Duolingo Q1-25| Earnings & Call

The owl is flying very high now

My investment case on Duolingo is ready but will have to wait for quieter weeks as I don’t want to add volume to an already very busy earnings season. We are either way above a price I would buy so there is no rush.

Overview.

This one is a beauty.

Revenue. $222.97M | $230.74M | 3.49% beat

EPS. $0.51 | $0.72 | 41.18% beat

Business.

Starting with frequentation. Hard to do better as with the company’s highest increase in monthly & daily active users sequentially & YoY - up 33% & 49% YoY respectively, while increasing the proportion of payers from 8.6% to 8.9% of total MAUs. Not bad, especially while management confirms that there is no change on the actual demand due to macro concerns.

“So far in Q2, we’ve been monitoring the metrics we always monitor, and we haven’t seen any real change in the trends based on any macro environment.“

We see comparable strength from service providers like Netflix or Spotify, not affected at all by global reduced spending. Duolingo being in the same basket would be really bullish, being even less expensive as average spending to access this app is around $6 per user. Secondly, users are from all over the world & growth is homogeneous - the company doesn’t rely on the economic health of one geography only.

“A majority of our bookings and revenue come from outside the U.S.”

In English: demand & conversion are both growing, no slowdown.

Impressive, as many were talking about a plateau or difficulties to find new users. I personally have learnt from my mistakes on Netflix & Spotify and will not assume anymore when user acquisition is over, there is always room for more.

And Duolingo’s Total Addressable Market remains large & is increasing each time they release new verticals. Estimations for language learning are around 2B - a 2.3% market share for Duolingo based on DAUs or 6.5% based on MAUs.

Acquisition is step one, conversion is step two. To normal plans or Duolingo Max & its AI features, which convinced 7% of total subscribers as of quarter end. No comments were made on retention besides:

“I think on the retention rates, it’s kind of as expected. It’s early days, but we feel confident that it’s going well on the overall retention rates for Max at this point.”

My expectation would be wild churns as the service is far from perfect for now. Most of the demand for Max comes from English learners as Lilly isn’t yet available in many languages - which gives an idea of the potential.

On leveraging AI.

Lots of things to say. First, their pace of innovation is entirely thanks to AI as it helps for content creation or can use it to translate rapidly between languages. They did in one year what took them six years to set up before leveraging AI.

“At the same time, we continued to expand our learning content at an unprecedented pace. We were able to introduce nearly 150 new language courses for different geographies in Q1 using AI-generated content.”

To clarify, Duolingo doesn’t have courses for 150 languages - they have around 40, but those courses are now accessible from 150 languages which massively widens their potential user base.

“So for example, if you were a Portuguese speaker, you couldn’t learn Korean. But now you can.”

And it isn’t used only for languages as management shared they intend to roughly quadruple the Math courses volume in the next months.

Second, they use it to create new products, like video calls with Lilly.

Conversations are an essential to learn any languages & it is now available - with the premium subscription. They also add visuals to help with the flow of conversation - necessary while keeping it fun. More to come to make it even more interactive.

Service isn’t perfect yet according to feedback, some latency or variety issues but the service will improve in time & as Duolingo accesses better technology.

Few words on AI costs which grew due to those new services. Those are impacting margins as the company focuses on the product more than its optimization. In time, costs’ growth will slow down due to those optimisations and a lower price per token as AI becomes more deployed around the world.

As token prices go down, Duolingo can either reduce subscriptions’ price - as pricing per user will be lower, or keep its pricing steady to have a very high margin business. Reduce pricing, please users & grow your reach. Or generate more cash. Not a bad deal & a potentially very good optic from a user PoV.

They can only win - as long as there is demand & the product is good.

On what’s next.

The first focus is to improve actual contents - when it comes to languages. Propose better courses & more advanced ones as Duolingo did focus mostly on the basics of languages early on, but some users are now past that point and now want advanced topics.

“So there’s not that much in terms of new courses to add, but we are going to continue improving the courses that we have and also getting them to teach to more advanced levels.“

They do not intend to add more languages per se, as demand for new ones is very specific & it wouldn’t make much sense economically - not a lot of people wish to learn to speak small dialects for example.

They also continue to expand, to chess this time - after music & mathematics. Global interest around the board game grew rapidly the last few years, fueled by influencers & social media at large to become a really big niche driving tons of interest in the streaming community.

