Alibaba | Q3-24 Earning

The narrative continues.

You can find here the investment thesis on Alibaba.

Overview.

EPS. $2.26 | $2.15 -4.87% miss

Revenue. $33.47B | $33.7B | +0.69%

$4.1B of buyback or a net reduction of 2.1% in total shares.

Rapid laïus on the net income & EPS miss which is honestly due to compatibility and depends on what one juges to be income or not. More details below.

Business.

The biggest branch of the company, the Chinese e-commerce, is pretty healthy although I expected stronger growth, which might come next quarter as the macro data shows an acceleration of consumption in China & Alibaba released impressive numbers from the Chinese 11/11 festivities.

The bottom line for now is that traffic is increasing while their VIP members continue to increase their spending on the platform.

“During the quarter, online GMV growth was supported by double-digit order growth year-over-year, mainly driven by the increase in purchase frequency, partly offset by the decline in average order value.”

The Cloud business in shape, with revenue growth acceleration coming from the new technologies services - namely AI, exactly like in the west.

“Growth in our Cloud business accelerated from prior quarters, with revenues from public cloud products growing in double digits and AI-related product revenue delivering triple-digit growth.”

This remains a big part of the bull case as Chinese companies will have to rely on those infrastructures sooner than later, and Alibaba still is the biggest player, continuously investing to improve its capacities & products.

The international e-commerce branch is slowing down but we'd need a better breakdown on geographies to see what is really happening as I suspect that Europe is decreasing its consumption. We're still with a very healthy growth rate, but we’d need this to be only a bump and not a continuous tendancy.

Cainiao remains the infrastructure used for Alibaba to deliver internationally and is therefore doing alright. The Local Services Group grew 14% YoY with an increasing usage of some applications - notably Amap & Ele.me, the Google Maps & Uber-like. Pretty positive.

Revenues.

A pretty complex quarter.

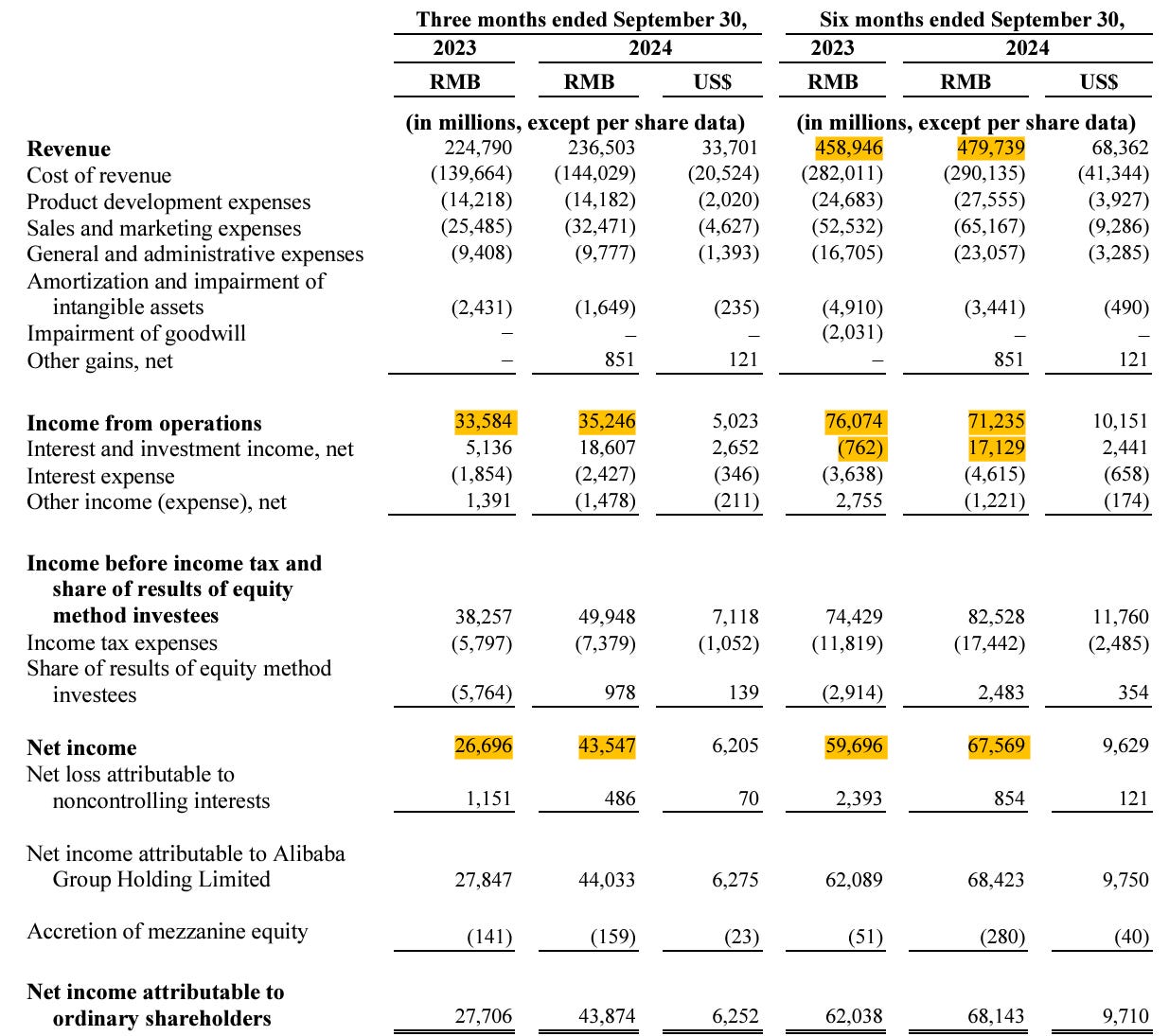

The six months comparison is not that good to be honest as we clearly see a +4.5% revenue growth which doesn't translate into a growing operating income, which declined -6.4% YoY. This is due to growing expenses to marketing & to improve its business, which is a good thing long term.

We have a growing YoY net income because of external income sources, especially interests on cash, which should remain as long as rates stay high. This is where the EPS hurt as they are calculated without this income.

To dissect the business one by one, the profitability tendencies stay the same. The Chinese e-commerce is the cash generation machine and the cloud business is growing profitability thanks to higher margin products & growing demand. This is the great part, still very good one more quarter.

The rest continues to be unprofitable - except for Cainiao which is stable-ish. The international strategy still is on market share acquisition, hence burning cash, while the local services are growing rapidly and were not, at least this last semester, a big drag on the global profitability.

Balance sheet remains very strong with $45B of net debt & $1.9B of FCF this quarter after more than $2.4B invested in their cloud & local e-commerce infrastructures.

My take.

The narrative remains the same, Alibaba is using one massive cash generating business to grow either its market shares on others or its capacities & offerings to build new business. On the last case, the Cloud business is shaping well - maybe even better than expected, while the International e-commerce business remains cash burning short term. Management continue to grow expenses & investments to upgrade its main business which should, in time, yield stronger growth.

Not much changed although we should note that these long term objectives are of course heavy on the company's execution short term, with reduced margins & net income for the business itself - not including interests & side earnings, although those are cash in their pockets at the end of the day.

To me, it’s a pretty good quarter, true to the investment thesis - to which we have to add how undervalued Chinese equities still are at the moment.