Celsius | Q4-24 Earning & Call

I am definitely out.

I have followed Celsius for some time now & commented lots, being mostly wrong as the stock kept plunging during that time. I sold my Celsius shares some time ago after it broke its local bottom, and my entire ride with the stock negatively impacted my portfolio by around 1.5%. Not terrible, but a loss nevertheless.

Ironically, I decide to stop following the company while the stock is up more than 30% pre-market, but I do not believe this is justified. I’ll detail why below.

Overview.

This isn’t a good quarter in numbers.

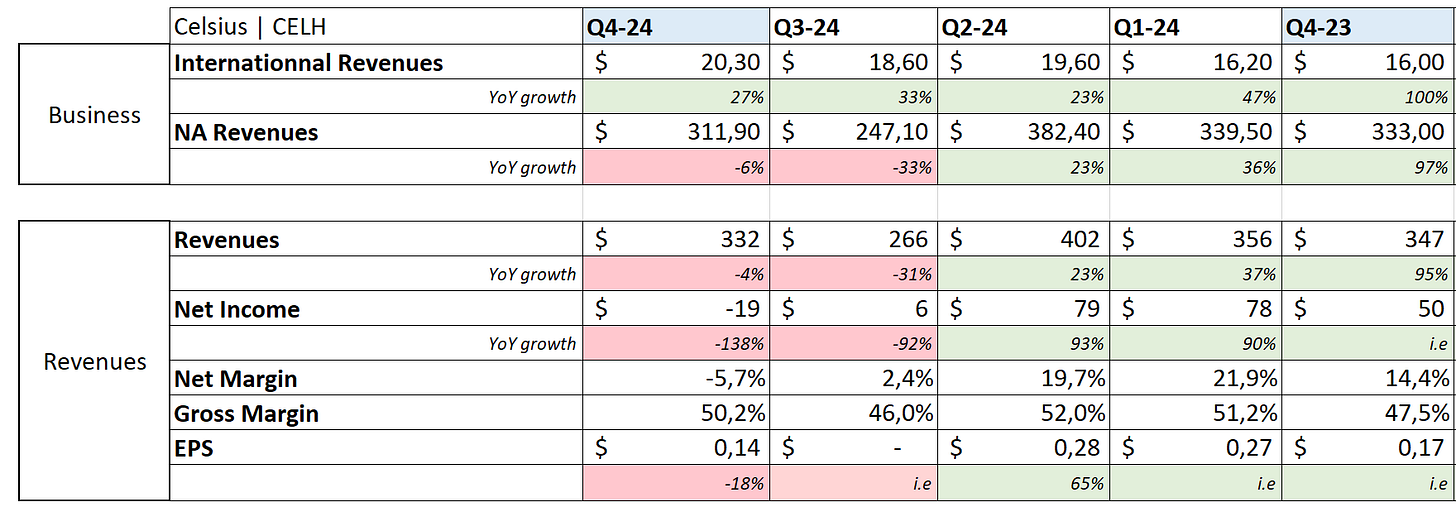

Revenue. $327.02M | $332.2M | +1.58% beat

EPS. $0.10 | $0.14 | +40.00% beat

But we need to go a bit further to detail things, as numbers aren’t enough to paint a story.

Business.

My bull case was simple & detailed in the conclusion of the Q3-24 write-up, with this sentence to summarize it rapidly:

“We could easily have a double digit growth in FY-25 without any increase in demand, simply due to inventory optimization & easier comps.”

In other words, we needed to see continuous demand for the product in terms of retail sales, and math would do the rest for us in terms of growth & comps.

A rapid word on some positives first. International sales are still kind of negligible but growing healthily, which is a net positive. Secondly, Celsius will be distributed in Subway starting March 2025 which again, is pretty positive as any new distribution points means potential growth. And we will talk about the acquisition which can be seen as a positive, although I have my doubts.

What went wrong.

But things are mostly negative to my opinion.