It isn’t yet available but the success on math & music tends to prove that this one will also be one - around 3M daily active users on the others. Duolingo isn’t just about learning, it is about how you learn. We’ve all been to school & learning isn’t the funniest activity there is. But Duolingo is.

“But in general, the strategy is really to become not just a language learning app, but an app that teaches you subjects that take a long time to learn, and these are all going to be subjects that hundreds of millions of people want to learn and that take a long time to learn and that are also good for the world.”

This is most of my bull case which I will share later with you & proves that Duolingo won’t slow down any time soon.

Other Comments.

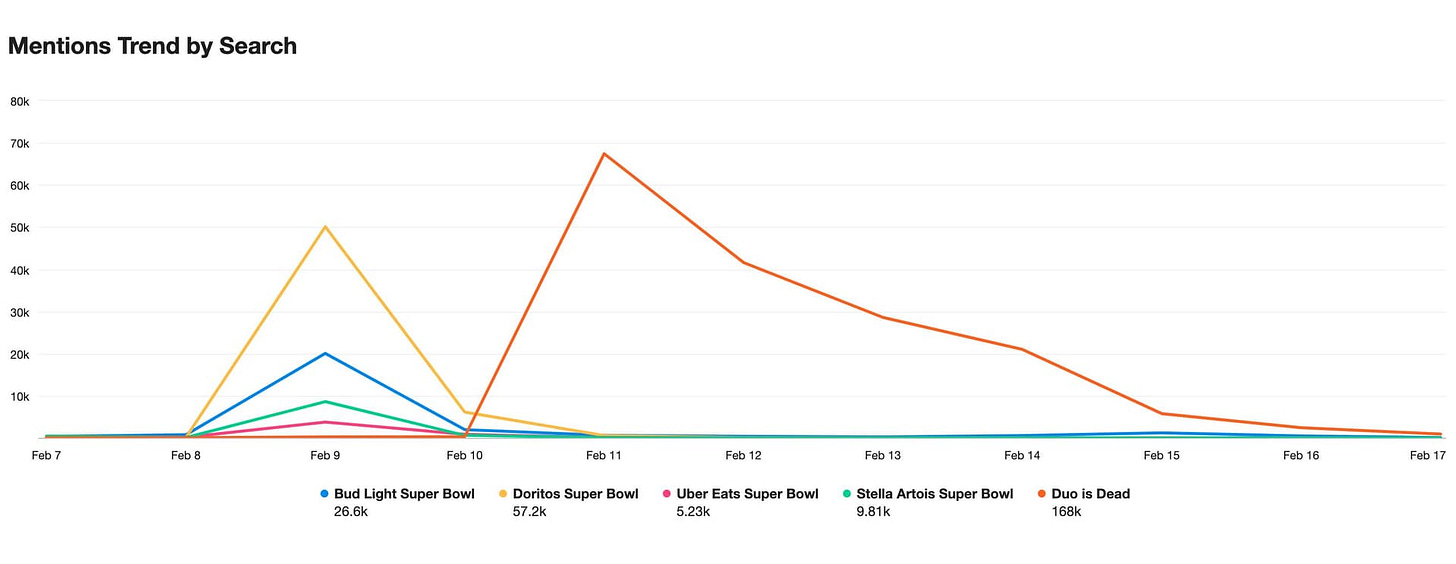

Few words on their last marketing campaign, Dead Duo, which generated a small 1.7B organic impressions on social media & much more queries than some Super Bowl ads - not a small feat.

Even better when you hear this kind of comments.

“And the cost of that campaign really was essentially nothing.“

Some personal thoughts on subscriptions. Today, you can access everything with the same plan - be it normal or family, except the Max functionalities. Subscriptions are here to take ads away but do not differ on courses consumption. Management confirmed they do not intend to change this soon but are doing some tests &, in time, as they deploy more verticals & advanced classes, things might change.

This is to give an overview of what could be in the next years, I wouldn’t be surprised to have different bundles depending on your usages exactly like Adobe does for example. Food for thought.

Financials.

No surprise, numbers are excellent.

Growth is driven by their core business: a growing user base, growing conversion to subscription & to their Duolingo Max plan leading to a 37.7% YoY revenue growth. This new plan also puts some pressure on margins as it requires higher costs, hence the 100bps or so loss in gross margin, a tendency which should continue for the next quarter & reverse later on as the company optimizes its usage & AI costs actually go down - through improvement from computing power providers. FY25 margins should decrease 150bps YoY according to management to stabilize around 72%.

