Google | Q1-24 Earning & Call

I thought it worse to talk a bit deeper about $GOOG as the company had a wonderful Q1-24 & kinda came back from the dead as many investors put it directly into the cemetery after a really small bump with their AI image generation & Cloud branch.

Overview. No need to introduce Google, let's enter into the quarter directly.

EPS: $1.51 $ | $1.89 | +25.1% beat

Revenue: $78.59B | $80.5B | +2.4% beat

$15.6B of buyback.

Google is also a dividend stock by now with $0.20 to be paid quarterly.

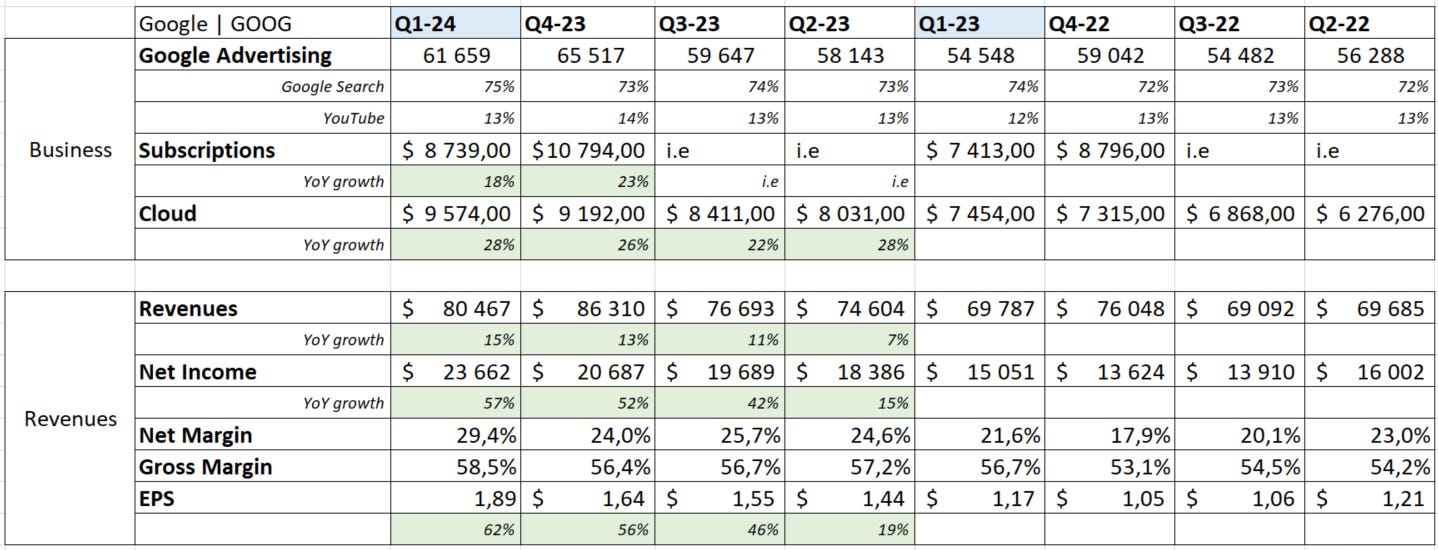

Google changed its way to declare earnings hence the hole in the subscriptions. But the takeaway is very easy, a stable company with stable growth all over the table, mainly on the net income & EPS with the buyback program and growing margins.

And people said Google had no moat...

Business. I find the quarter very hard to criticize.

Everything is growing and there isn't much to comment honestly for Google. Except for how this seems to be only the start of the next leg of growth according to Sundar, Google's CEO.

"we expect YouTube overall and Cloud to exit 2024 at a combined annual run rate of over $100 billion."

This will be an achievement although it wouldn't need much more growth as at today's revenues we should already have reached $100B at the end of the year. It still is something.

"We continue to deliver significant growth in our subscriptions business, which drives the majority of revenue growth in this line."

