Celsius Holdings | Q2-24 Earning

The undervalued & consumer centric stock.

Second purchase this week. Yes, I’m back in Celsius after selling my entire position a few weeks ago in the low $60s for a very small loss - less than 3%. Let’s review the quarter and the reasons for buying back in.

Here’s my investment case.

Overview.

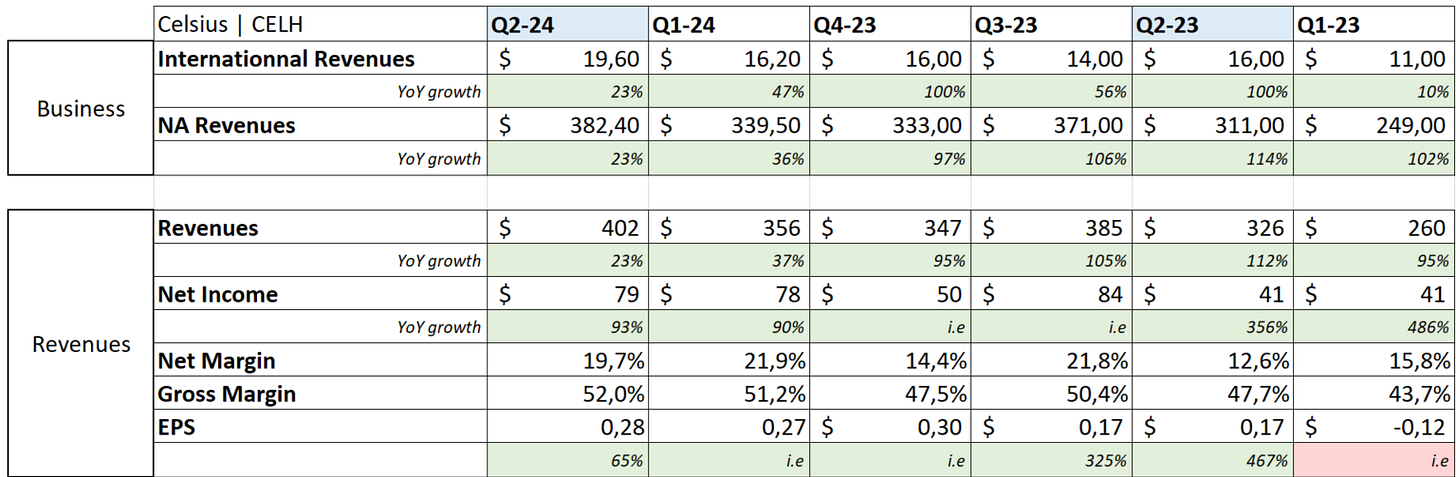

There is nothing exceptional here if we compare it to where Celsius was last year. But the growth trajectory is still very good & the company very healthy.

EPS. $0.24 | $0.28 | +16.67% beat

Revenue. $402.45M | $401.98M | -0.12% miss

"Celsius continued to lead the energy drink category, contributing 47 percent of all second-quarter growth, and we believe that we are well-positioned to capture incremental category dollar share."

This isn’t the overview of a dying company.

Business.

It is hard to be bearish on Celsius’ trajectory. Everything on the market is a matter of valuation, and the pessimism surrounding the brand lately is because of that. The business itself is going as well as it used to.

