Alibaba | Q2-24 Earning

Everything you need to know about Alibaba & why I am invested in this company can be found here.

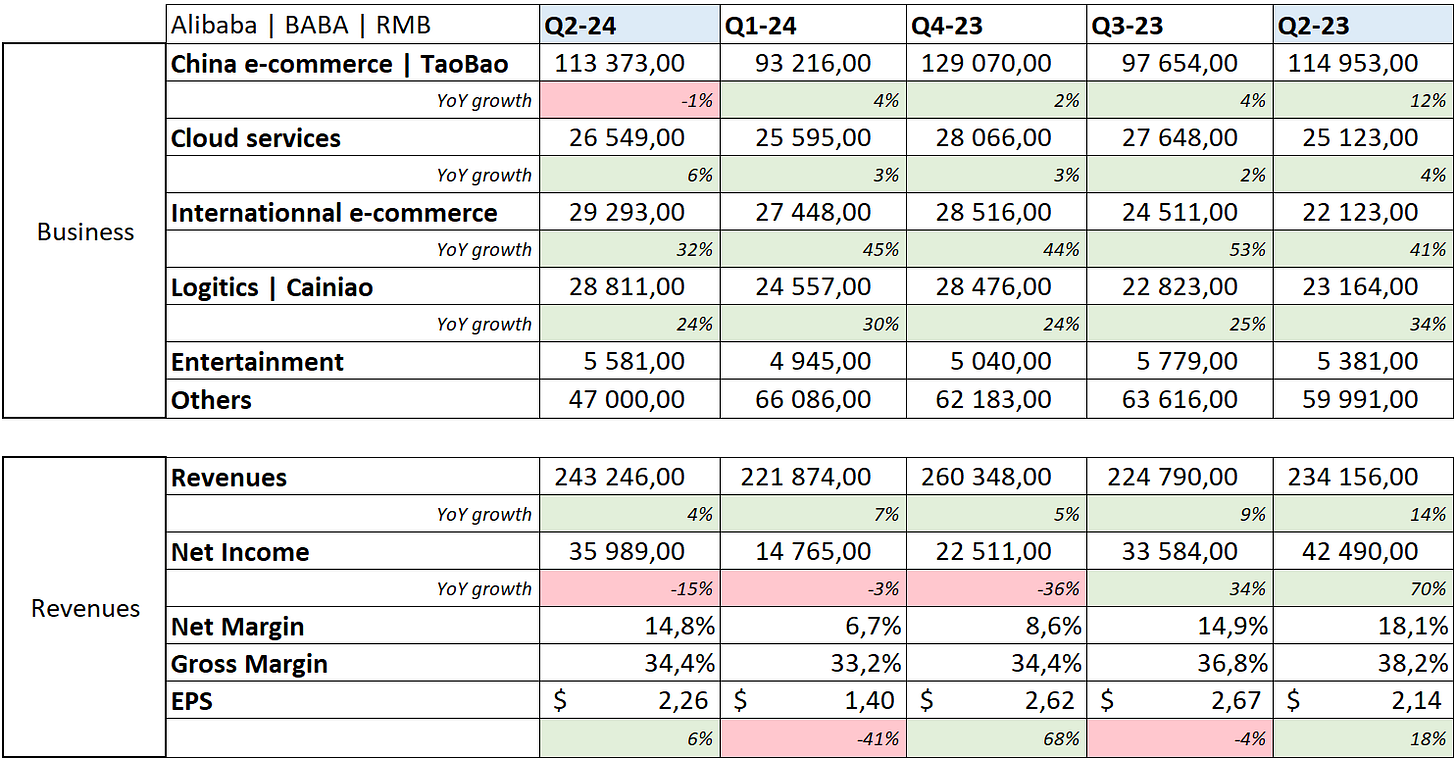

Overview. This isn’t the best quarter for the company, at least in appearance. But I’d rather call it a pretty complex quarter than a bad quarter, with lots of things to read between the lines.

EPS. $2.13 | $2.26 | +6.10% beat

Revenue. $34.81B | $33.47B | -3.85% miss

$5.8B of buybacks.

Although the overview isn’t that bullish, let’s go further than just some numbers.

Business.

We know Alibaba is an octopus comparable to Amazon, so I’ll try to go over the important branches of the company here.

Local e-comerce. This is a very important part of the investment thesis, which is based on a rising Asiatic buying power, hence a growing consumption of non-priority products - hence growing e-comerce, which seems to be what is happening.

“Taobao and Tmall Group is winning the mindshare of our consumers. During the quarter, we achieved high-single-digit online GMV growth and double-digit order growth year-over-year, driven by increase in the number of purchasers and purchase frequency.”

Yet, there is a decline in direct sales, which doesn’t really go with what was said just above.

Here’s the justification.

“attributable to the decline in sales of consumer electronics and appliances due to our planned reduction of certain direct sales businesses, partly offset by the increase in sales of groceries.”