It's also important to note that the growth in advertising comes mainly from APAC retailers, exactly like $META. Not surprising but it's another sign of a potential strength coming back from one of the oldest countries in the world.

"First, results in our advertising business in Q1 continued to reflect strength in spend from APAC-based retailers"

And all of this is without even talking much about Google's new AI products which are being developed and start to be used.

"We are already seeing developers and enterprise customers enthusiastically embrace Gemini 1.5 and use it for a wide range of things."

Revenues. As the business is going perfectly, the revenues also are.

Besides revenue growing, it's important to note the expenses flattening - or growing +5% which is pretty flat compared to revenue growth of +15%. Google cut lots of costs, losing 10,000 employees during the last years for example and more. Operating margin grew 12% YoY and this trend should continue as revenues keep growing.

"We continue to manage our headcount growth and align teams with our highest priority areas. This speeds up decision-making, reduces layers, and enables us to invest in the right areas."

The company is profitable since long but is now growing margins and coupled with buybacks, we should see the EPS rise to continue over the next years.

This isn't the only strength of the company as they're not sitting on roughly $95B of net debt with a $16.8B of FCF... We understand that they now can pay dividends - they could before though.

Price Action. we've been through a ride with $GOOG over the last months although the trend stayed pretty bullish.

Pretty glad I bought at $137 on the scandale of their AI image generation and called the stock "far from dead".

https://buymeacoffee.com/wealthyreadings/google-isn-dead

No doubts what pleased investors was the announcement of that new dividend more than the quarter itself as at the end of the day, that's what makes the market move. Guidance & shareholder returns... Not sure what to think about it but at least, it gives us some buying opportunities as often as we have those pumps.

Won't complain.

Call. Some more notes on the call.

Generative AI. Many think that Google will probably die as different LLMs will take their place over the next decade, kinda killing the free to use model, based on advertising. I'm not sure about this at all.

"We have been through technology shifts before, to the web, to mobile, and even to voice technology. Each shift expanded what people can do with Search and led to new growth. We are seeing a similar shift happening now with generative AI."

If Google is able to integrate any kind of LLMs to Search, people certainly won't go to pay for ChatGPT or else... But AI doesn't stop at LLMs, it's only the beginning - if not the fetus. And Google knows that since long.

"We've definitely been gearing up for this for a long time. You can imagine we started building TPUs in 2016. So we've definitely been gearing it for a long time."

YouTube. The app continues to be the number one of streaming.

"We announced that on average, viewers are watching over 1 billion hours of YouTube content on TVs daily."

And we start to see an acceleration on YouTube premium growth.

"we announced that in Q1, YouTube surpassed 100 million Music and Premium subscribers globally, including trialers."

We're not yet at Spotify's levels but I still believe YouTube premium is a better offer than Spotify.

But it's not the only interesting information on YouTube as to consume, you need to create and it really seems that there's no competition to YouTube in terms of creators.

"In 2023, more people created content on YouTube than ever before, and the number of channels uploading Shorts year-on-year grew 50% [...] We also hit a new milestone with 3 million-plus channels in our YouTube partner program [...] And advertisers continue to lean in to find audiences they can't find elsewhere."

And those content creators are of course being paid for it while Google gets paid even more by advertisers. And their monetization is getting better.

"I mentioned how the monetization rate of Shorts relative to in-stream viewing has more than doubled in the last 12 months."

Waymo. I'm still long Tesla and won't ever compare Waymo to FSD but it's nice to see that Google is expanding the service.

"we started offering paid rides in Los Angeles and testing rider-only trips in Austin."

Conclusion. A great quarter for a great company & business, a new All-Time High and a dividend. Lots of positive. We might be a bit stretched to buy in by now. A good time to be a $GOOG holder, nothing to do but sit on our hands.

But remember, I do me, you do you.

Thank you for reading it all! If you like it, please consider subscribing to receive it all directly in your inbox and not miss a thing!

Everything I share here is free but if you found the content valuable enough, you can always leave a tip!