LVMH | Q3-24 Earning

Weakening conglomerate or macro-dependent businesses?

I don’t follow LVMH very closely but I always have a glance at their stock & results - because I have to be proud of it as a French, but mostly because it is a great company and opportunities can arise. So I had a look at this quarter and I’ve seen pretty interesting things while the stock got smashed & printed a yearly low.

I won’t be a buyer today because I’d rather put my liquidity on other stocks. But the actual prices might be good enough to start a position or grow it for a daddy portfolio, focused on established & valuable companies.

Let’s dissect this quarter and see why I believe that - this review will be a bit different from what I usually do.

Moët Hennessy Louis Vuitton.

I never wrote an investment case on LVMH but I assume everyone knows at least one brand owned by the conglomerate - if only for Louis Vuitton. But I am 100% sure that you guys know others.

You might start to understand why Bernard Arnault is one of the richest men on earth when you see this portfolio. We’re talking about luxury brands in many sectors like clothing or watches & jewelry but we’re also talking about wines & spirits, perfumes, and some less known retail stores.

As written, probably one of the biggest conglomerates that exists.

Business.

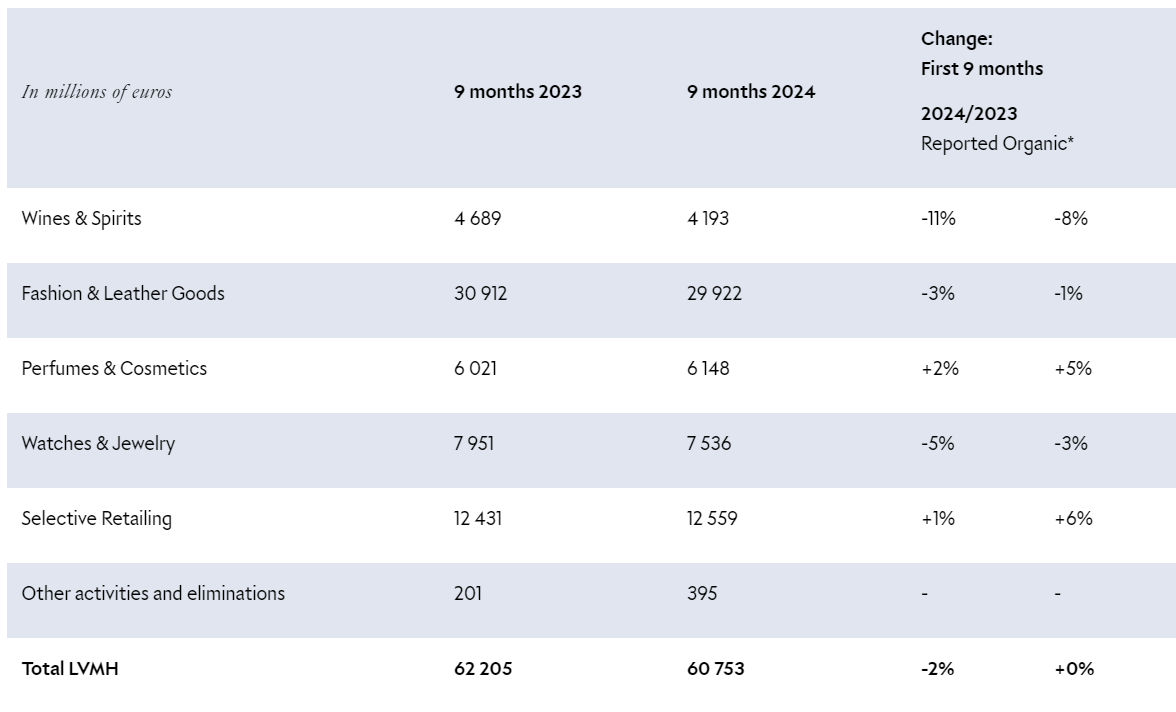

The market was disappointed because of what are legitimately “weak” results, although the YoY comparison is very tough as 2023 was a wonderful year for luxury brands.

