Hims&Hers | Q2-24 Review & New Position

I bought in. Again.

I already owned Hims some months ago and finally bought in again this week. I’ll use this post to review the quarter and detail why.

Overview. Once again, it is hard to find anything wrong with this report, but the market figured out a way to be disappointed, although not with the company itself.

EPS. $0.04 | $0.06 | +50% beat

Revenue. $298M | $316M | +6% beat

$19,8M of buybacks.

"We believe healthcare is undergoing a transformational period, as consumers are starting to expect manyofthesamebenefits that technology has unlocked across other areas of their lives. These include transparent pricing, convenience, speed, and affordable solutions. Our infrastructure has centered on these elements from the beginning, and we are pleased to see our consumer base grow as we broaden specialties and capabilities across our platform."

But yes, the quarter was as good as the overview suggests.

Business.

We could reduce Hims & Hers to a personalized online pharmacy to explain it very, very rapidly. Clients can go online & buy the products they need or go to online appointments to get personalized solutions, a service accessible through subscriptions. This is a very rapid presentation, and we’ll go through the business in much more detail during the investment case.

The company focuses on what I’d call “wellness” drugs. We are not talking about anything too medical - hair & skin products, some mild mental relaxants, sexual treatments & weight loss drugs. Highly demanded products mixed a digital experience, easy to order and receive.

“Consumers are increasingly expecting the same quality and level of service that technology has unlocked across other areas of their lives. This includes speed, convenience, transparency, affordable pricing and a personalized experience.”

This is what Hims & Hers offers. A simple, rapid, cheap & efficient solution to access products that help consumers feel better.

A quick word on the management as things changed a lot since I first got interested in the company. The board brought in some very interesting profiles, and this is one of the arguments that made me reinvest. We’re talking about people like Christopher Payne (ex-COO at DoorDash) & Kare Schultz (ex-CEO of Teva Pharmaceutical). Two profiles that are hard to imagine working together, but that’s the magic of the internet.

“we brought on world-class talent across multiple levels of the organization from the Board to ML leaders that will enable us to further refine our capabilities and scale them to increasingly broader audiences.”

Metrics & leverage. The entire business relies on a few metrics & concepts. First, trust in the products they sell, those are still drugs.

Second, a growing & loyal user base. They need to attract new clients and convert them to subscribe to their service or at least move from casual buyers to regular consumers.

They have learned to do this very well and this quarter continues on a very strong upward trend. Subscribers have been constantly rising for the last two years with very strong retention - more than 785,000 (42%) of them now utilize a personalized solution. An attractive service that convinces first-time users to commit more deeply to the platform.

“Over 40% of subscribers in the second quarter were utilizing a personalized solution, representing close to a 30 point increase in just two years [...] we are seeing an increasing number of our existing subscribers switch to a personalized solution.”

This is the first leverage the company is working on: attracting customers & converting them into long-term consumers. Their second leverage will be to grow Average Revenue per Subscriber (ARPU). This will be done by converting actual subscribers to another treatment or to a more personalized/regular one - a trend already happening.

“During the second quarter, stronger value propositions resulted in over 40% of new sexual health users subscribing to solutions oriented around building a daily habit […] As a result of that, we've seen more and more folks opt to switch to a daily habit and especially that's historically been more of an on-demand type of dynamic.”

This metric has been very stable over the last few years and even slightly increasing in recent quarters, mainly impacted by the late inclusion of weight loss drugs and GLP-1 products a few months ago - which are much more expensive treatments than the others proposed by Hims & Hers.

GLP-1 drugs. This is very likely what triggered the stock sell-off as the market got very excited with the introduction of these new drugs on Hims & Hers - proprietary drugs produced by Novo Nordisk & Eli Lilly, which are actually in shortage as the demand is much stronger than the supply. The market was scared that Hims couldn’t supply, with some reason.

“I think we are sitting in the same place as almost everybody in market, which is trying to get supply for the branded medication.”

