Enphase | Q2-24 Earning & Call

We start to see some light.

It has been a tough year for Enphase but the company seems to finally see some light at the end of a very dark tunnel.

Overview. The quarter & the Excel sheet are not appealing at all, but there’s much more to it than its last numbers.

EPS. $0.48 | $0.43 | -10.42% miss

Revenue. $309.67M | $303.46M | -2.01% miss

$7.5M of buybacks.

Most of the interesting information came from the call and from one sentence in the earnings report.

"Our global channel inventory returned to normal levels as we exited the second quarter of 2024."

Business.

A brief overview of the company, which is focused on clean energy solutions - solar energy, and sells two categories of products: microinverters & batteries.

Everyone understands what batteries are and what they are for, but microinverters are a more technical product. These devices are used in solar power systems to convert direct current (DC) generated by solar panels into alternating current (AC) for use in homes and businesses. It is essentially the small & most important piece of any solar installation, allowing you to use the energy captured by the panels.

Many companies are now in this business (namely Tesla with its Powerwall), but none are selling comparable microinverters as this technology is an Enphase technology which directly converts the current with only one piece of hardware while other solutions have to rely on different pieces for the same result.

This makes Enphase products more reliable, performant, with a longer life span and easier installation & maintenance. It also makes its products more expensive, which is logical for a better system - but are a few hundreds or thousands making a big difference when installing a full solar system for a house? I think not, it’s often worth it to buy higher quality for those installations.

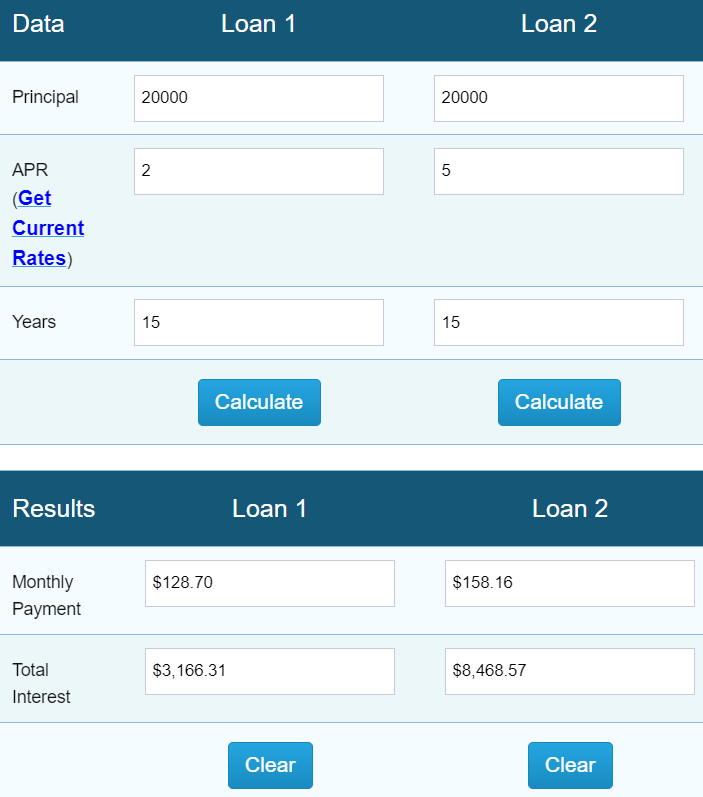

All was good for Enphase which was gaining market share and growing until last year, as interest rates were raised rapidly to fight inflation in the U.S., Europe, and elsewhere. These installations are often done through borrowed money from banks, and borrowing at 2% or 5% makes a very, very big difference for these kinds of prices.

That is how Enphase ended up in a situation where its products were not much demanded anymore while its installers (the professionals who buy their hardware to install them in houses), had a pretty huge stock with no demand.

And the struggle started, easily shown by the amount of microinverters sold by quarter.

The tunnel is still long, but we finally start to see the light.

Firstly, interest rates should go down in the next months (hopefully before the end of this year) and are already going down in some other western countries. This will bring demand again, slowly at first. Secondly, the inventories accumulated by installers are finally cleared, which means they’ll need to stock again to answer the return of the demand.

“This is the healthiest backlog position we have had in the last year.”

This quarter showed the first signs of growth as the company sold more microinverters & batteries QoQ although comparison is still hurting YoY as 2023 was a golden year for Enphase.

Geographically, it seems like the U.S. is rebounding and will continue to rebound faster than Europe, where the demand is still pretty weak - no growth QoQ. The region’s weakness won’t impact Enphase too much over the next quarter as the company is still expanding to those countries and isn’t too dependent on them - revenue mix was around 65% / 35% during Q2.

Although this should change over time.

“We plan to introduce our entire portfolio cross more European countries this year.”