I will only focus on organic comparisons - without currency fluctuations impacts. I believe this reflects better the demand for the products as LVMH sells in every country & currency around the world.

We are flatish YoY, no growth at all - compared to the company’s strongest year, ever. It’s not perfect but I don’t think it’s bad neither in terms of demand. There is a decline in revenues but again, LVMH cannot do anything about the currency mix and with the euro being strong lately, YoY comparison is made harder.

To give the most important points, Wines & Spirits are down “reflecting the ongoing normalization of post-Covid demand”. People apparently drank a lot during the lockdowns.

Fashion & Retailing are going pretty well with Louis Vuitton taking shares in the luxury sector while retail stores are also eating the Americans' market, with Sephora growing rapidly which isn’t helping the Ulta & Elf bulls and is the reason why I stay away from both for now.

Perfumes & Cosmetics are both doing well, not very surprising when we’re talking about brands like Dior, Guerlain, Givenchy, Kenzo…

Not many comments were given on the Watches & Jewelry part despite the fact that they are rolling out new products, commercials & marketing strategies…

The conclusion here is that there is a YoY revenue decline for the last nine months, due to the currency mix. That was the first “problem”.

Geographies.

Let’s see the second main issue.

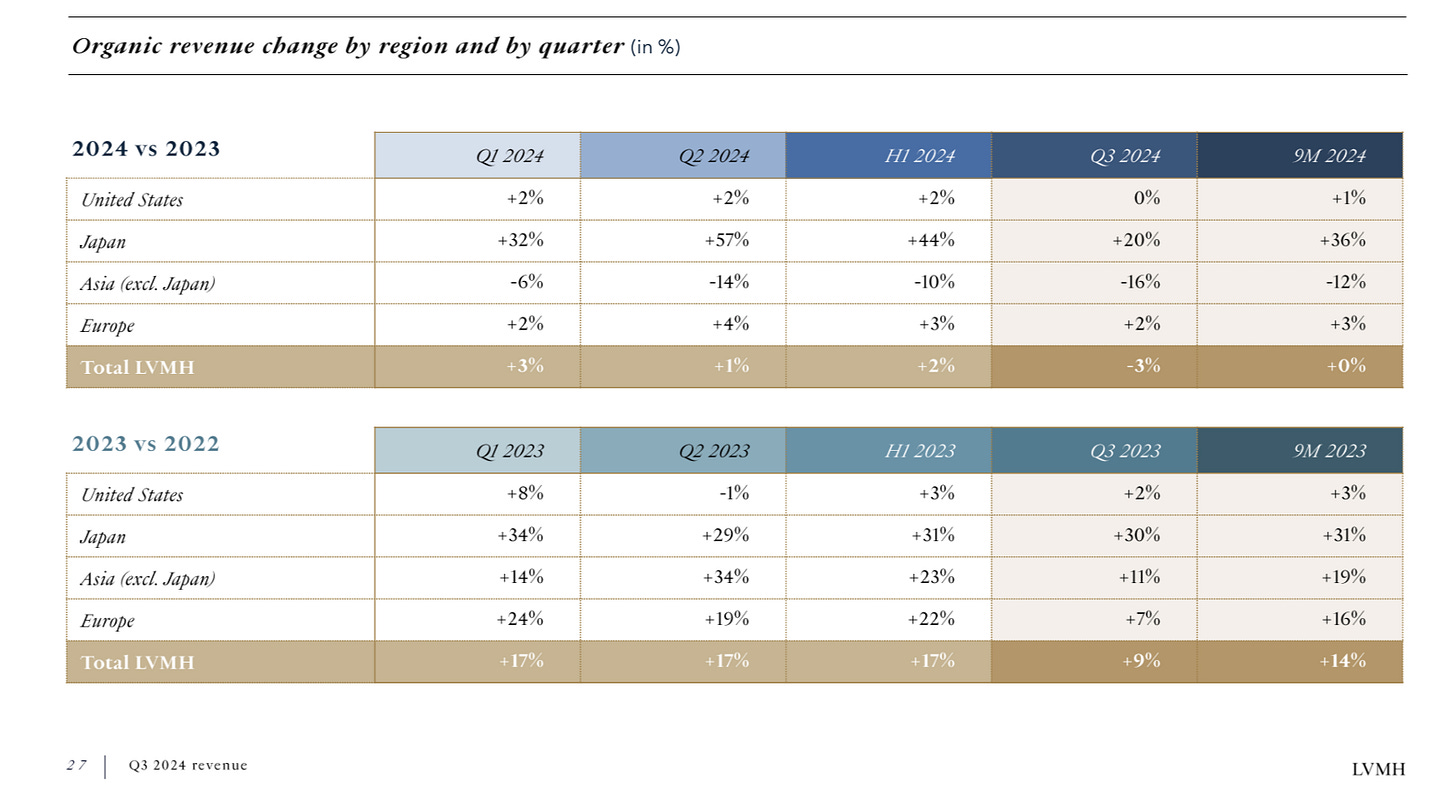

Organic comparisons once more. We clearly see the difference between 2023 & 2024 and how exceptionnal 2023 has been, all over the world.

The bigger problem comes from Asia (excl. Japan). We see a constant double-digit decline in the region consuming the more luxury, ever: China. And this is very spooky for many investors, especially combined with a slower/no growth in the west. Japan is still strong but doesn’t compensate for the decline of other regions.

This is the second issue: demand is rapidely slowing all over the world. The question is why? Is it a LVMH problem? Or something else?

