ASML & TSM | Q2-24 Earning

The AI hardware monopolies.

ASML.

Let’s start with the first in the chain and talk about the monopoly on lithography.

EPS. 4,01€ | 3,70€ | +8.4% beat

Revenue. €6,07B | €6.24B | +2.8% beat

€96M of buybacks.

"While there are still uncertainties in the market, primarily driven by the macro environment, we expect industry recovery to continue in the second half of the year."

The first glance doesn’t paint the best picture as we clearly see a decline YoY, but this is known by the market & the management as the company is pivoting.

Business. Nothing changed much in terms of business and the tendency of the last months continues, with the logic part of their portfolio growing faster as more & more companies are building infrastructures capable of creating computing power chips.

Their biggest clients, and the biggest country to invest in those solutions, is of course China - raising tons of concerns, but we will talk about it a bit later.

Not sure the tendancy will change as many countries & companies will fight to have access to ASML’s lithography technology and as no one else really provides anything equivalent…

Revenues. But the business change from the company are reflected in their results with a YoY decrease in almost all metrics while the improvements are rapid QoQ. It will take more time, but everything here is aligned with previous guidances.

Guidance. And it should continue to improve as the company expects its next quarter’s revenues between €6.7B & €7.3B, with a stable gross margin between 50% & 51%.

Good numbers overall.

Taiwan Semiconductors.

TSM did much better, growth is back on track thanks to its innovations which, like ASML, cannot really be found elsewhere.

EPS. $1.38 | $1.48 | +7.25% beat

Revenue. $20.02B | $20.82B | +4.01% beat

$90M of dividends.

"Moving into third quarter 2024, we expect our business to be supported by strong smartphone and AI-related demand for our leading-edge process technologies."

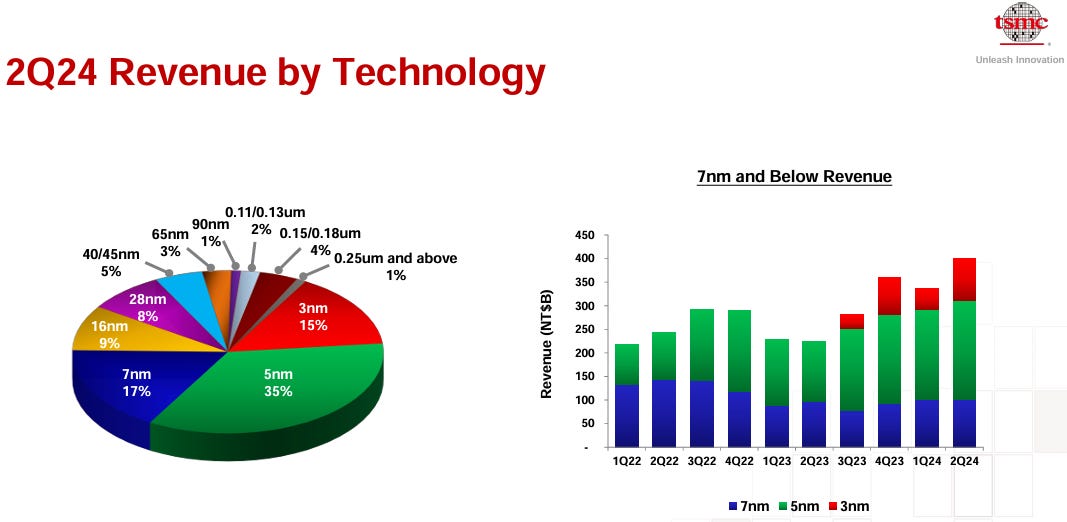

Business. Life is very easy & very hard at the same time for TSM. Demand is very strong for a product they are the only one capable of selling: 3nm chips.

The 5nm is still the biggest part of their revenues as it is enough for most products but the war to always propose faster devices will, in time, see an increase in the 3nm demand which will certainly reflect in TSM's revenues & margins.

Demand mostly came from High-Performance Computing (HPC), which basically means hardware tech companies building more hardware from those semis, namely Nvidia, Apple for their own MX, AMD, Qualcomm, etc...

This confirms once more the continuous trend of computing power demand.

Revenues. Lots of positive this quarter, starting with the company’s highest ever revenues with more than $20B - up 41% YoY & 14.7% QoQ. Gross margins are nicely growing QoQ, slowly going back to where they were in early 2023.

Net margin decreased and reached its lowest value but this is mainly due to higher taxation - the pre-tax margin is actually better YoY & QoQ.

Guidance. To continue with excellence, TSM is guiding Q3-24 to beat this quarter’s actual revenue record with an expectation between $22.4B & $23.2B - up 38% YoY, with a gross profit margin between 53.5% and 55.5% - expansion QoQ & YoY.

You’d have to look very hard to find anything “Meh” in this quarter.

The Semis Industry & Geopolitics.

Both companies are showing good results, even excellent for TSM, and yet both stocks are down, -10% for TSM & -17% for ASML. The first conclusion to take here is that this reaction isn’t due to business, ratios are contracting which make both of them cheaper than they were last week. Fundamentals are strong - business is always good when you have a quasi-monopoly.

But the market is worried and his reaction is mostly due to (geo)politics.

ASML is a European company selling the most efficient equipment to create patterns of circuits on a chip, a primordial step to create any semiconductor. These are impossible to create without equivalent technology, and ASML is the best (the only one) selling it.

But its biggest client is China, with whom the tech/trade war persists and fear of stronger regulations to sell this kind of technology to the country certainly triggered the selling.

Taiwan Semiconductors is selling semiconductors, as advertised, and these are used in each & every tech thingy we use, from our cars to our cellphones, passing by our washing machines. Its problem is, as advertised again, its location: Taiwan.

The famous island is constantly under China’s threat (or not), and the market is scared that any day, Xi wakes up on the wrong side of the bed and decides to send missiles to reunify with the island by force - be it a rational fear or not doesn’t matter.

But these two factors are old and known by everyone. The market simply remembered them this week because of one person: Donald Trump.

Trump. His words are being watched more & more as the odds of him being the next president are increasing every day, and earlier this week, he stated that the U.S. defense policy would certainly change under his presidency - meaning he wouldn’t defend anyone but the U.S. “for free” anymore.

This of course includes Taiwan, and those words were enough to remind the entire market of the regulation & confrontational risks of these two names - and the entire semiconductor sector.

Conclusion. This was a lengthy report, but the summary is that businesses are buzzing, demand is very strong especially for computing power, which is a very good sign for the market at large as this sector is still the driver of the short-term trend.

The sell-off was pretty violent but not due to any fundamental problems. Many actors are mostly either deleveraging themselves while fewer want to buy at these prices. Markets often over-react.

I wouldn’t buy here either, but I do not think the computing power narrative is over yet. Demand is still there, still strong, and these two companies have both delivered great numbers - and got cheaper for it.

Thank you for reading it all! If you like it, please consider subscribing to receive it all directly in your inbox and not miss a thing!

Everything I share here is free but if you found the content valuable enough, you can always leave a tip!