But they have solutions. First of all, people looking to lose weight are at different stages and aren’t all in need of the same products. GLP-1 drugs are strong drugs and can come with side effects. This isn’t the proper medication for everyone, and Hims proposes other solutions.

“there's a lot of people that come in who are at very different stages of their process, right? Many people have come in and have tried everything, and they want to be the most impressive as possible. And often that means going with something like a Zepbound, right, highest chance of weight loss, self-inject, right? These things are actually quite scary for a lot of people, and many of them come in and say, hey, I want to go a little bit slower. I want something that involves an oral medication or something that I can chew or dissolve them on the tongue that might not be as extreme but is much more known and has been around for decades, and we see every customer in and between that spectrum.”

Second, besides those other solutions, they also already propose unbranded, comparable products, and there will be more & more of those over the next few years.

“But I think there's also probably going to be five or 10 new medications that come to market in the next few years, just given if you look at the clinical studies and the FDA pipeline.”

This reaction from the market is a short-term reaction because of a short-term shortage. The long-term trend is that more and more solutions will be available with time and Hims & Hers will propose them all to their clients, with possible personalization in terms of products & dosage, simplicity to access, order & receive, and lower cost thanks to their supply chain & quantities.

The revenue boost of GLP-1 drugs will be seen over the long term.

Macro & consumers. I had the suspicion that in an economy where the consumer is weakening, Hims could suffer as they could choose to cut these expenses, which might appear less important than others, but I am reviewing my take on this.

“we serve consumers across a wide variety of some of the most emotionally resonant conditions that impact how they look, how they fill each and every day. And so we've observed historically during these moments of economic uncertainty is that consumers are very reticent to let that go.”

Compelling argumentation.

Revenues.

As often, when business is buzzing, revenues also are.

They grew 53% YoY and this growth is reaccelerating after a few quarters under 50%, due to an improved business and the addition of a wider range of weight loss drugs. This is fueling and will fuel growth over the next quarter, which is what matters, but it also comes with inconveniences.

Weight loss drugs are very expensive products to buy or produce, and as Hims & Hers’ business is also to propose affordable treatments, they’ll need to beat competition on pricing, which ends up in a lower-margin product. It shouldn’t be an issue when we are talking about a business growing above 50% YoY with more than 80% of gross margin, but it should be known for the next quarters: margins decreased and will decrease - and this is normal.

A necessary sacrifice that will largely pay back with time. The second half of the year will also see more investments, stronger marketing & expenses globally, which will again sacrifice a bit of margins to fuel more growth over the next years - again, a positive thing long term, but the market doesn’t like it. These have already grown during the first half of the year, but the trend will continue.

Even with those two factors, which seem pretty negative globally, Hims & Hers is printing another profitable quarter, the third in a row - a strong accomplishment that proves once more a very strong revenue growth, fueled by proper investments made quarters ago. Exactly what they’re planning to continue doing.

In terms of balance sheet & cash flow, the company is very healthy with a $117M net debt and very bullish growth trends in every important metric.

The company’s free cash flow is impacted by strong stock-based compensations, but this is normal behavior for a small capitalization that still needs to find funds and reward its workers. The buyback program starts to mitigate the dilution, and this trend should continue as the company is now profitable and should keep on this trajectory.

Management gave some clarity on how they intend to prioritize their cash over the next few years, and again, the market might not have liked it, but I personally think they are making the right choices.

Priority will always be given to the business itself and to any investment that can improve it, whether in terms of product mix, services, or optimization. Second priority will be on M&A if management finds any company or infrastructure worth buying to once again improve or optimize their core business. Return to shareholders only comes last, as it should for a young business & small capitalization.

Guidance.

As good as business, even better, as the company raised its FY-24 outlook.

We’re talking about a 65% growth YoY for Q3-24. This is a very strong growth acceleration, the strongest in more than a year, and this again is proof of an improving business.

The FY-24 growth continues on a very strong trend with continuous profitability, without a very strong net margin, but nothing unexpected. The focus on this metric will come later; growth is what matters today.

