Buying Plans | 10/07

A review of all the stocks I follow, the stage they're on & my buying plans.

I’ve talked already about my investing methods & how I do things, this write-up is about how I apply the concepts.

Once fundamental analysis is done, convictions are built & a fair price is defined, the only thing left to do is to buy. But everyone has limited liquidity which means we must prioritize some purchases over others. The goal being to purchase the perfect stock at the perfect time - that's what performance is about, although no one can do it perfectly. This is what I try to do with a combination of strong fundamentals & strong price action.

I categorize my stocks into three groups based on their price action:

The Accumulation is about slowly buying while the stock price is ranging.

The Uptrend Phase is when I buy on retests with more aggressive positions as the market gave its confirmations that the stock will go higher while trying to keep my average price at or below what I consider its fair value.

The Downtrend Phase is about observation, waiting for a technical bottom or a valuation so stupid that starting to accumulate becomes possible.

This write-up will have tons of charts as it is the first one but I will only update the necessary stocks for the next ones. You’ll also find an investment case for most of the companies presented below in the tab dedicated to IC - the rest is being written.

Global Review.

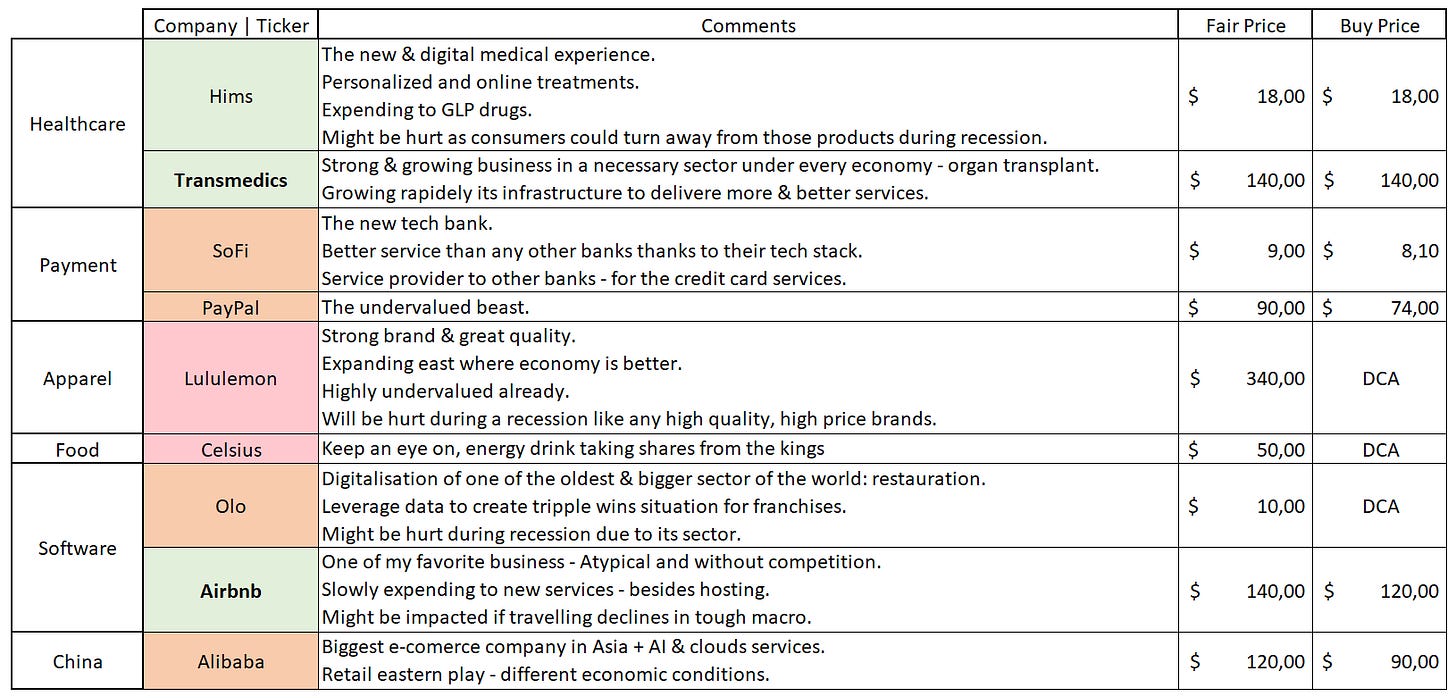

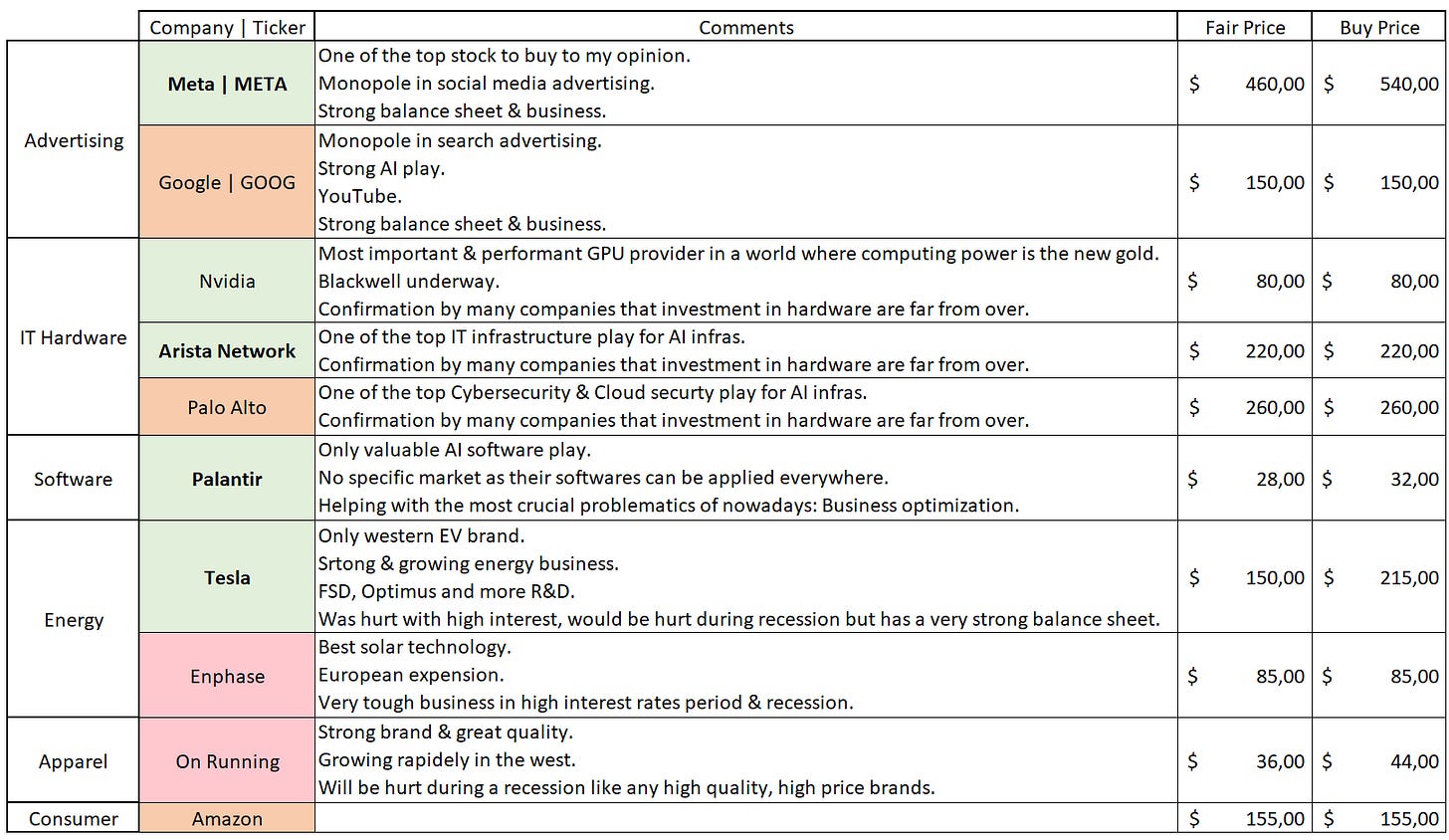

First, a global view on the companies; what I judge to be the fair price for their stocks & the price at which I intend to buy - with DCA being a slow accumulation without any specific price in mind. I'll go over the charts & argument for each below, but you might not be interested in that so you'll find the information you want right here.

