Hims & Hers Q3-24 | Earning & Call

When great isn't enough.

If you do not know about Hims & Hers, everything you need is here.

Overview.

Heads up, the EPS beat is entirely due to a tax benefit; we’ll talk about it later.

EPS. $0.04 | $0.32 | 700% beat

Revenue. $382.2M | $401.56M | +5.06% beat

$30M of buybacks.

Everything is great.

Management came back on why I & many invest in Hims; affordability, their tech platform & accessibility, user experience, personalization, etc. All of these are detailed in the Investment Case linked above so I won’t come back on them.

Business.

We’ll start to talk about the business at large before we dig into some specific subjects, especially the GLP-1 drugs, as this clearly is the only narrative the market focuses on lately…

Starting with the biggest subject: subscribers. Management talked about reaching 1M subscribers under a personalized solution before the end of the year… This was achieved this quarter.

We’re now past 2M subscribers, growing 44% YoY with above 85% of multi-month subscribers and half of them using a personalized solution. The stats are already very strong, but they go further as more than half of the new subscribers went directly to a personalized product.

“North of 65% of new subscribers benefited from a personalized solution in the third quarter, and we believe this number can continue to grow with continued innovation to meet customers' clinical needs.”

This is a strong shift in their clients’ behaviors and shows the growing demand for such products, confirming part of the investment thesis, while 87% of multi-month subscribers confirm the stickiness of their clients.

We also saw ARPUs growing up to $67, mostly due to the impact of weight loss drugs - not only GLP-1, which have an average subscription higher than other products - 40% more expensive for the cheapest weight loss program compared to average products excluding weight loss.

The rapidly growing proportion of personalized subscriptions also contributed as those are more expensive than classic products, Lastly, subscribers are starting to organically turn to treatments in other areas after their first subscription, increasing their average expenses.

“In the third quarter, nearly 300,000 subscribers were treated for two or more conditions on the platform, inclusive of subscribers on a single treatment with multi-condition capabilities.“

These tendancies should continue over the next quarters and become the new normal for some time as the comapny continues to upgrade its platform & service.

The company has now more than 400,000 subscribers on Hers - still a small proportion of their total business, which and gives an idea of the potential left, especially as the company will release “perimenopause, menopause, hormonal therapy and all of the related impacts that might have for women as they age. Same thing on the men's side of the business. We expect that business to be something that is rolling out in the next couple of years.”

Next couple of years is a long timeframe though.

GLP-1.

The bullish narrative around GLP-1 & the compounded semaglutide Hims is selling works until the FDA takes the molecule outside of its shortage list. Once they do, Hims will have three months to stop selling this product. That’s why the market actually sees Hims as a business with a Damocles sword above its head, which is absolutely untrue for the reasons below.

GLP-1 are a strong potential but very small portion of today’s demand & revenues for Hims.

First of all, GLP-1 drugs were only 4% of total revenues last quarter and only 4% of this quarter’s new subscribers came for these drugs. The potential of this drug is pretty strong but I personally believe many overestimate it, although it is of course better to keep it than not. But Hims focuses on weight-loss at large and not only on GLP-1 and works this through different verticals.

The shortage is still strong & patients cannot find branded products. This raises questions about when the FDA will take semaglutide out of the shortage list.

“While the regulatory landscape continues to evolve, the data we are seeing on our platform suggests widespread difficulty accessing name-brand GLP-1 solutions, and a resolution of the GLP-1 shortage would not be possible without the potential disruption of care to hundreds of thousands of Americans. In the last two months, a total of over 80,000 reports have come through our platform from consumers that have been unable to obtain name-brand GLP-1 treatments. And we are seeing the number of consumers voicing their frustration increase, not decrease in recent weeks. In fact, on a single day last week, we saw nearly 2,000 indications from individuals that have been unable to obtain name-brand GLP-1s.”

Hims’ products is better than branded products as they can compound semaglutide with personalized dosage thanks to their factories but also interactions with patients. This allows for fewer side effects than branded products; hence a much better alternative for clients.

