Netflix Q1-25 | Earning & Call

The real recession proof business

Overview.

Another pretty strong quarter for the entertainment company.

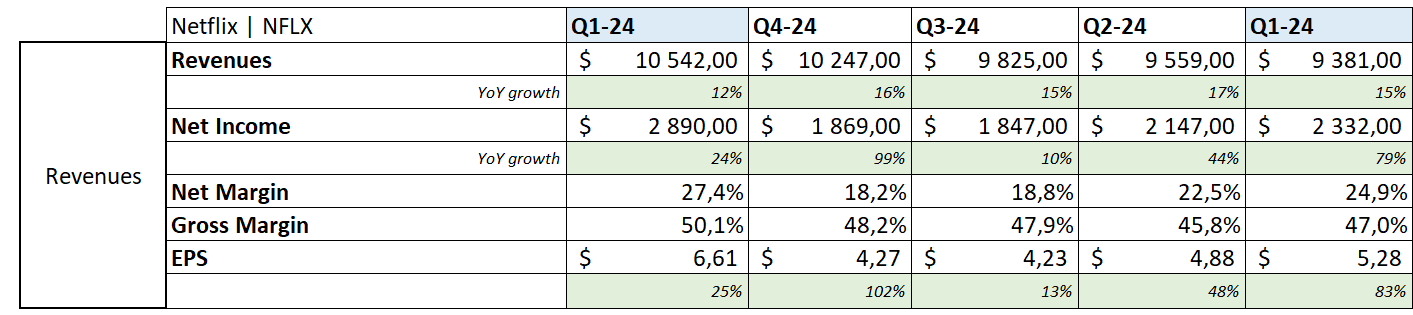

Revenue. $10.51B | $10.54B | +0.31% beat

EPS. $5.72 | $6.61 | +15.56% beat

$3.5B of buybacks | $13.6B left on plan.

Lots of positives with results even above management guidance.

Business.

Important to note first that both pricing & user base did grow simultaneously. Netflix does not report memberships anymore but confirmed that they continued to acquire new members while raising their pricing & not seeing significant churn. A pretty impressive combinaison.

The opportunity remains large according to management with “less than 10% of TV hours” at the moment & “about 6% of consumer spend and ad revenue in the areas that we serve”. Lots of potential left. Netflix will continue to focus on taking this time & money spent from classic programming more than from competitors. Kind of finishing off the dinosaurs first.

Estimations talk about an audience north of 300M payers for around 700M viewers today, with two-thirds outside of the U.S. & growth from all around the world.

Continuous demand acceleration in Asia which can be explained by a bigger focus on local content with $2.5B invested locally - Squid Game surely helped as a proof of demand. Continuous strength in LATAM although FX isn’t helping, healthy & stable EMEA and slower U.S. business mostly due to pricing timing & higher comps with the NFL games in Q4 - which will come back this year. Next quarter should see a reacceleration.

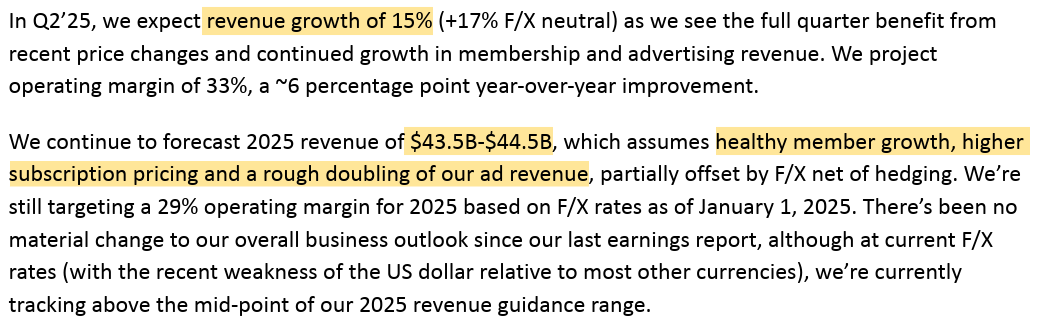

Lots of improvements on the ads plan. Netflix is building its ad platform internally & works closely with advertisers to build the tools they need. Plan is available in the U.S. & Canada already and will be expanded to 10 other markets this year, with the plan to double their revenues during the same period.