Management also talked about their expectation of 1M subscribers with personalized solutions by the end of the year - a 25% growth from today. This would be a very strong achievement, which they are capable of, and which would yield very strong returns over the long term if retention stays as high as they expect.

My Take & Why I Bought In.

Hims & Hers is a new & wonderful business that perfectly answers a strong demand for easily accessible & affordable wellness products. It seems to hit all the important boxes in terms of offering but also carries many risks - starting with regulatory ones, as we’re still talking about health. We’ll review all of this later in the investment case.

As to why I bought in now, the answer comes with the data: Better-than-expected subscriber growth with a stronger conversion to personalized products. This is the most important factor for Hims & Hers, to be able to convert their users to daily usage & personalized treatments - this is where the money is. This quarter's data showed a strong capacity to execute and a growth reacceleration.

The new availability of GLP-1 drugs on their platform is also a strong argument because the long-term prospect of those is hardly quantifiable today, but very strong. Only $15M of revenue came from those treatments this quarter, we’re far from seeing the potential, and the assumptions based solely on the core business would already make the stock fairly priced today.

The company is expecting to reach at least $1.6B of revenue by 2025 and management said during this call they are very confident in achieving this goal.

“Our execution to date is instilling greater confidence in our ability to either meet or exceed this ambitious goal.”

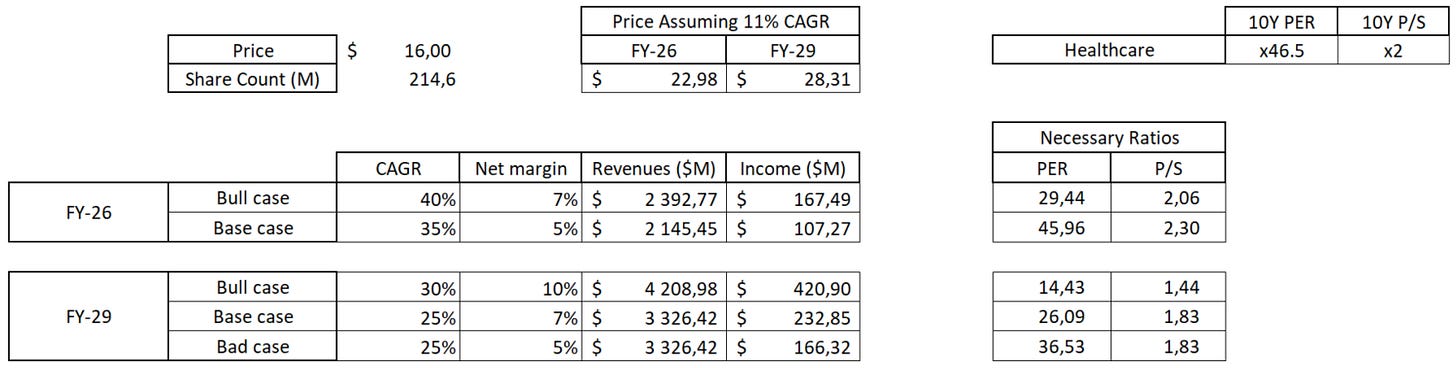

This projection requires a compounded growth rate between 35% & 40% which is what I used for my FY-26 projections. In both cases, at today’s price, we’d need ratios comparable to the global healthcare industry’s median to reach our required returns - while Hims & Hers clearly deserves higher ratios. This is a short-term target and these projections are based on data not reflecting well the impact of GLP-1 drugs.

Things look pretty good already.

It’s much harder to forecast past 2026 as this kind of business can be impacted by many factors (up to 2026 as well), and growth could accelerate or slow down rapidly. But we can see that we’d need Hims to grow “only” 25% with a 5% net margin to reach our required returns while still trading under the global healthcare industry’s median ratios.

I honestly expect Hims to do better, hence why I started a position this week - a position I will continue to DCA over the next few months as long as we stay under what I consider its fair price, around $18 per share as of today.

Things can change and I will adapt if they do so. But that’s where I stand for Hims & Hers as of today.