“Studies have shown that intolerable side effects and lack of access to affordable solutions result in less than 70% of patients continuing the medication after four weeks of treatment. That number falls further to 42% by 12 weeks. Across the Hims & Hers platform, we have seen strong retention rates for compounded GLP-1 solutions. At four weeks, 85% of GLP-1 patients are engaging with the platform, including through continuation of care, completing a check-in, a proactive engagement with the provider. By 12 weeks, we observed 70% of patients continuing with their subscription.”

As I said above, Hims has a pretty small sample size but the data is here and shows a big difference between their compounded products & branded products. Andrew even psuhes the argument further.

“And I think the regulators, the legislators, the drug companies, the healthcare system really respect the clinical need of that personalization when it's necessary for a patient. And given you're talking about north of 100 million people suffering from obesity in this country, and a very, very high side effect rate with these medications, we fully expect that there's millions of patients that will need that level of personalization that our platform over the long-haul is really well-equipped to deliver on.“

&

“We believe that dosing specifically for this type of a treatment to mitigate side effects is very much right down the center of what that compound exemption is built for.“

I believe he tries to tell us that he expects the FDA to allow them to continue compounding semaglutide for the good of patients… I believe this is wishful thinking but this is only my opinion.

Lastly, Hims proposes other weight loss products, less heavy than GLP-1 drugs while approaching 70% efficiency compared to those drugs. An already good alternative but they are going further as Hims will propose liraglutide in 2025, a generic GLP-1 drug.

“Next, we plan to bring liraglutide, the first generic GLP-1 in the market to the platform in 2025. We have already confirmed a core supplier for this addition and over the next few months, expect to finish completing test and batch validation as well as confirming certificates of authenticity.“

They’re still undergoing tests but it will happen and will allow them to continue offering GLP-1 drugs at an affordable price - although probably more expensive than their compounded semaglutide.

In summary, GLP-1 is a potential growth driver but still represents a small portion of Hims’ business. Their global weight-loss branch is much bigger and has many more efficient & demanded products - and will have more in the future. Compounded semaglutide won’t disappear overnight as shortages are far from resolved and Hims will have alternatives afterward with an offering of liraglutide.