Macro.

I personally blame most of it on the harsh macro difference between this year and last year - only my opinion of course.

We could find many reasons for 2023’s wonderful performance but I believe that so much money was saved or given away by governments during Covid lockdowns that many found themselves with more cash to use than usual.

What better way to use it than to buy a nice bag or some new perfumes?

2024 is very different with inflation, interest rate hikes in Europe & U.S., lots of economic uncertainties in China with the real estate crisis and youth unemployment… These clients do not have the cash anymore and what they have, they might save for harder times.

A pretty simple dynamic.

Consumers. Another way of explaining 2023’s outperformance is that the liquidity given & saved during Covid allowed many to purchase goods they usually could not afford. If that is the case, it means those clients were one time clients and will not come back to the brands over the next years.

For now, we saw that 2024 was flat YoY in term of demand, with a much harder macro which seems to go against that argument. But it can be heard.

Tailwind & Valuation.

We’ve seen the negative. It’s time to talk about the positive.

Brands. I will repeat myself again: we are seeing no YoY organic growth compared to the company’s best year, ever, with very tough macro conditions all around the world. This is a display of strength to my opinion and not many companies can say the same, retail or luxury.

Macro & China. We had numerous headwinds over the last year but it seems like we finally are seeing lights at the end of the tunnel. We’ve talked already about the Chinese stimulus meant to boost consumption or about the interest rates cut going on everywhere in the west.

This will help consumption and my personal take is that if YoY organic comparison was flat between an easy year macrowise and one of the toughest year since a good decade… Next years should probably be much better, maybe not 2025 but later on.