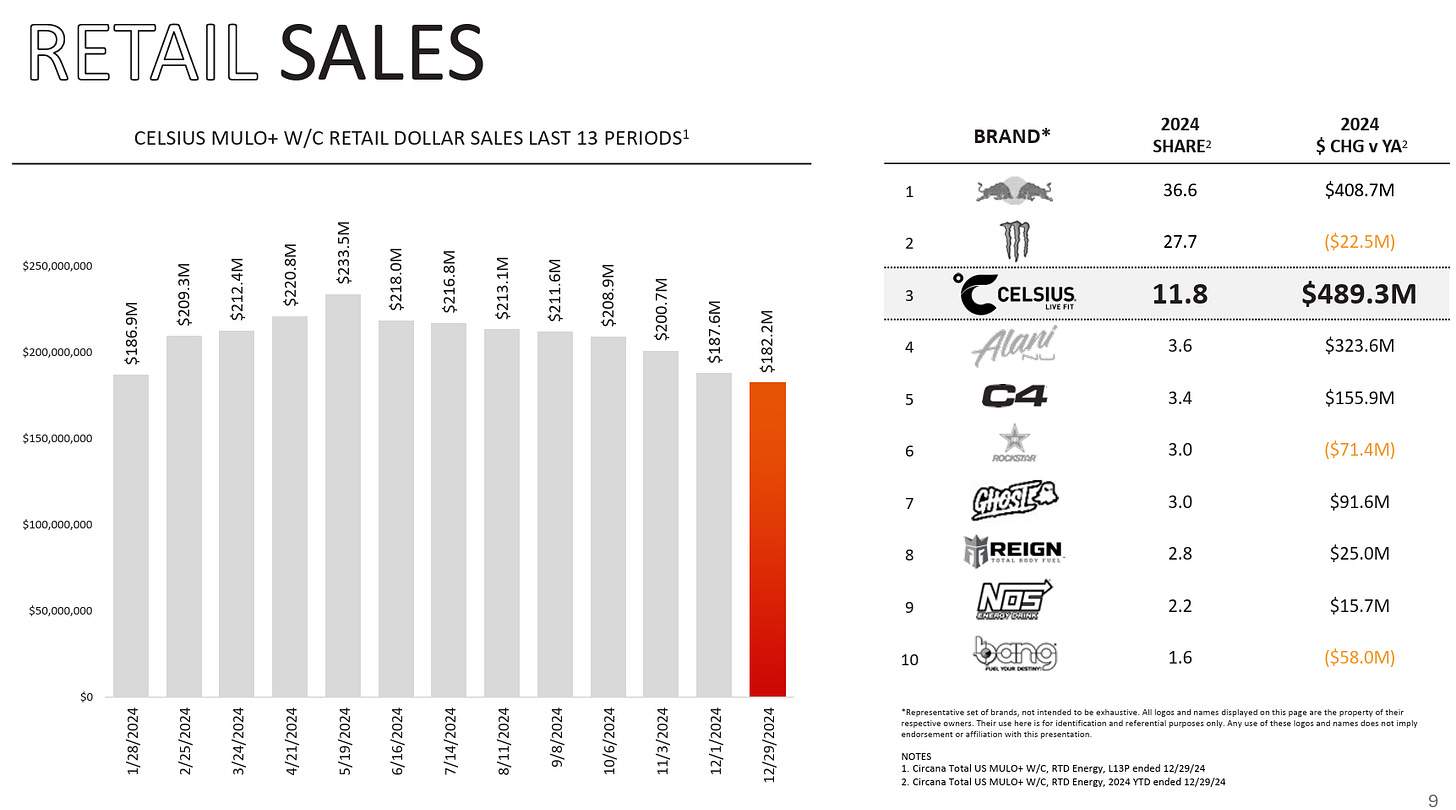

I think this rests my case. Retail sales are in a constant decline MoM. The argument of the winter months could make sense but we are even declining YoY, which means that consumers buy less Celsius today than they did last year.

I want to stress that this isn’t an inventory issue. Management talked about an $8M to $10M revenue impact from inventories, but we’re only talking about retail sales here - two different subjects.

