ASML & TSM Q1-25 | Earnings

Demand for hardware remains strong.

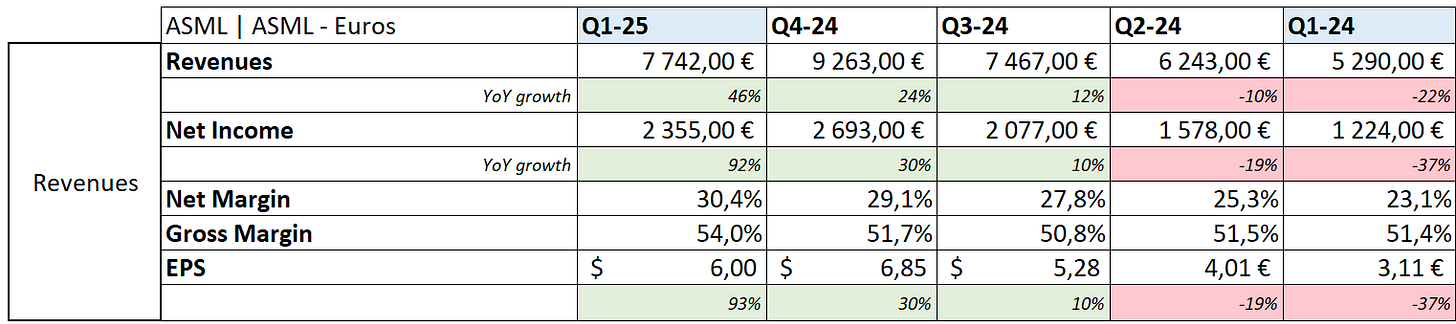

ASML.

The lithography king is still giving satisfaction while future is pretty blurry between the global trade war & the worries about selling western high-end tech to China.

Revenue. $7.76B | $8.14B | +4.92% beat

EPS. $5.76 | $6.31 | +9.55% beat

Dividend raised & €2.7B of buybacks.

The company is still doing really well & management confirmed that according to the talks with their clients, the next two years should bring growth although everything will be affected by macro, the trade war & potential export controls as we are talking about high-end tech and the United States are really strict on what can be sold to some countries - namely China.

ASML is a European company but it is pretty hard to know lately where each country will lean. And the company relies a lot on both Chinese & American clients…

Future is uncertain and ASML is in a sweet spot to be used as leverage by politicians, while being either way affected by other policies…

Besides those concerns, the quarter was pretty good. Correct growth respecting its guidance while net bookings came a bit short but are healthy. Margins increased with a higher proportion of EUV systems sold this quarter which led to a very healthy cash generation, which coupled to a strong balance sheet, share buyback programs & increased dividends should please shareholders.

There really aren’t anything bad to say about this quarter despite the fact that we have no idea what is going to happen. This is true in general but is even more for high-end tech, non American companies like ASML.

Taiwan Semiconductor.

The conditions aren’t different for TSM although this company is under the American umbrella, which doesn’t give it much opportunity to negotiate.

Revenue. $23.92B | $25.53B | +6.71% beat

EPS. $1.82 | $2.12 | +16.48% beat

NT$4.50 dividend payable in June.

Another impressive quarter which shows how important & dominant the company is in the hardware sphere. Slightly slower demand from HPC & smartphone but other industries took the lead to bring what is still a really big YoY growth.

The most impressive remains the company’s guidance & confidence in the future. No concerns about tariffs as they confirmed clients continue to behave normally. TSM is guiding first for an 11% growth QoQ for its next quarter with growing margins - due to higher demand from their U.S. lab as we will talk about on Sunday, then for a mid 20% growth YoY to finally tell us they intend to grow 20% CAGR for the next 4 years with stable margins.

Management is basically telling us they will remain the socle of the tech industry for long, with a constant pricing power & demand. Impressive, a company I want to own for the next decade as I shared in my buy & hold portfolio.

Thanks for sharing!