Google | Q2-24 Earning & Call

Overview. This won’t be a very long report because Google doesn’t need many words.

EPS. $1.85 | $1.89 | +2.16% beat

Revenue. $84.20B | $84.74B | +0.64% beat

$2.5B of dividends | $15.6B of buybacks.

"We are innovating at every layer of the AI stack. Our longstanding infrastructure leadership and in-house research teams position us well as technology evolves and as we pursue the many opportunities ahead."

It already gives us a pretty good idea of what to expect.

Business.

Growth everywhere. One of the biggest companies in the world, above $2T of capitalization, growing faster than many companies labeled “growth” - having a quasi-monopoly helped to build such a strong position, of course.

“we are uniquely well-positioned for the AI opportunity ahead. Our research and infrastructure leadership means we can pursue an in-house strategy that enables our product teams to move quickly.”

Nevertheless, Google needed great execution and brought it by creating one of the best work cultures that we can find anywhere in the world.

No comments needed, the only thing not growing is Google’s headcount as the company has been on a freeze lately and should restart hiring in specific positions later this year.

Search. The strongest growth this quarter in the advertising business, proving once more that ChatGPT & other potential competitors aren’t yet up to the task. The AI functionality that Google set up is apparently very well received by users.

“People who are looking for help with complex topics are engaging more and keep coming back for AI Overviews.”

And it should not stop there.

“Visual search via Lens is one. Soon, you'll be able to ask questions by taking a video with Lens. And already, we have seen that AI Overviews in Lens leads to an increase in overall visual search usage. Another example is Circle to Search, which is available today on more than 100 million Android devices.”

&

“Soon, you'll be able to ask Photos questions like, what did I eat at that restaurant in Paris last year?”

Search’s future will be cool.

YouTube. As we saw in Netflix’s quarter, YouTube is still the number 1 streaming platform in the U.S. in terms of watched time. The platform is still growing very well while growth was mainly driven by subscriptions - as to when will Spotify users finally convert to a better service, we will never know.

“And as we've said on many calls here in a row, the subscription revenue growth continued to be quite strong. It was driven by subscriber growth in both YouTube TV and YouTube Music Premium. So, it continues to be very strong. We see a lot of take-up in it, strong subscriber growth, really pleased with it.”

Global Advertising Tools. More globally, the new advertising tools proposed by Google (or “AI” tools) are driving stronger conversions for advertisers - significantly higher when paired together.

“As we said at GML, when paired with Search or PMax, Demand Gen delivers an average of 14% more conversions.”

“Also, advertisers who adopt PMax to broad match and Smart Bidding in their Search campaigns see an average increase of over 25% more conversions of value at a similar cost.”

And the company is working on more tools to drive even better conversion.

“We're beta testing virtual try-on and shopping ads and plan to roll it out widely later this year. Feedback shows this feature gets 60% more high-quality views than other images and higher click out to retailer sites. Retailers love it because it drives purchasing decisions and fewer returns.”

Waymo. Some news on the autonomous riding service the company delivers in San Francisco, as they already served 2 million trips & around 50,000 weekly paid trips per week, are pretty impressive numbers.

Revenues

The income statement are of course as good as the business is.

With a special focus on costs as S&M and G&A are pretty flat YoY. Google is focused on growing profitability and scaling its tech services. This helped the company grow its margins, and the tendency is crystal clear, with net margins up 3% YoY which makes a pretty strong difference in EPS & income growth. A tendency that should continue over the next years as AI keeps optimizing operations.

Ended the quarter with $13.5B of FCF & $60.8 on a 12-month trailing. A balance sheet with $88B of net debt.

Capex. Up to here, everything is closer to great than just good, and it will stay like this but the market is a capricious beast and punished Google for the exact same reason it punished Meta last quarter: too much spending. We’re talking about $13B in capex and Ruth confirmed during the earnings call that this rhythm of expenses should continue through the year - meaning a yearly capex of around $50B.

The market loves return on investment but hates investments - the irony. So the question it asked (fairly) was, when can we expect to have a return on such colossal investments?

Sundar answered.

“I think the one way I think about it is when we go through a curve like this, the risk of under-investing is dramatically greater than the risk of over-investing for us here, even in scenarios where if it turns out that we are over-investing, we clearly -- these are infrastructure which are widely useful for us.”

Fair enough to my opinion.

Thank you for reading up to here! If you like it, please consider subscribing to receive it all directly in your inbox and not miss a thing!

Everything I share here is free but if you found the content valuable enough, you can always leave a tip!

My Take.

As I said: Great quarter.

The market wasn’t happy about spending so much money even though we already see the results of such spending over the last year. It allowed Google to create more advertising tools which are very demanded by advertisers and are driving much more conversion than before - 5% to 10% is huge, really huge in this business.

Search is growing, YouTube is growing, Cloud is growing, all of them above 10% YoY, and everything seems to point that this growth isn’t slowing any time soon as new products are released and scalling. And those happened because of strong investments in powerful hardware and intellignt softwares soluations, allowing the company to propose better services.

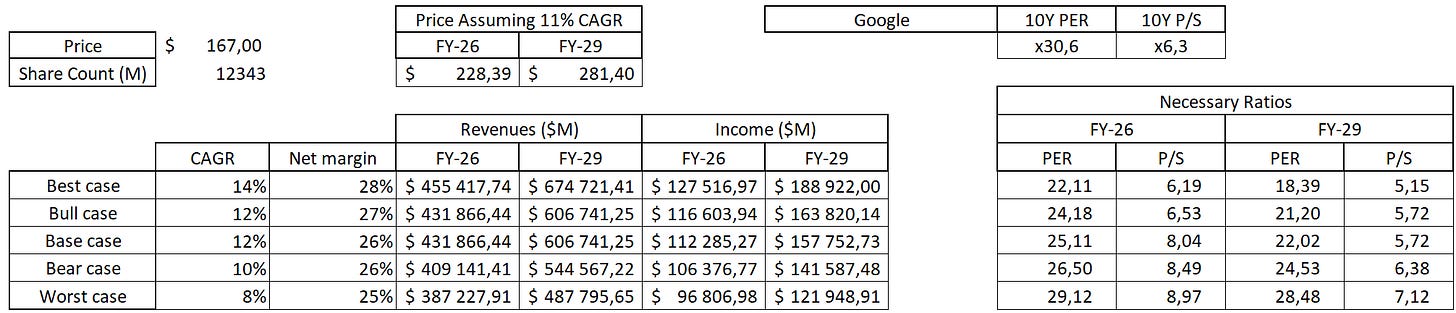

But everything is a matter of valuation and Google dropped 8% after delivering such results as the market is scared of an “overspending” - which could happen.

A wonderful business without any doubts but not a cheap business - nor too expensive though. I still wouldn’t buy in after this drop. But I certainly wouldn’t sell my shares either.