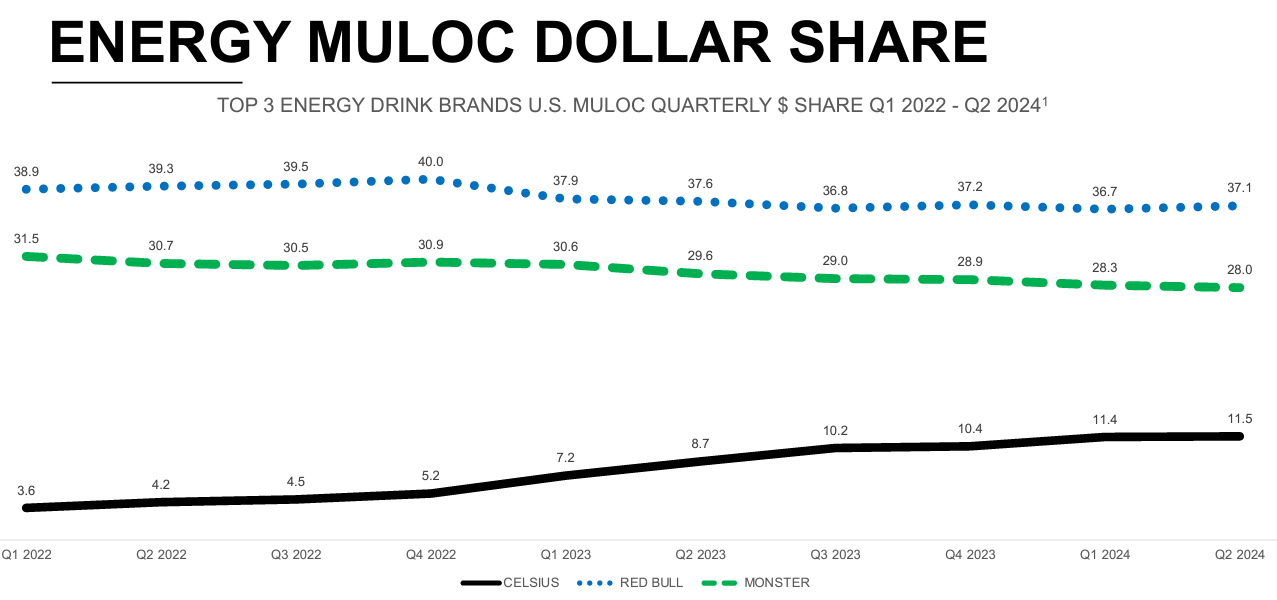

Many investors are worried about the company’s market share but in my opinion, the trend is very positive.

It sure is less explosive than it was in 2023 but the game also becomes harder when you become a bigger player. Its online business is a significant growth driver and a strong advantage compared to Monster and Red Bull, which aren’t as present online - Amazon sales increased 41% YoY.

But the company at large is growing rapidly, responsible for 47% of all Q2 energy drink category growth and gaining shelf space, which means its partners are exposing the products more than they used to. This is a positive sign, as it also means they are being bought more than others and deserve more exposition.

The planned expansion is still on track but as said last quarter, it will take longer for it to yield returns as sales will only begin during the second half of the year in three countries, having started only a few months ago in others.

Management said that the brand established itself better than expected, but it will still take time.

Pepsi Inventory. The call didn’t provide much news about Pepsi’s inventory, management didn’t exactly avoid the question but certainly didn’t answer it properly.

“I think in mid-June, we were at a good point in terms of providing what we expected. I think we'll have to see where we go. So unfortunately, I can't predict what our partners will do. That's really up to them to continue to optimize their system. And if it's fully optimized, then we'll be in good shape. But there's still some flexibility within that system for them to further optimize. We'll have to see where that goes.”

Hard to draw a takeaway from this, which is surely why the stock didn’t move at all. The market isn’t reassured as long as these matters aren’t fully resolved and optimized. Management still confirmed that relations were very good, and the new contracts set up two quarters ago make everyone happy.

All good long term.

Revenues.