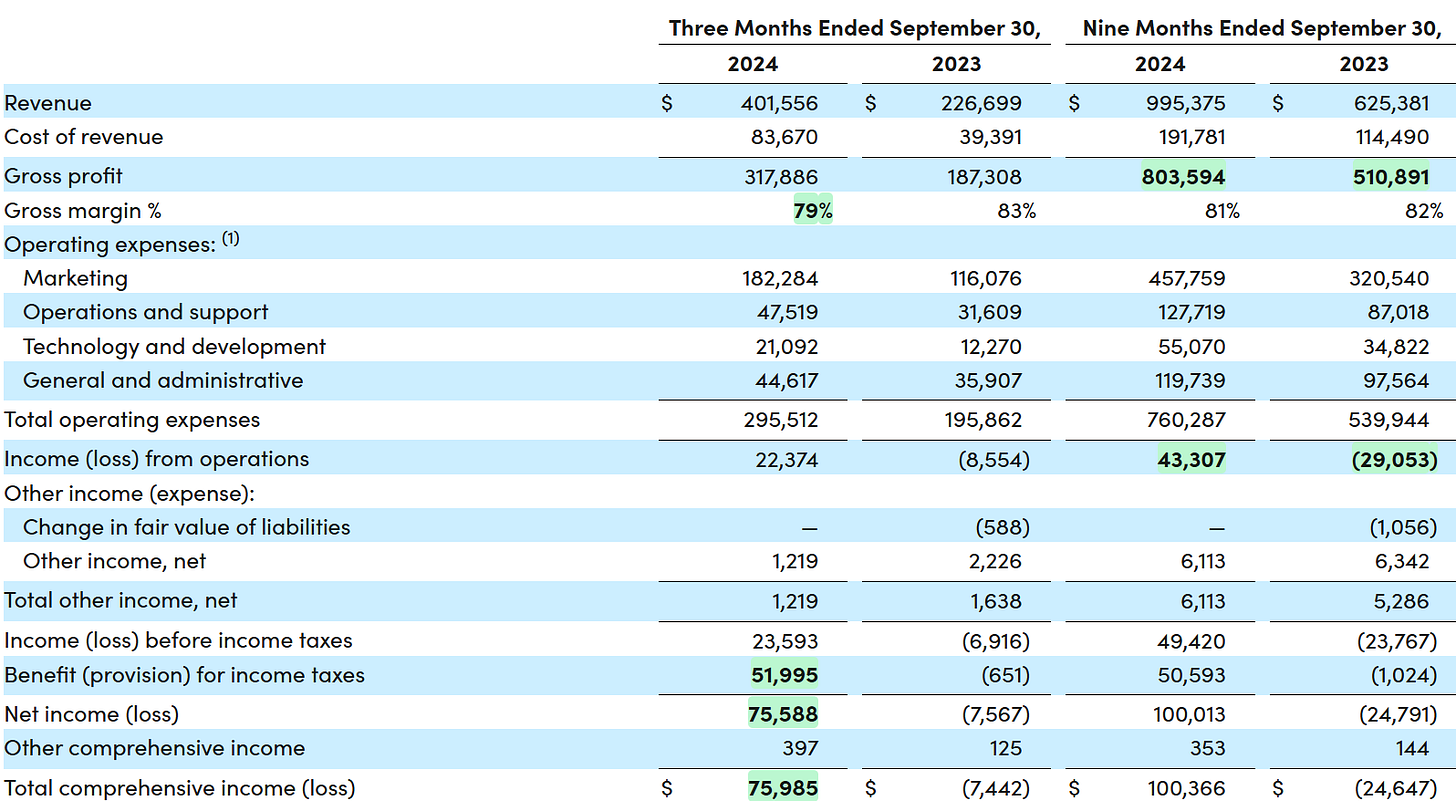

Revenues.

As often with companies I write about, and without any surprises, everything is great.

Few things to highlight though; we gotta do comps first with revenues up 77% YoY and nine months ending up 57% YoY - with strong & growing profitability each quarter passing. This quarter’s net income is impacted by a tax provision; net margin should be just south of 5.8% without this benefit - an improvement either way.

Gross margins continue to decline but we talked about this last quarter; it is a normal behavior as weight-loss drugs take up a bigger proportion of business and this will continue during upcoming quarters. Sacrificing few points on margins for such growth is entirely worth it.

Hims is also planning to increase both CapEx & expenses during upcoming quarters to improve business through different verticals - user experience, technology, infrastructures & automation. Everything is meant to optimize business and bring stronger long-term growth. I know lots of investors hate this kind of expense but I believe those should own Apple, not Hims! I personally love them as long as they are done properly.

In terms of balance sheet: Hims ends the quarter with $244M in net debt and $79.4M in FCF for dilution under 3% YoY - very reasonable considering its results. We can also talk about their $30M used on buybacks at an average price of $15.8, —which I’d personally consider an optimum use of surplus cash.