Expenses grew 32.6% YoY which is slower than revenue growth, with higher spending in R&D to deploy more courses & improve their quality. A focus on improving the business itself. All of the above is also impacting net margins which are slightly lower YoY but from a much higher basis hence cash generation being stronger.

In terms of cash, Duolingo ends the quarter with $876M of net cash & $103M of FCF with 30% coming from SBCs while management is planning for a 1% dilution FY25, very reasonable considering actual growth.

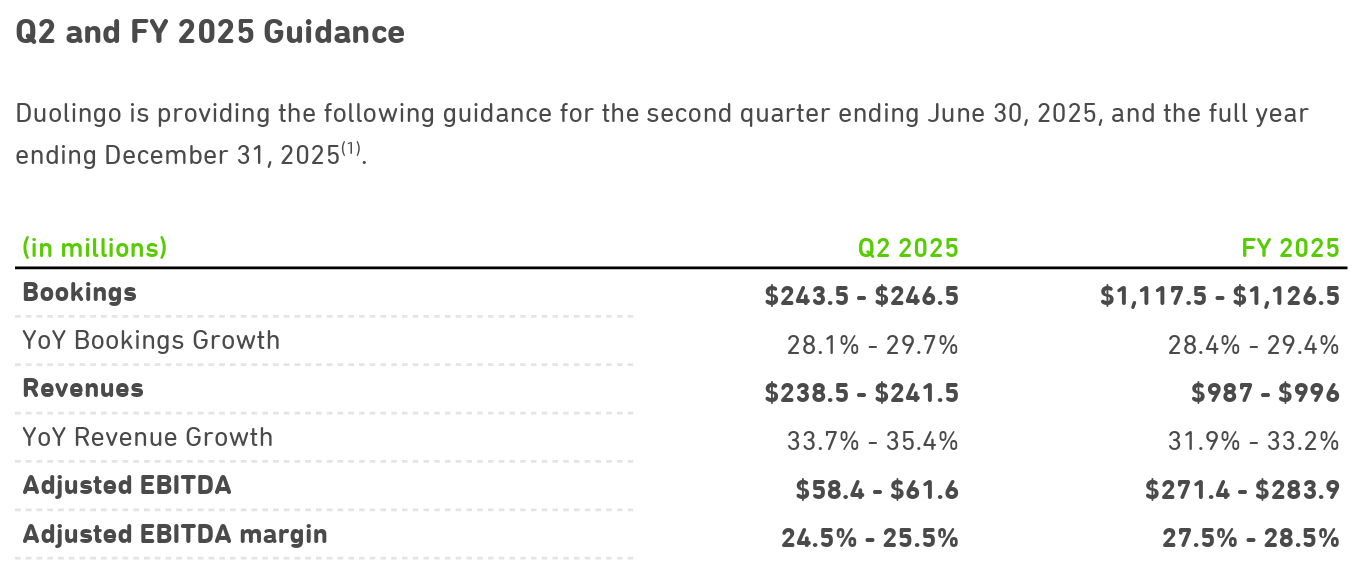

Guidance.

Everything shared above made management raise their guidance.

Nothing to comment, everything is just really strong.

My Take & Valuation.

Impressive is the only word which comes to mind.

Demand is raging, the product is getting better by the day with more content for any kind of curious spirit, beginner or advanced, with a massive TAM left to conquer & the potential to expand to many other verticals. Duolingo is a language learning app with the objective to become the new global learning platform. This would multiply the TAM many times, and they did prove they are capable of delivering.

This will take time to unfold & I will leave my projections for the investment case I’ll share in a few weeks. As for valuation, we had a great potential entry point which I missed as I was still working on the fundamentals. We have time and will have more opportunities - maybe real soon, so no stress.

This model assumes a 30% & 25% CAGR growth until FY26 & FY29 respectively, 15% of net margins, no returns to shareholders & multiples equal to its 3Y P/S average at x15.5 - very high due to its growth.

Keeping in mind that Duolingo is a growth stock. And like with every growth stock, a moment comes where growth slows & the market destroys it as it assumes it does not deserve its multiple premiums anymore. This is the ritual of passage from growth to established & valuable companies & Duolingo will pass through it. We don’t know when, but it will.

Company is wonderful. Business is booming. Potential is enormous. Holders must be very happy, and I will be one of them when I have the opportunity.

Thanks for the write-up! 800% in less than 3 years 😳😁