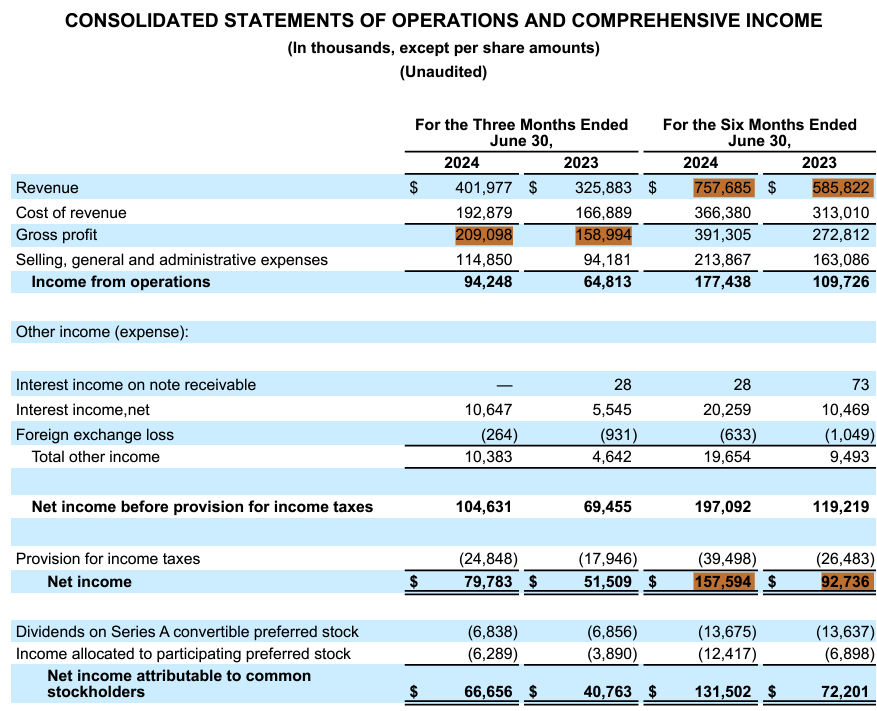

While everyone is worried & considers the stock worthless because growth is slowing, the company grew revenues 23% YoY for the quarter and 29% YoY for the semester. Slowing, yes, but far from weak.

Especially since revenues aren’t everything with these kinds of companies. Both gross and net margins have rapidly expanded YoY, although they declined slightly QoQ but this was to be expected, and management talked about it last quarter.

Net income is growing rapidly, with H1-24 up 70.6% YoY. This is where Celsius will shine over the next few years, as I mentioned on the investment case.

The company closed this quarter with a $903M net debt, $174M of OpCF, and $161M of free cash flow. Once again, this is where Celsius will shine: generating cash the company has no immediate use for and will very likely use to return value to shareholders. What shareholder doesn’t want this?

Images are always better.

Tons of cash. No debt. Generates lots of cash each quarter from its business alone with solid net and FCF margins - with a tendency to expand over the long term. It’s hard to imagine them continuing to expand, but for comparison, Monster has net and FCF margins of around 23% and 20%, respectively - this is Celsius’ long-term objective.

My Take & Why I Bought In.

We’re looking at a solid quarter for Celsius, above many analysts’ expectations, with a good business, strong brand and demanded products while summer isn’t finished. In terms of revenues, we have solid growth, expanding margins and strong cash generation with no massive R&D or expenses - as expected.

I was already in Celsius some time ago and sold my entire position because the pessimism around the stock was ridiculous and the Nielsen data was simply feeding it - with no valid reason, in my opinion, but the market doesn’t care about my opinion. I waited for a bounce to exit and was right to do so.

Nothing has really changed since in terms of business. But much has changed in terms of valuation as we’re down more than 36% since I sold my position. Celsius is confirming that growth will continue at a stable pace, much slower than it used to, but still more than solid, probably above 25% up to 2026, with stable margins at worst.

FY-24 should already be up between 35% and 40% YoY, so we’d need 20% growth FY-25 and FY-26 to reach a 25% CAGR up to 2026. I wouldn’t call those numbers overly optimistic considering the brand is expanding to six new countries this year and still gaining market share in the U.S.

At today’s price, we’d need pretty low ratios to reach our 11% return as you can see in the screenshot - almost half of Monster’s actual ratios, which is expected to grow around 10% up to 2026.

The truth is, if Celsius were to grow at a 10% CAGR over the next three years and trade at Monster’s current ratios, we’d still achieve our 11% CAGR on our investment. The question is, do we believe Celsius cannot grow more than 10% CAGR? Does the company deserve lower ratios than Monster if it does? And does it deserve higher ratios than Monster if it grows faster?

I answered those questions myself before buying in. I still think the next few months can be tough as the market is still afraid of a recession - which could happen. If so, the stock will certainly go lower but the company’s strong balance sheet should be enough to weather it easily.

The market can be scared, but the company is healthy and growing while the stock is beaten down more than reasonably. I’m picking up those shares with a slow DCA as long as the stock is under $50.