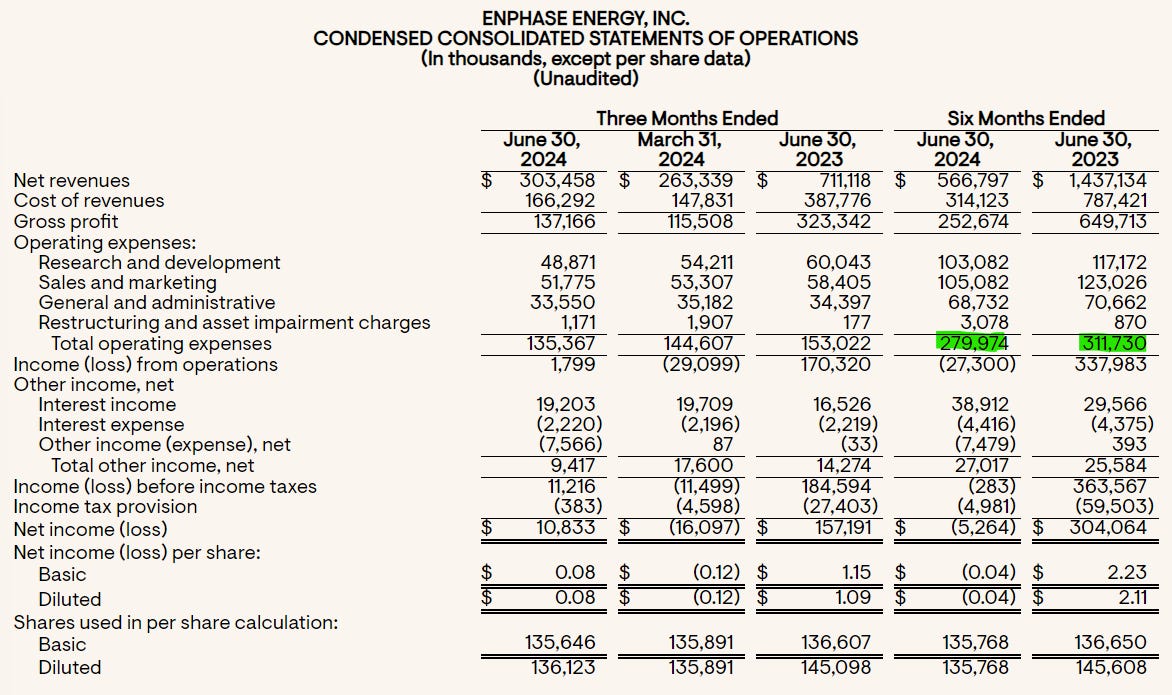

Revenues.

Nothing is shining in terms of revenues obviously, but this last year confirmed one thing: how good management was at navigating the period, mainly by cutting costs.

The company also grew its gross margin during this period, mainly due to the balance between microinverters & batteries - the latter has higher margins.

There isn’t much more to comment as a struggling business is linked to struggling revenues, although as I said earlier we start to see some growth QoQ. Hope.

We’re still strong on the balance sheet, another proof of proper management as they didn’t need to use their cash to sustain the business and ended the quarter with a $350M net debt, which they are still trying to find the best use for.

“I mean, look, obviously, our first priority is to take into account the needs of the business, invest in the right things. If we need anything like the domestic content, factory investment, we will do that. Second one, which we are actively looking is, are there any new verticals and M&A areas that we can get inorganically in software, in power conversion, even in batteries, we're always looking at that. And the third is if we find one and two are -- meaning we don't have many opportunities or we have done what we can, and then we repurchase shares as long as the share price is below a conservatively estimated intrinsic value.”

Free cash flow is still positive at $117.4M, mainly thanks to the shares program, still strong but largely lower than it used to be.

Guidance.

The guidance is stable although far from excellent. As I said, we start to see hope but we’re not there yet.

A slower YoY decline, a slower but existent growth QoQ & stable margins - or slightly growing as the battery branch grows while demand for those products isn’t slowing.

“the batteries have an opposite proble. I’m very tight on batteries.”

Thank you for reading it all! If you like it, please consider subscribing to receive it all directly in your inbox and not miss a thing!

Everything I share here is free but if you found the content valuable enough, you can always leave a tip!

My Take.

I will repeat myself once more but there is hope. Or confirmations of a brighter futur.

The inventories & channels are cleared and demand for their products is growing as many homeowners now want to install solar systems to be autonomous. The technologies were not performant enough some years ago but things have changed, prices have been lowered, and demand is strong - pushed by many governments.

What hurt Enphase this year was simply the cost of their products and those should come back to more affordable ones as interest rates get lowered. Growth and strong profitability will certainly come back as they are providing the best hardware of the industry - and again, homeowners will want the best when they invest tens of thousands.

The business can only get better from here as conditions improve, and the price action might have seen its worst.

We’ve had a clear bottom at $75 and have since ranged between $93 & $140 depending on the market’s mood. It’s hard for me to imagine a case where the stock would plunge from now own - except in a global market crash or any black swans of course.

I am considering buynig again, very slowly at the bottom of the range. I needed some confirmations that their products were demanded & that solar was still interesting homeowners before buying again. I think this quarter showed both.

I’ll certainly keep a close eye on the company and will buy slowly as it might be the time to start, but it isn’t the time to be aggressive yet - I’ll need more confirmations that business is back on track before doing so.