Amazon | Q2-24 Earning

Falling from the Olymp?

Overview. The market had huge expectations for Amazon but this quarter didn’t really satisfy…

EPS. $1.03 | $1.26 | +22.3% beat

Revenue. $148.57B | $147.9B | On Expectations

"As companies continue to modernize their infrastructure and move to the cloud, while also leveraging new Generative AI opportunities, AWS continues to be customers’ top choice."

It’s a pretty great overview that we have here with growth accelerating on AWS while the rest of the octopus is doing well with a strong focus on profitability. But the market wanted more - nothing is never enough.

Business.

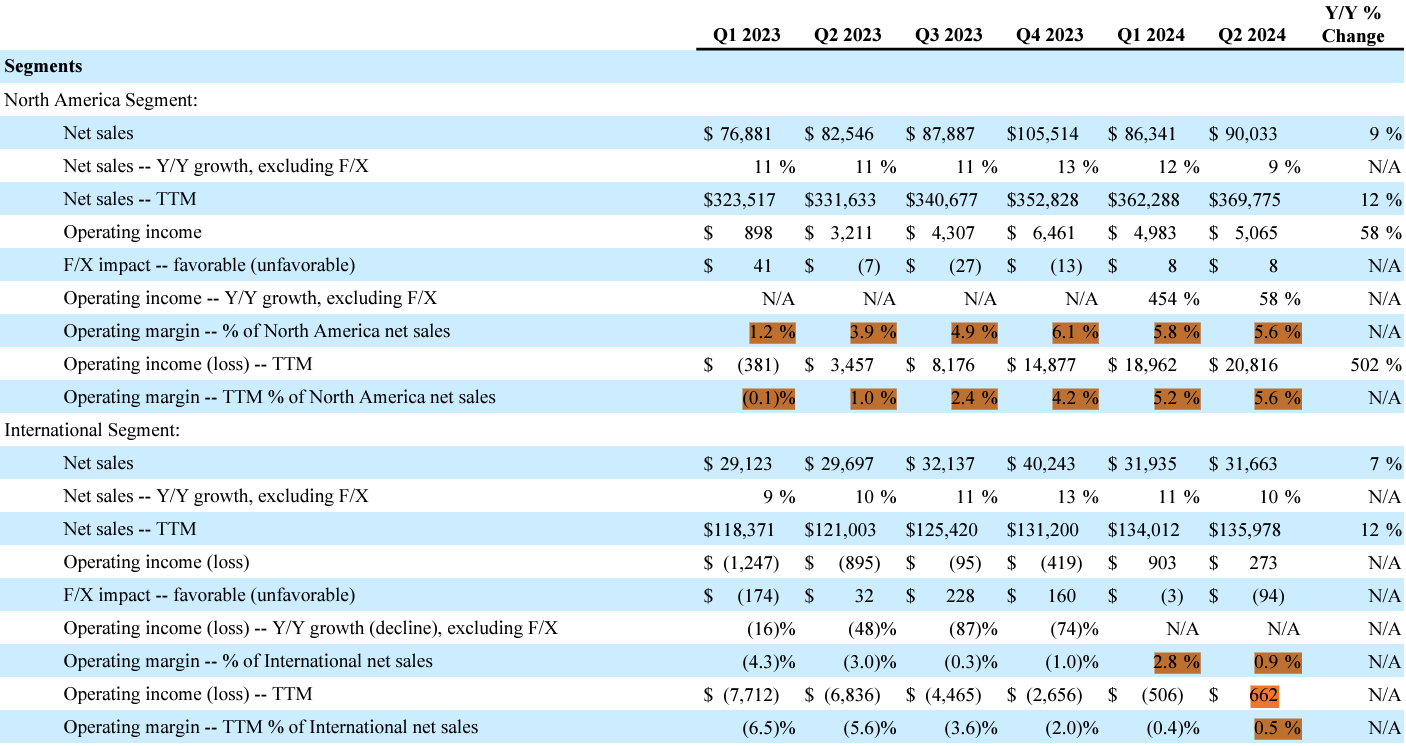

Everything seems to be going well for Amazon in terms of products and services, growing properly to strongly. From Q1-23 to Q2-24 left to right, ending with YoY change.

It’s very hard to see anything wrong long-term. Growth is stable in the double digits and even more when talking about TTM growth - very impressive.

Even more impressive, Amazon’s perfect execution in terms of margins and profitability which we can clearly see in the operating margins growth over the last quarters and the net income YoY growth.

Everything is great & impressive to me here.

E-commerce. Both regions are growing properly at 10% YoY although the international part of the business is heavily impacted by the different exchange rates. But the tendency of Amazon at large is also present in the e-commerce segment.