That could be a temporary situation. That could be blamed on macro conditions or anything you want it to be blamed on, but the facts remain that consumers buy less, and this trend isn’t what I want to hold.

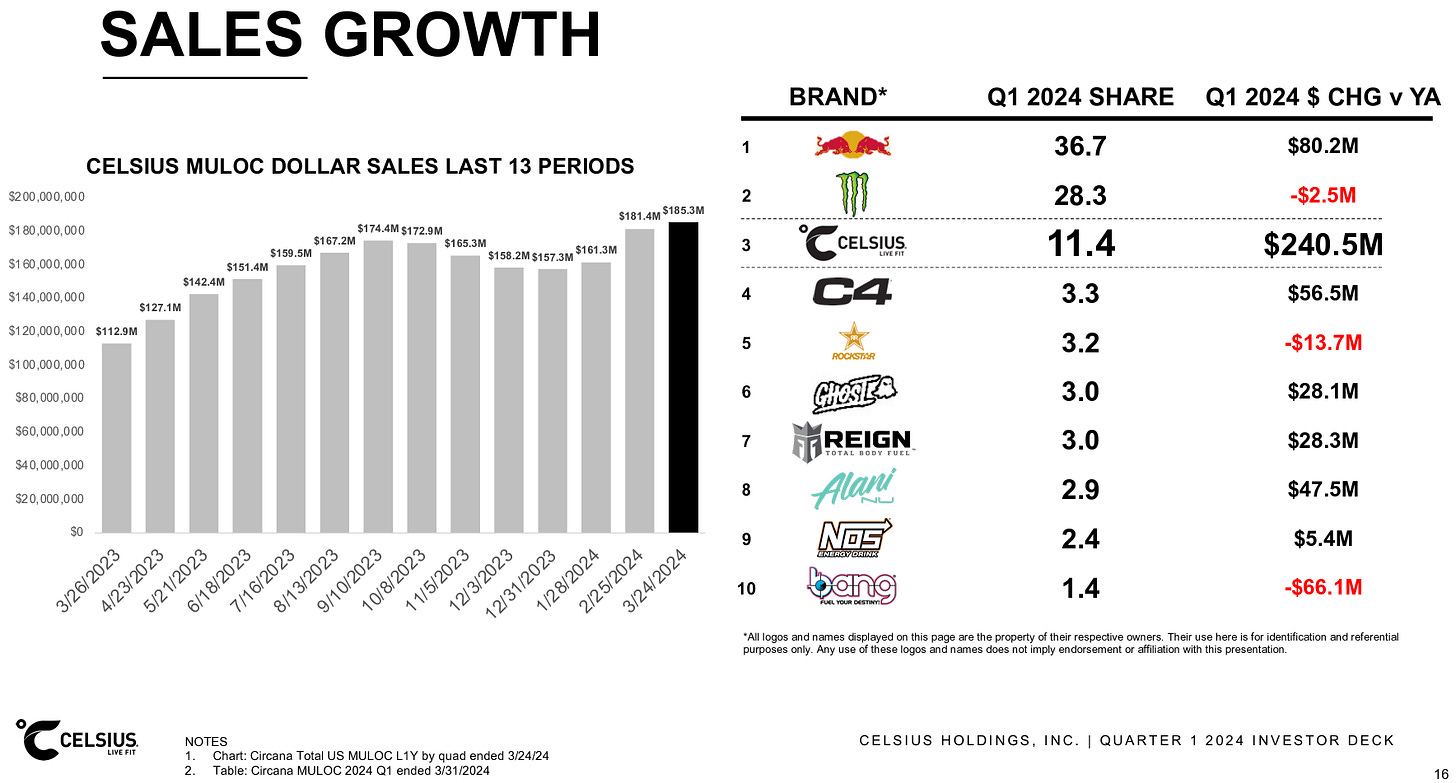

As a comparison, here’s the retail sales data from Q1-24. That I’d buy.

The winter months were clearly lower than summer, which is entirely normal, but the global trend was upward with strong growth in consumption YoY.

This was the number one data point to check for my bull case. And it failed big time. From there, I was already not interested anymore.

Alani’s Acquisition.

