Alibaba | Q1-24 Earning & Call

It's finally time to review the quarter of one of the biggest Chinese & internationnal e-comerce platform, while investors are apparently slowly learning to trust the Chinese market again.

Overview.

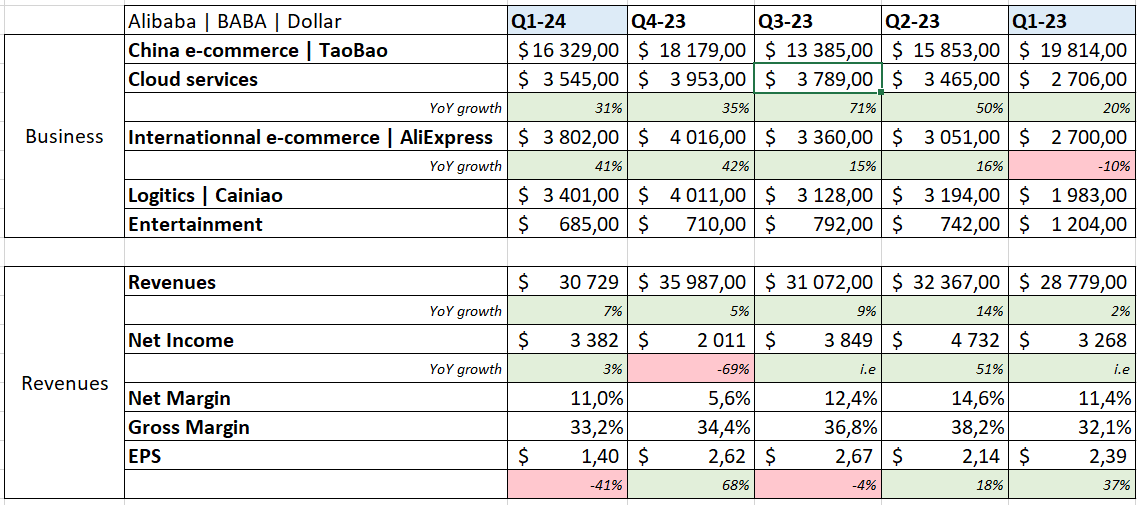

EPS. $1.41 | $1.40 | On expectations

Revenue. $30.40B | $30.73B | On expectations

$12.5B of buybacks | $4B dividend plan FY-24 divided between already approved dividend & an exceptional dividend.

"This quarter’s results demonstrate that our strategies are working and we are returning to growth."

Small precision here as the China e-commerce seems to have strongly decreased, they are now accounting differently and removed some revenues from Tao Bao to "other revenues". The branch really grew +4% YoY considering equal accounting.

The takeaway could be easy with my expectations which were simply to see growth in both e-commerce, clouds & to have strong buybacks. The truth will need a bit more explanations as we can wonder what happened with margins & EPS this quarter.

It's all explainable. And it's not bearish to my opinion. Lots to say and lots of important information. Let's start with the Chinese market.

Chinese e-comerce | TaoBao & Tmall. This branch of Alibaba is crucial as it simply allows the company to do everything else. This is the profitable & cash-generating machine, and we need it strongly profitable & growing. Which it is.

And management is still focusing on it.

"We are increasing strategic investment in areas such as price competitive product supplies, customer service, 2 membership program benefits and technology, aiming to enhance user experience, which resulted in improved consumer retention and higher purchase frequency."

Besides the global usage of the app growing, the VIP subscriptions also grew double digits YoY to more than 35M. Globally, this branch is growing well, evolving well and driving more engagement & revenues.

"During the quarter, we achieved double-digit online GMV and order growth year-over-year, driven by strong increase in the number of purchasers and purchase frequency."

This growth also shows a stronger retail spending in China which goes with my take on the country - which is that they're changing their entire economy which leads to struggle but not extinction as many forcasts...

https://twitter.com/WealthyReadings/status/1707408948876226903

Cloud & AI. A very interesting part of this quarter as it has been growing stronger than expected - up +31% YoY and continuing a strong growth trend. The company is now focusing on delivering stronger margins products while leaving less profitable services behind.