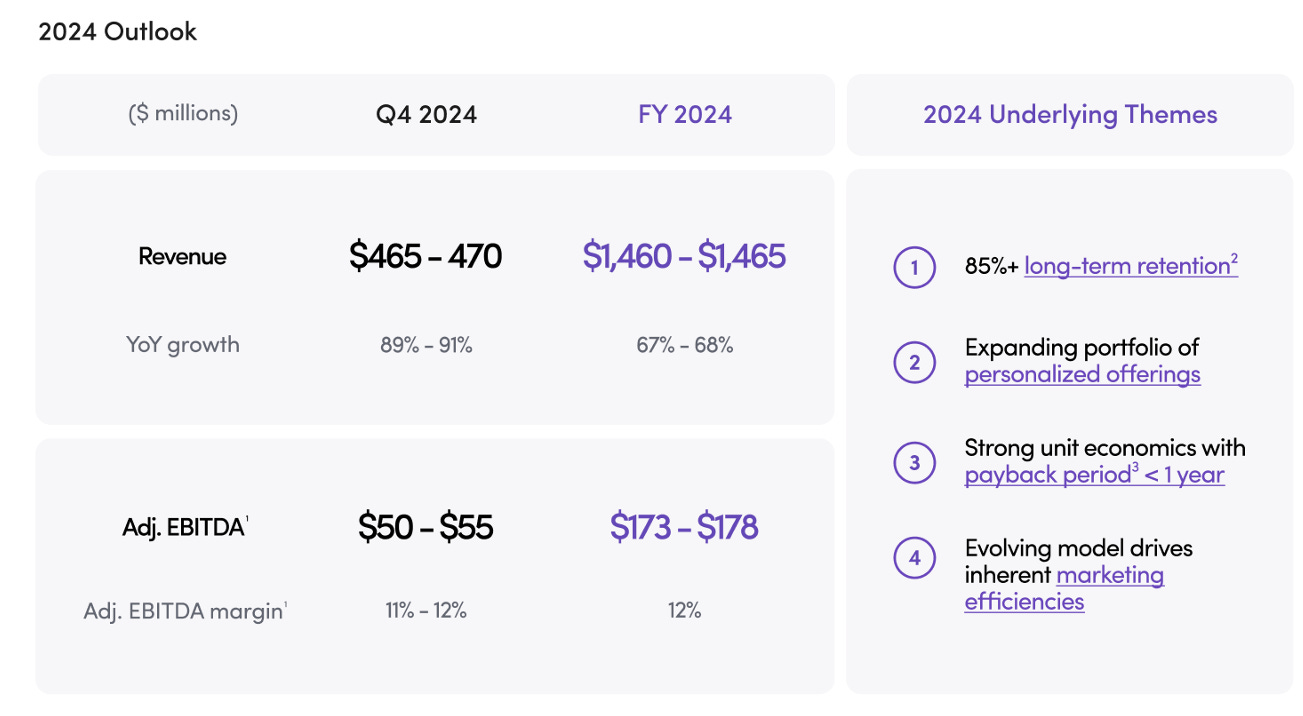

Guidance.

An excellent quarter requires excellent guidance. It didn’t fall short.

Continuous YoY revenue growth acceleration & increased yearly outlook… What more could we ask for?

My Take.

This quarter is excellent from beginning to end and the market would realize it if it weren't so focused on GLP-1s. Hims is doing everything perfectly even without these drugs - and things get even better if you acknowledge that they probably won't be impacted by FDA decisions once they can propose liraglutide.

This quarter is also showing that the thesis was right: Hims' advantage comes from its affordability, products & most importantly, its user experience & personalization. That's why many turn to Hims in the first place and once they're in, they're not leaving and are turning themselves to new products, growing their consumption.

As the company is doing & planning to do much better than expected, we should review the valuation & price target. It's complicated to imagine up to where growth acceleration will go but the tendency is here and it seems to only be the start.

Assuming $1.46B of revenues FY-24, as the guidance shows, Hims would need to grow 28% CAGR up to FY-26 to deliver my base case revenue target.

With actual data pointing to a continuous acceleration through 2025, it certainly doesn't seem to be a very optimistic assumption - with or without semaglutide, and yet we'd need very reasonable ratios to have our 11% return on investment at today's price.

The bull case would require a 42% CAGR from FY-24 to FY-26. Requires more optimism to make this a base case but based on today's data… I wouldn't be surprised if it were to happen.

Something in between those two would be my assumption and I'm really okay calling Hims a buy between $20 & $23 or so, prices I’ll use as my new average target from now on. We gotta adapt when business improve.