Growing revenues at a stable pace, growing profitability while the international segment is profitable for the first time, although margins aren’t following a clear uptrend. Things are still positive globally.

Prime Day reached its biggest ever day in terms of volume and revenues for Amazon as more & more consumers subscribe to it and intend to use it fully.

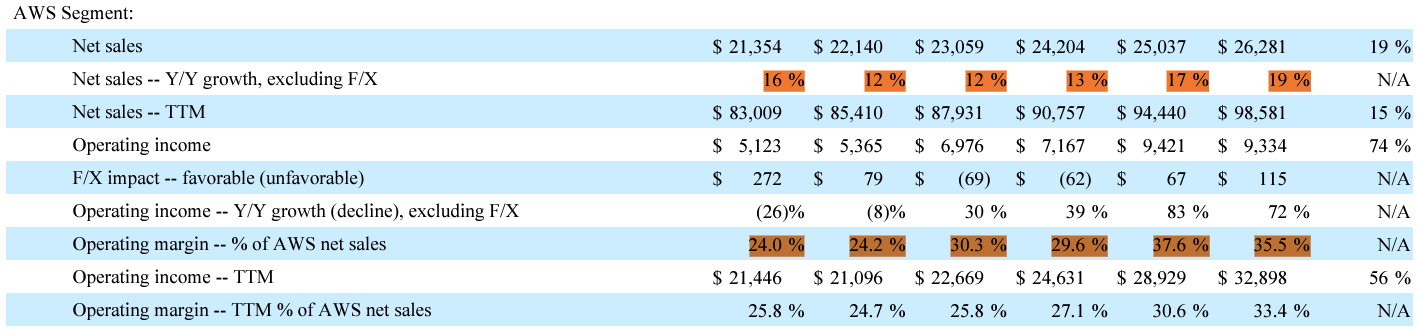

AWS. The cloud services is indeed the beast everyone think it is.

Growing & accelerating revenues, growing margins… What else should I say?

Revenues.

What is true for each business is true for Amazon at large.

Stable growth, controlled cost & growing profitability. OpCF increased 75% to $108B TTM and $53B of FCF TTM for a -$86B of net debt - not the best balance sheet but easily manageable with such cash generation.

Guidance.

I feel like I’m repeating myself - surely am, but Amazon is guiding again to a high-single / low-double digit growth, between $154.0B & $158.5B - 8% to 11%, as stable as usual and still impacted by unfavorable exchange rates.

My Take & Price Target.

I do not really agree with or even understand the market’s reaction to this quarter. I personally see nothing bad, and I do not think Amazon was so overvalued around $190 that a good quarter wasn’t enough.

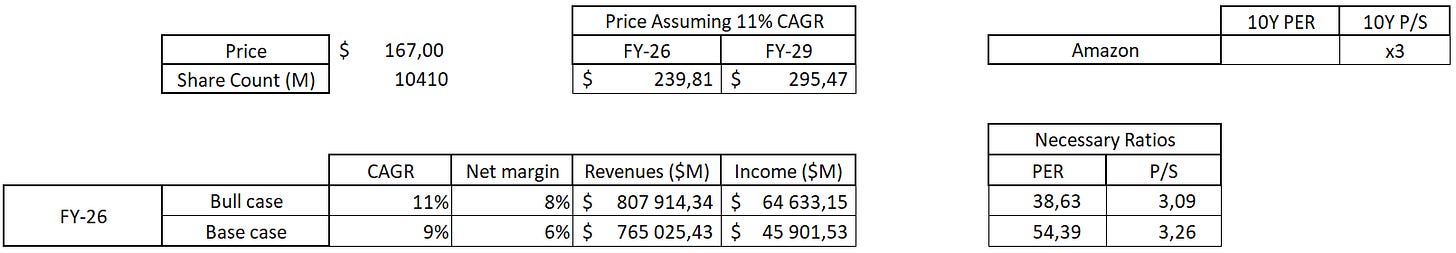

It’s hard to judge Amazon in terms of PER because we do not have much to compare it to, not even itself as the business was historically focused on unprofitability.

The stock closed at $167 on Friday and is expected to grow between 9% and 11% while margins should stick between 6% and 8% during the next few years, so the assumptions represent the best and worst case of those expectations.

This is what I would call a very buyable stock for the long term as the business itself doesn’t need to prove anything anymore - it is a great one. And we’re now at a good price.

Nothing shocking for me to buy & start a position at today’s price. I’d rather wait until under $160 to add to the margin of safety, but we’re talking about Amazon here, not a small capitalization that needs to prove itself.

A beast trading at a very fair price.