But they are talking about YoY growth in GMV, so my only conclusion here is that the take rate is very different depending on the products users are buying - which seems logical but not really in their favor this quarter.

Is this a good sign or a bad sign… I don’t think one quarter of slower consumption is enough to trigger an alarm considering the company’s valuation. It’s not perfect, not even good, but not a red flag yet.

It’s just a slower quarter.

International e-comerce. This is the bonus, as Europeans like to consume cheap and there isn’t anything cheaper than AliExpress.

“rapid order growth in cross-border businesses, especially from AliExpress’ Choice.”

I was in France the last two weeks and noticed that all my family & many friends were using either AliExpress or Temu to shop online, while they were using Amazon exclusively two years ago or so. This is a very small base to work from, but it seems to be a growing tendency in all Europe. And this has been their plans all along, to spend and lose money on purpose to acquire Europeans’ attention & wallets. They seem to have done it.

The only problem is that growing revenues apparently mean growing net loss… But we’ll talk about this in the next section.

Cloud services. Nothing surprising to see this section grow as China needs to upgrade its tech services and needs cloud infrastructures to do so.

“AI-related product revenue continued to grow at triple-digits yearover-year. We will continue to invest in customers and technology, particularly in AI infrastructure, to increase cloud adoption for AI and maintain our market leadership.“

It is a good thing to see the demand for this section grow, even if the growth is a bit slow compared to U.S. companies - especially AWS & Azure. Growth is still accelerating, and it will continue to do so as long as Chinese companies have a demand for AI & cloud tech - and it seems to be growing.

“The number of paying users using Alibaba Cloud's AI platform (百炼) increased by over 200% quarter-over-quarter.“

Cainiao & Local Group & Entertainment. These aren’t really part of the main investment thesis, so I’ll go over them rapidly.

Cainiao is logically growing as international e-commerce is also growing (this is their logistics platform, so they pass money from the left pocket to the right pocket). But even though revenues are growing, net income is declining…

The local services group is doing well, with decent growth and close enough to profitability, but not there yet.

Digital media is kinda irrelevant.

Revenues.

Up to here, things aren’t bad - not good either.

Small bump in local e-commerce growth, easily caught up by stronger growth in cloud and correct growth in International. Things aren’t bad in terms of growth.

But they are in term of income.

Every branch of the company has lost profitability during the quarter, and the only ones which grew more efficient are still unprofitable. The only exception to this is the cloud business, which grew more profitable YoY - and that is good news, but the only light in the dark.

Costs are detailed further in the report, and there are two ways to interpret them.

First of all, cost of revenues stayed flat YoY in terms of percentage of revenues, this is pretty good news as it means Alibaba was capable of growing revenues without growing costs - even slightly declining them. It means their business are more efficient at their core.

But everything else is growing big time, in flat value & in revenue percentage. Bulls will argue this is investment for the future, and when you see the marketing spent during the Olympics or even globally in Europe, they sure overspent, but it seems to work as growth remains strong. Bears will say that they cannot grow their business profitably which forces them to grow their expenses, margins will only decline & decline until the company dies.

But this quarter's complexity doesn’t stop here.

Cash Flow & Shares Programs. Two more things

A much lower than usual cash flow, for two reasons. First, a much lower net income for the reasons we talked about earlier. Second, much more investment, mainly in their AI & cloud infrastructures. The interpretation can continue here: more investment to bring more growth or to die more rapidly?

I’m also pretty sure there will be a big drama around the share-based compensation, which grew the net income 4.1B RMB this quarter while it was down -1.6B RMB last quarter, but the details tell a different story.

It’s only a matter of timing, and share awards were actually lower YoY.

The only constant for Alibaba this quarter was their buyback program, as they bought $5.8B of their own shares - a 2.3% net reduction in one quarter, and still have $26.1B left until March 2027. More than enough to grow the value of the company through the next quarter, as the market surely won’t reward this one.

My Take.

It’s time to conclude. I will be on the bull team - I was earlier and I will stick with it today. The investment thesis is still alive even with this small decline in local e-commerce growth. This will need to be monitored, but one quarter is nothing, not for an already undervalued company at least. The rest is going pretty well in terms of growth, cloud is accelerating, and even if international growth is slowing, we’re still above 30%.

Everything here is about the company’s expenses. If those are well done and end up yielding returns & stronger growth, everything is good. If not… Bears will be right. But the answer will come in the next quarters, not next week.

For now, I’ll decide to trust that management knows what it’s doing and that the investments will pay off. I’ll move on if they don’t, but I want to give them time to show results especially as in their case, time is a good thing. This kind of quarter surely won’t pump the stock, and you don’t really want it to pump when you still have the opportunity to buy $26B of it under its fair value.

I won’t go as far as saying that they’re doing it on purpose. But if there is one moment to raise expenses to fuel growth, it’s now. This isn’t a bad quarter, but this will be a controversial one.