Lululemon Q4-24 | Earning & Call

Uncertainty is here.

If you didn’t know about the trade, it was detailed here.

And it played out pretty well, but it also might be time to close it.

Overview.

The quarter was good, I won’t say the contrary.

Revenue. $3.58B | $3.61B | +0.87% beat

EPS. $5.87 | $6.14 | +4.60% beat

$332M buyback | $1.6B buybacks FY24

Let’s go over the rest.

Business.

We should start by saying that Lululemon’s management is really good at what they do, as they finally fixed the issues they talked about quarters ago faster than expected - the newness mostly.

“Looking at Quarter 1, we have increased our level of newness on par with the past.”

And ended up delivering a quarter beating both expectation & the guidance they raised themselves few weeks ago.

Pretty impressive.

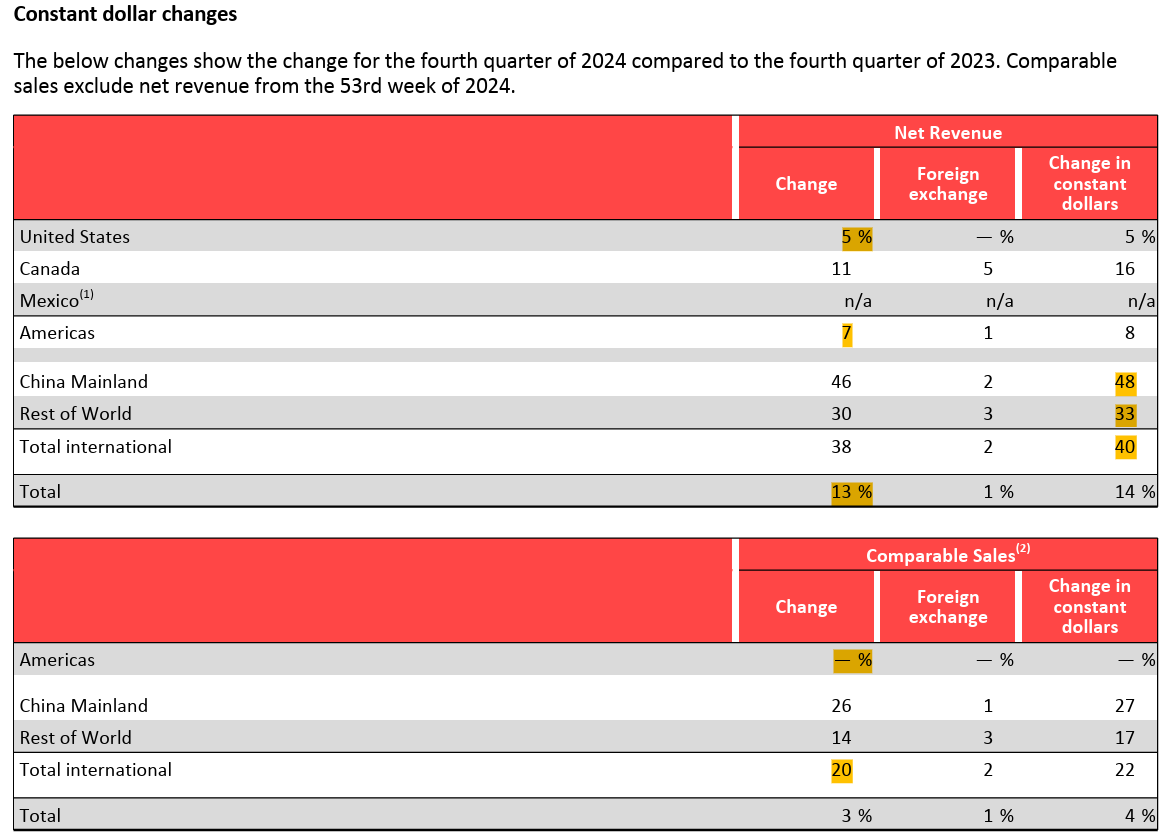

And this was done bringing the confirmations I personally was looking for, namely a stabilization in the U.S. market & a continuous growth internationally, boosted by growth in consumption from their new stores.

This data shows everything I wanted although it’s important to say that the numbers are slightly boosted by the fact that the year had 53 weeks, hence more shopping days while the last days are usually sales, driving huge volume. I am choosing here to include it as I believe excluding it would be slightly unfair as sales & volume would have happened either way.

We have a 5% change in revenues in the U.S. with flat comparable sales, already better than it was last quarter & management attributed this to more newness & new products which pleased.

“These are just some of the recent product launches, which have been well received by our guests and demonstrate how we continue to innovate and bring newness into our core activities while also expanding our casual offerings.”

International is giving the best picture with a clear growth in comparable sales which means customers keep coming & a much bigger growth in net revenues, which means their new stores are working really well. The company chose to focus on those markets - with reasons to my opinion, and it delivers results. And they’re not stopping now.

“We will continue to open stores in existing markets and enter several new countries this year, including Italy as a new company operated market, and Denmark, Belgium, Turkey, and the Czech Republic under a franchise model.”

As for China, they confirmed that most of the growth in terms of surface will happen there, to capitalize on the enormous opportunity they have.

The company continues to work on its brand awareness which remains pretty low in the West in general to be honest, with many events & partnerships with personalities in many different sectors & sports.

Financials.

Quarter & year was far from bad so financials are pretty solid.

FY24 closed up 10% with growing margins due to lower product costs, markdowns & improved shrink. The company kept optimizing its business with pre-tax incomes up 18.4%, pretty great.

Cash position is also strong with a balance sheet sitting at $2B, inventory decreasing - not a bad thing in a lower consumption period, and $1.6B of buyback done this year, with $1.3B left on repurchase program. At today’s price of $290, that would allow them to buy back 3% of their capitalization.

A strong position.

Guidance.

Lots of things to say here, but this is where the issue really is as even premium brands start to talk about shaky consumers - something I say is about to happen since months.

“As you have seen, we started this year with several compelling new product launches, but we also believe the dynamic macro environment has contributed to a more cautious consumer.”

And the guidance reflects that with an expected FY25 growth between 5% & 7%.

As I didn’t exclude the 53rd week on my comments above I won’t exclude it here. They also factor FX headwinds & 20bps from tariffs, while not including future buybacks in their EPS guidance.

Conclusion.

Tough quarter. To be precise, great quarter, great company, great management & terrible conditions, as they can do nothing about what is happening.

None of it is due to their business, brand or methodologies, it is due to tough macro conditions made tougher by policies - past, actual & future. Market hates uncertainty & we are in a period where things are impossible to forecast, so I won’t try to.

Management confirmed being ahead of schedule for their Power of Three x2 but the truth is everything will depend on the strength of consumers for the next months to years & if you follow me since some time now, you know I am not bullish medium term.

I personally intend to cut the position. Today seems to be unreasonable as the market is really, really pessimist but I do not intend to hold Lululemon through a period of uncertainty about consuming power, with my personal convictions being that it’ll be tough. I’ll keep you posted.

But again, nothing to do about the company. It’s only a matter of investing & the actual condition is about cash & gold. More on this later.