Nebius | Q4-24 Earning & Call

The market wants results yesterday.

If you are interested in the bull case behind Nebius, you’ll find it here.

Overview.

It is kind of hard to do comps as the company was broken up & was listed on the Nasdaq a few months ago. No long term data.

So we’ll focus on the business itself as that’s where the bull case is either way, and the big players know it.

“we went on to raise $700 million in December in an over-subscribed capital raise from top-tier partners including Nvidia, Accel and Orbis.“

Business.

The bull case & key metrics are easy to identify.

AI is going to grow in our world and take different shapes, from autonomous driving to customer support, passing through data collection and optimizations, etc. Every company will either use or propose AI services, and that means demand for their training and for inference should continue to accelerate. That is what Nebius is proposing - mainly.

We want to see a constant growth in demand for their services - translated by ARRs, and reasonable plans to grow their capacities.

Nebius ARRs.

This is number one as it gives us an idea of the actual demand & its growth, and as we can see, we had a decline QoQ which isn’t very healthy as it means some clients reduced or cancelled their subscriptions. Management commented on it.

“what we observed is the deals with customers, the lead times were taking longer than we observed in the previous periods of 2024 as customers became much more selective and wanted to do more in-depth proof of concept testing or proof of POCs and so on. In addition, we had a couple of large customers that completed their engagement with us in Q4.”

Some comments here.

Firstly, clients are becoming picky which highlights a competitive landscape. Nebius remains very competitive on costs & that’s what made it very interesting from the start, plus its modularity.

“And so as we build out our AI specific cloud platforms and its functionality, we expect this trend should work in our favor as we're not only able to demonstrate our price advantage, but also the quality and flexibility of our platform.”

Secondly, some big clients closed their needs. Be it training or inference, contracts will have different timeframe and this was shown with DeepSeek, which rapidly grew demand for inference for a very short period of time for example. This highlights the strength - the flexibility of Nebius, but also the volatility of the demand for their service.

“So I think that there's, we should expect a a certain amount of churn in a market such as as the AI market, period.”

Thirdly, it took longer to bring in other clients. Sales team weren’t ready yet & management focused on growing it to treat those situations better. It will take a bit longer to be perfect on this end as management estimates that they need 6 months or so for sales hires to become fully productive.

They also said that things were shapping better for the next quarters.

“we are back on track in 2025.” & “Based on contracts already in place, March ARR will be at least $220 million, and we have additional potential deals in the pipeline.“

This is more important to me. It is a guidance which will need to be respected next quarter, as if it isn’t, we’ll have to start to question management. But so far, there is nothing to worry about; the outlook remains strong & was confirmed again.

“Our projected December 2025 annualized run rate revenue of $750,000,000 to $1,000,000,000 is well within reach.“

This surge in growth should come from part of their H200 not installed yet & Blackwells, which will come online only later this year.

Nebius Infrastructures.