Second subject. I have mixed feelings about this as I understand the bull case, but it is one based on optimism, in my opinion. Here’s how management talks about the company.

“Alani Nu is a growing female focused brand that delivers functional, great tasting wellness products for a growing community of millennials and Gen Z consumers.”

They assured that their products target another category of users - mostly young women, not cannibalizing their own Celsius consumers. Their products are also labeled as fit & sugar-free, so it aligns with the current brand.

In terms of financials.

We’re talking about a rapidly growing equivalent of Celsius in terms of products, with $595M of revenue in FY24, or 44% of Celsius’ FY24 revenues, meant to become a pretty significant part of the business as it’d push their combined FY24 revenues slightly under $2B. What pleases the street is mostly the company’s growth, with a 50% CAGR since FY22, which is good.

The strategy makes sense: comparable branding - “Live fit,” different addressable market meaning Celsius will net increase its consumer base, significant proportion, correct growth and new products.

I need to stress that this acquisition is entirely between Celsius & Alani, management commented that no distribution partnerships were set with their partners; any products going through Pepsi or others would obviously be bullish.

The deal is planned to close in Q2-25, and Celsius plans to acquire Alani for $1.8B, or 3x FY24 sales, which is pretty reasonable considering current growth & potential. Financing is done through cash, debt, and share issuance - hence partly diluting shareholders.

I also want to stress that this acquisition isn’t finalized. Even if both parties are in agreement, they’re still pending regulatory approval, etc. I am not saying this won’t happens, I’m just sharing the information.

My Opinion.

I believe there are different kinds of acquisitions: those done from a position of strength, with a rapidly growing business out growing competition, and those done from a position of weakness, with declining growth but enough cash to try things.

Celsius is in the second category to me, trying to bring growth back from other products as theirs aren’t growing anymore for now.

Don’t make me say what I didn’t say: I am not saying it won’t work. I am saying they are adding more commodities to their portfolio while their own is slowing down in terms of demand. It can work. It can fail. We can’t know.

I understand the logic and the narrative. I understand why the markets like it, that it believes Alani’s products could be distributed by Pepsi & other partners, boosting growth & more. I understand the optimisim, I just don’t invest on optimism.

Revenues.

I’ll comment rapidly on things here.

Revenues are up 2.8% YoY in FY24, while net revenues are down 40.9% during the same period. This is explained by much higher costs, some due to their normal operations, others due to different unique situations like a legal case, some restructuring expenses and some charges from previous acquisitions.

The bottom line is that FY24 was challenging, and comps are completely biased by Pepsi’s inventory which kind of messed up lots of things. That is why I look at retail data.

Despite that, the company still generated cash and will end the year with $890M on its balance sheet with no debt, although this should change once the acquisition is finalized.

My Take.

I believe it is the first time since I started writing that a stock is green big-time pre-market while I am not convinced by the earnings. It usually is the contrary. Although somehow it makes me happy, as I still held option calls, which I will be able to close for a profit after selling my shares for a loss. A potential complete breakeven which feels good, I won’t lie.

Now I guess you understood my take. It’s not that I believe Celsius will fail; it’s that I do not think Celsius is worth any liquidity or consideration of liquidity anymore. The way I see it, we’re talking about a company selling a product whose consumers have reduced their usage of and which is trying to CPR its growth by acquiring competition.

It can work. It can fail. Am I ready to put my own money on a “maybe”? Nope.

What if the acquisition doesn’t go through? What if Alani’s growth slows down next year? What if consumers do not go back to Celsius products? What if global demand for energy drinks continues to slow down? What if international growth slows down? And what if…?

Sure, you can answer, “What if it works? What if growth accelerates?” and you’d be entirely right. I just don’t want to invest in “if” while the data shows that the probabilities of this specific “if” happening are lower than not.

At the end of the day, we have limited liquidity and I want to concentrate it in the best assets I can - not in probabilities based on optimism and not data.

And to me, that’s what Celsius is today.

Hey Bro, excellent write-up, just out of curiosity where did you get the retail sales data from, is it on the Celsius report?