The color code represents priorities, with green being the highest and red the lowest, while bold text highlights my strongest convictions.

Starting with the ones trading under fair value.

And the ones trading above.

I don't have any cryptos in the Excel because it's impossible to find a fair price for them, so I only work with price action but we'll talk about them.

Uptrend.

The stocks which the market acknowledges and are going up; I buy these only on retests as long as the average price stays around my fair price.

Meta. The company has been nothing but wonderful and I was lucky enough to have some shares during the last "crybaby" moments from the market, when it cried about Capex & Reality Labs.

We're waiting for a retest of the $540 breakout but I probably won't buy as this would push my average a bit too high. As said some weeks ago, Meta's growth & margins will be impacted by its AI products & hardware but it's impossible to anticipate these for now so we'll need to wait & see. The fair price could be much higher, but I wouldn't raise my average too much without data.

Google. Like other AI companies, Google is impacted by its Capex & expenses and the stock spent a lot of time under $150, falling again after its breakout.

We'll surely have more opportunities in the months to come to buy around that price as the market is very capricious. But this chart is a beauty.

Nvidia. I am not in Nvidia and it’s hard to imagine when an opportunity will come as it’s still the popular girl in the market and I won’t buy the actual ratios.

The current range & potential retest around $100 would still be a bit expensive to start a position so I'll probably wait out. GPUs, like semiconductors, are a pretty cyclical business, so we'll probably have to wait until the next cycle.

Arista Network & Palo Alto. I won't post the chart for these two as the stocks are far from my targets and the potential retests are still much above them. These are missed opportunities for now; it's important to keep an eye on them as they could give an opportunity during a fast crash or so but I probably won’t buy until then.

Palantir. The beast. One I have accumulated well enough to have an average under what I judge to be its fair price today.

The stock is still in beast mode so it's hard to know when we will see a buyable price action, but I'll stay patient and still think $30ish should come eventually. I’ll buy when this happens.

On Running. Another beauty when it comes to price action.

Next buyable price is around $44 without pushing the average above $36.

Hims. Very volatile lately! I've been nicely accumulating over the past months under $18 and we should open this week around $19 with the S&P 600 SmallCap inclusion.

We'll need to see how this goes, but if the stock rockets up in the short term, the $18 retest will probably be the last opportunity at a fair price before a probable ATH and I won’t miss it.

It's a wait & see here.

Transmedics. You will receive the investment case this Wednesday, but to spoil it, I've assumed a fair price around $140 for a long-term position - we're talking about 2029 and beyond.

The stock has been behaving very well, and I would be surprised to see this bottom lost without any black swan or very bad fundamental news. I'm starting to accumulate slowly at current price but I wouldn’t be shaken out if the stock were to fall to $100 or less as long as fundamentals are intact.

It’s a very long term position and we’re already fairly price so there’s no point waiting.

PayPal. We are still under the fair price to my opinion when it comes to PayPal but it also started an uptrend.

The DCA part is over, and the breakout was retested; it's time to wait & see now but I'll surely buy much more if we go back to this support around $75. We’re still undervalued but it’s no reason to maximize entries.

Alibaba. The same goes for Alibaba although the stock is under different conditions.

I'd love to see a retest around $90 but with the actual Chinese stimulus and the new hype around Chinese stocks, it's pretty hard to imagine what can happen. I will buy it aggressively if ever given the opportunity. The other scenario is to break $120 and have a retest there, which I'd also buy if it were to happen.