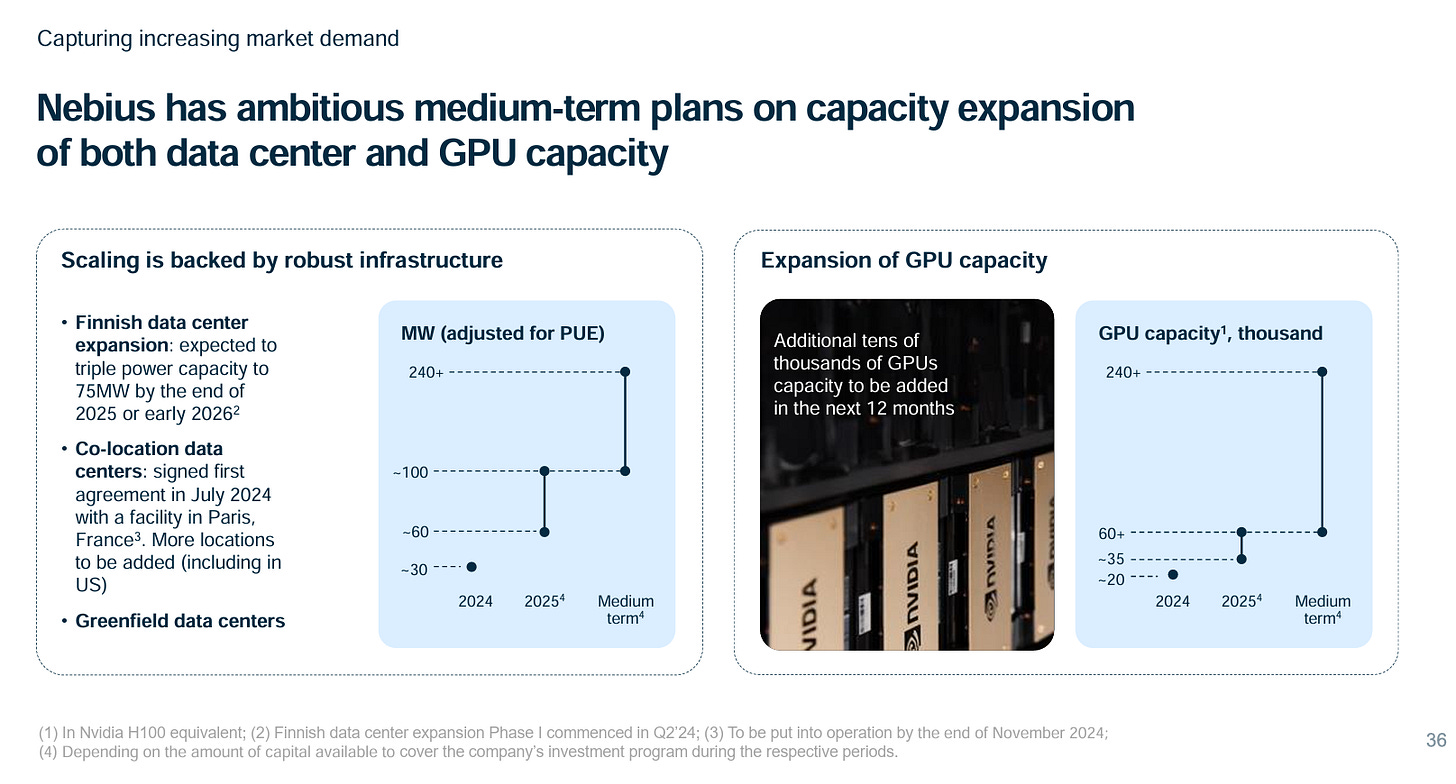

The company continues to build its data centers, financed through different capital raises we talked about earlier. CapEx totaled $417.6M and $808.1M for the quarter and year, respectively. Here are the headlines.

Nebius is talking here about clusters in Kansas City, but they also shared during the call that they will build their own data center in the U.S, with their own design. The Finnish & French data centers were already announcedand the call mentioned some more GPUs to be deployed in Iceland, to be available in March.

They are moving fast.

"we already have over 300 megawatts secured and we know how to scale it well, well, much more above that."

Their initial objective was around 100 MW in operation by year-end, and management confirmed they are on track, with potential to go over.

Let’s see where they end the year, but things seem to be going, at worst, according to plan, which is pretty good news especially in this industry where it is important to be fast, catch & keep demand.

Toloka, TripleTen & Avride.

Those other branches are great assets but not really part of my bull case - positive bonuses though.

Toloka, the data collection tool, is interesting, growing rapidly, up 140% YoY, without much more precision.

TripleTen, the online teaching platform, is also growing triple digits YoY, up 100%, boosted by a growing student base - adding 4,000 students, and new programs: Cybersecurity Bootcamp and UX/UI Designer.

Avride, the autonomous driving system, finalized a partnership with Grubhub and started its deployment of robot delivery at Ohio State University, while their technology received certifications in Japan. This is to be added to their Uber partnership for delivery in Austin, Dallas, and Jersey City.

Pretty cute, eh?

Revenues.

As a reminder, we are with a growth stock here, so we won’t much look at margins & profitability. The most important metrics are the fundamental metrics; financials will be about funding, controlled unprofitability & growth acceleration.

Growth is here with a really strong 462% YoY increase, although to be fair, compared to a different business pre-separation with the Russian entity. Nevertheless, there is rapid growth in revenues and in ARRs; we’ll need more confirmations, but things are going in the right direction.

Expenses have also increased and remain much higher than actual revenues. Again, this investment isn’t about profitability; it is about growth. Interest on cash helped a bit for a FY24 loss of $400M or so. Management confirmed its plan to EBITDA breakeven this year or so - not the best metric, but a positive.

The rest comes from the discontinued operation, which has to be fixed but won’t be here anymore in the future.

The company closed the year with $2.45B of cash - from share dilution after emitting 33.3M more for the last financing round, which will be used for CapEx and expenses in the future, and $6M of debt.

My Take.

Again: this is a growth story.

The market isn’t happy about the ARR miss as it means churn was stronger than acquisition, but management answered this already.

And it is clear enough in my opinion. The company is very young and is moving fast, but will need longer to form their sales team & install their data centers, with more H200 and Blackwell GPUs to come this year. It’ll need a bit longer for them to be operational & commercialized.

The $220M ARR by March should be a bullish indication enough that demand is here, and even if clients are getting picky, they keep going toward Nebius. It’s hard to know what will be short-term, long-term, and stick from this number, but it highlights a growing demand.

Fundamentals remain pretty strong in my opinion; the company will just need a bit of time to get there, for very valid reasons. They estimate themselves that most of the growth will come in H2 2025, with a trained sales team and up & running data centers.

In term of price action, I shared some time ago that a nice retest of the ATH breakout would be a good acumulation opportunity. So that’s what I did.

The market wants results yesterday. Nothing changed for me.

Good call on catching the retest; let’s see how things unfold!