both very good ways to maximize the company’s value.

Guidance. Management raised its FY-24 expectations to 14% / 15% growth with operating margins around 26%.

The next quarter should bring another reccord revenue up 14% YoY and as margins should improve, probably another very profitable quarter and raising EPS.

The only headwind for Netflix is F/X rates, which they cannot control but hurt their business as currencies worldwide have been pretty volatile lately (thinking of Argentina, Japan, or Switzerland). This means Netflix could have done even better.

Conclusion. A great quarter but nothing the market wasn’t expecting. yet another proof that Netflix’s business is goign well and that the company knows how to execute and get the best out of it. This is probably very satisfying for shareholders.

I surely wouldn’t do anything if I were to hold Netflix as they’ll use the next years to ramp up their advertising business which will be the most interesting thing to observe. I won’t buy in either so I guess sitting on our hands is the best thing to do here.

Thank you for reading it all! If you like it, please consider subscribing to receive it all directly in your inbox and not miss a thing!

Everything I share here is free but if you found the content valuable enough, you can always leave a tip!