"We expect the strong revenue growth in public cloud and AI-related products will offset the impact of the roll-off of project-based revenues"

It's watch & learn here, nothing much to detail, things are going well and the company is focusing on delivering growth & margins.

International e-comerce. We enter the "great or bad" part of this quarter, you'll decide which side you're on later.

The strong growth continues with a +41% revenue growth YoY following last quarter's +42% YoY. The company clearly understood its competitive advantage and is playing hard with it.

"We are committing more resources to cross-border e-commerce because of the clear customer value proposition of price competitiveness and timely delivery to consumers around the world."

But this growth came at a cost as it is in part due to their new 5 & 10 days deliveries which of course, come at higher costs for the company and made this branch of the company unprofitable, even more than it used to be.

Amazon's playbook.

Cainiao. And as the international e-commerce branch is unprofitable, the logistic & delivery branch which takes part in those deliveries also is. They go by pair and the trend might continue as Alibaba expanded and plans to expand this rapid delivery to other countries going forward.

"We are committing more resources to cross-border e-commerce because of the clear customer value proposition of price competitiveness and timely delivery to consumers around the world."

Local Service Group. I won't take much time here but it's important to note a 19% YoY revenue growth on those other applications Alibaba owns. It helps the global growth although once more, it's an unprofitable section of the company.

Entertainment. I won't talk about this part. too small and irrelevant to the investment case.

Revenues. We talked about the global business branches now it's time to check those revenues, which will simply illustrate what I already said.

Very correct to strong growth all over the board in terms of revenues as I said.

There's no doubt that the company is globally growing and that its apps & services are more and more demanded while being optimized to drive more engagement and revenues by the team.

Things are going well. But.

Cash & Cash Flow. Before talking about what the market didn't like, I'd like to talk about the Cash Flow & the balance sheet, which is still strong with roughly $75B of net debt. On the contrary, FCF dropped -51% YoY to $2.1B due to a very, very strong CAPEX for its cloud & AI services and infrastructures growth of $1.5B. Now keep that in mind as we move on.

Profitability. Now, here's the hic which didn't please the market.

Most of the branches are not only unprofitable, but they are getting worse YoY, losing always more money. This is the moment to chose which side you're on.

Team 1. Alibaba is aggressively trying to eat market shares internationally and is leveraging its Chinese e-commerce, its cloud branch & its strong balance sheet to do so. It also is aggressively investing in the growth of its AI & cloud services, which is a necessity and is done by each company of the magnificent 7 in the U.S - especially $META and the market reacted the same way.

As I said earlier, this is the Amazon's playbook. Grow. Be aggressive. Grow fast. Be profitable only then.

The only difference is that they do it with a rock-solid balance sheet, a plan to return value to shareholders and a strong and profitable business which can hold other investments on its shoulders.

Team 2. Alibaba is investing and focusing on unprofitable branches while they should focus on their cloud & Chinese e-commerce part and return even more value to shareholders - or whatever else you want them to do.

Conclusion. This is my take on this quarter. I didn't really expect Alibaba to invest so aggressively in its future growth and services but I'm team 1 and am nicely surprised.

Cainiao & International e-commerce will logically grow together and will become profitable together when the management decides to focus on this. And when they do...

I believe it to be very smart from the management to do it now and to leverage their very profitable Chinese e-commerce branch to do so. I don't see any risks here, they simply are burning their own cash to grow and that seems to be a sound decision, turned to the future - I had the same reasoning with $META.

I get why some investors are not happy with this quarter, the investment case was that the stock was undervalued, but if the company starts to grow its expenses aggressively and destroy its margins & EPS for market shares, the numbers don't look so undervalued anymore.

Yet, to my opinion, it makes the stock even cheaper. I'm sitting on my hands but am considering growing my position if we lean under $80.

The market might realize that we're now with an aggressive & growing company and not with a simple undervalued grandpa.

Thank you for reading it all! If you like it, please consider subscribing to receive it all directly in your inbox and not miss a thing!

Everything I share here is free but if you found the content valuable enough, you can always leave a tip!