The first scenario hapening will take my money.

Cryptos. I already shared my take on Bitcoin, Ethereum & Solana here and nothing has changed. I bought the wick retests each time and still plan on doing so.

We’re talking about Bitcoin around $55,000, Ethereum under $2,300 & Solana under $130. All the positions are double digit green since I shared this two months ago.

Accumulation.

The stocks that are trading below what I consider fair value & trading sideways, not on a clear uptrend.

Lululemon. Tough year for the yoga pants but we’re finally seeing a potential bottom with a favorable weekly reaction on a pretty strong support.

A good place to start accumulation as both the fundamentals & price action are pretty good by now. I started it some time ago already and continue to do so regularly.

Olo. The small cap has been in this accumulation range since I've known about it. There isn't much to comment; I'm just slowly buying as the price is a bit ridiculous, considering the potential & fundamentals.

Everything under $5 is bought, but this is where liquidity has to be properly allocated. It's important to accumulate, but it's also important to play the momentum on stocks that the market loves to maximize performance. Olo could trade sideways for a decade or never even break out, so attributing too much liquidity to it would hurt the global performance.

There's a balance to find

SoFi. The same is true for SoFi which many have held for years, hurting their portfolio’s performance. But we might be at the start of something big for the tech bank with a weekly close above that trendline for the first time in years and higher lows slowly accumulating for the past months.

I’ve been doing my DCA for a small year now but it might be time for SoFi to receive some love & some more liquidity.

Airbnb. To be honnest, Airbnb is a shitty chart and the market doesn’t know what to do with this stock, trading sideways since its IPO four years ago.

I still believe we're under fair value, and we might have seen a bottom, but we're still under a strong trendline and I won't consider Airbnb to be in an uptrend until we break it & its yearly high.

Until then, slow accumulation seems the best move.

Tesla. Complicated subject here but if we dezoom, we can fairly say that the stock has been ranging for years with some excentricities here & there.

We broke a major trendline with the hype of the 10/10 event but as I said often, this is a do or die event and I except the reaction to be violent north or south. It’s very hard to talk about prices for this stock as most of its price action is following sentiments.

As for me, I’d buy the support between $140 & $160 but I wouldn’t buy a retest on the trendline without very strong fundamental news - we’re talking about FSD licensing or robotaxi service starting (not promised to start).

Enphase. The stock has been in an accumulation zone for months but it's not one I really want to buy...

But this stock is a big subject, and it's pretty hard to give it a fair price at the moment as its business has been strongly impacted by the actual Western macro environment. I still follow and would buy with a big opportunity, but it's not my priority.

Downtrend.

Celsius. The only downtrend in a bull market.

As I said, I wouldn't buy into a downtrend unless the price became stupidely undervalued. That's where Celsius is. The market has no expectations for it anymore but I still believe it underestimates its potential growth, and I started buying around $35.

We could be touching the bottom now but the stock continues to decline week after week. I believe it's an attractive price but again, I'm not locking a lot of liquidity into it. I'll wait for stronger bottom confirmation before being more aggressive.

Starting the new weekly or bi.monthly recap, not sure how I’ll update this so feel free to give me ideas and tell me if you’re interested in it.

This follows the post on ivesting & why where i details the stages of investing. I ut different size of position depending where they’re at wth the biggest chunk entering when stocs start to pump

First DCA slow. Second enter aggressively on pump. Continue to do soo as long as avaerage stays under fair value.

So let’s go over each company I follow with my plan for each, knowing that I priveledge the riding in term of liquidity. All of the assets have an investment acse which you can find on the tab dedicated to it - except Ethereum & Amazon on which I am still working.

Global Review.

The riding ones

The bottoming

The Falling

Thank you for this insightful article and for sharing your thoughts on your Buy Plan! It’s really fascinating how you analyze and explain the different phases of stock purchases. Please keep up the great work – content like this is incredibly helpful for the community and inspires reflection on personal strategies. Looking forward to your next posts!