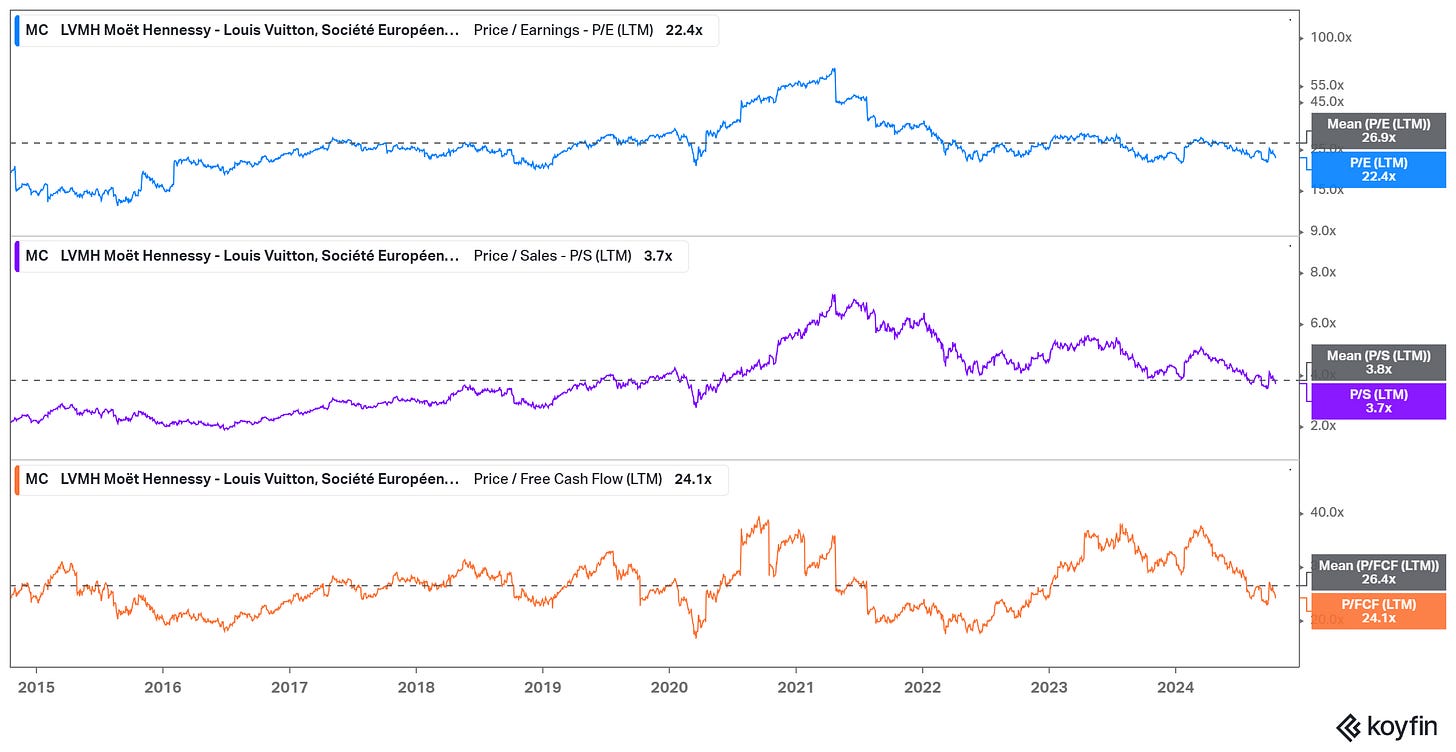

Valuation. Most importantly, after a strong FY-23, the stock has finally taken a breather, for all the reasons cited above.

The name now trades below its 10Y ratios medium and on a very strong support around 600€ in terms of price action. It’s very hard to do revenue projections without guidance but I am not sure it is necessary with this kind of company.

Buying LVMH is about buying stability, not performance.

Conclusion.

A conglomerate with a strong history of excellence, owning many top #1 brands in different industries. Demand for their products has been rapidly growing and is still very strong. Financials also are and the company pays dividends. Actual weakness might very well come from the macro worldwide but macro changes and we see some light at the end of the tunnel.

The stock has taken a beating as investors expect the company to struggle the next quarters. Once again, I wanted to present it today because I do believe there is a case to be made to buy the ticker right now: for a conservative & very long term portfolio.

This isn’t my investing. I could buy LVMH if we were to go to what I’d judge undervalued territory, and we might go there. But for now, I believe other tickers deserve liquidity more than LVMH. But everyone has a different style, and it wouldn’t be irrational to slowly buy at these levels.

Again, LVMH is about stability, not performance.

Really great post. I own $LVMH. Just as I own $MELI, $NU and other companies with stronger growth but higher volatility. It is a different holding. I don't expect 20% annual returns from now on. However, I do feel it adds stability to my portfolio and I want to have it.