“So I would say based on everything that we're seeing right now, we continue to expect that we will roughly double our advertising revenue in 2025 through a combination of both upfronts, programmatic expansion, and scatter.”

I joked about Netflix being a recession-proof business not long ago and it seems like I wasn’t wrong. Numbers continue to show acquisition growth despite higher pricing & no significant churn nor downgrade in subscription plans.

“Based on what we are seeing by actually operating the business right now, there’s nothing significant to note. Primary metrics and indicators would be our retention that’s stable and strong.”

Management even commented with the same conclusion as me on why Netflix would do well under recessionary times.

“Stepping back, we also take some comfort in the fact that entertainment historically has been pretty resilient in tougher economic times.”

If households cut down all other expenses, what are $8 per month to be occupied while you cannot go to the restaurant or out with friends anymore? You gotta find occupations somewhere.

Important to keep an eye on it and on the ad business, which isn’t perfectly finished yet. If Netflix were to be affected by lower spending and downgrading to ads plan, it would also be interesting to find if they can sell enough ads to advertisers to fulfill hours watched on the platform.

Games remain a very small part of their spending with good feedback on those tied to their IPs or on some kids' games as those are ad-free & without in-app purchases, making them safe to be used from parents’ point of view.

Few words on AI which, like me, management sees as an opportunity to improve their business quality but also budgets. Those tools will allow many to do what was only accessible to a few years ago.

“I read the article too, what Jim Cameron said about making movies 50% cheaper. I remain convinced that there's an even bigger opportunity if you can make movies 10% better.“

A win-win for everyone.

Financials.

Cannot not be impressed.

The company’s optimization is impressive.

Flat QoQ growth but 12.5% growth YoY. Costs declined 8.7% QoQ, S&M declined 29% QoQ & cumulatively are pretty stable YoY which explains much higher margins QoQ & YoY hence a much bigger cash generation. Only “complaint” could be on the shares outstanding which despite such cash generation & billions of buybacks aren’t reduced significantly; only 1% YoY.

Important to note that costs & S&M are expected to grow through the years as this quarter’s decline is due to timing of content slate. Some quarters are light in production & require less advertising than others.

“And also typically in Q4, we have a heavier film slate. We've also got sales and marketing expenses that will probably that we expect would ramp in the second half of the year, both to support the slate, but also ad sales, go to market operations and are hitting in our marketing and sales line.”

Closing the quarter with $2.66B of FCF with negligible SBCs, $7.2B of cash for $15.1B of debt. Really healthy. Spending priority remains the same for management, first into the business, second preserving their balance sheet’s strength, third buybacks & fourth acquisition if opportunities arise.

Guidance.

No change to their previous guidance.

This would bring FY25 to a low end of 11.5% growth YoY.

A continuous growth expectation in memberships while raising pricing & a growing proportion of revenues coming from their ads plan. All together, very healthy while their indicators do not show any weakness in consumer spending.

My Take & Valuation.

There isn’t anything to dislike in this quarter & Netflix continues to prove me wrong, that they are indeed a top-class company, generating cash like no other with, so far, no ceiling to their business nor weakness due to the actual macro.

Such a company deserves a premium, even if that premium remains really big today in my opinion, and I certainly wouldn’t be a buyer.

You’d need the company to grow 40% CAGR over the next two years or 22% over the next four years to trade at its 10Y average sales multiple of x7 & return above 11% on your investment. A good buying price, based on today’s growth expectations, would be around $600 in my opinion.

As for the business itself, as said above, simply impressive. I would sit on my hands with a big smile on my face if I were a shareholder.