Airbnb | Q3-24 Earnin & Call

Steady, steady, steady.

If you do not know about Airbnb yet, the business detail & investment thesis can be found here.

Overview.

Overall a correct quarter.

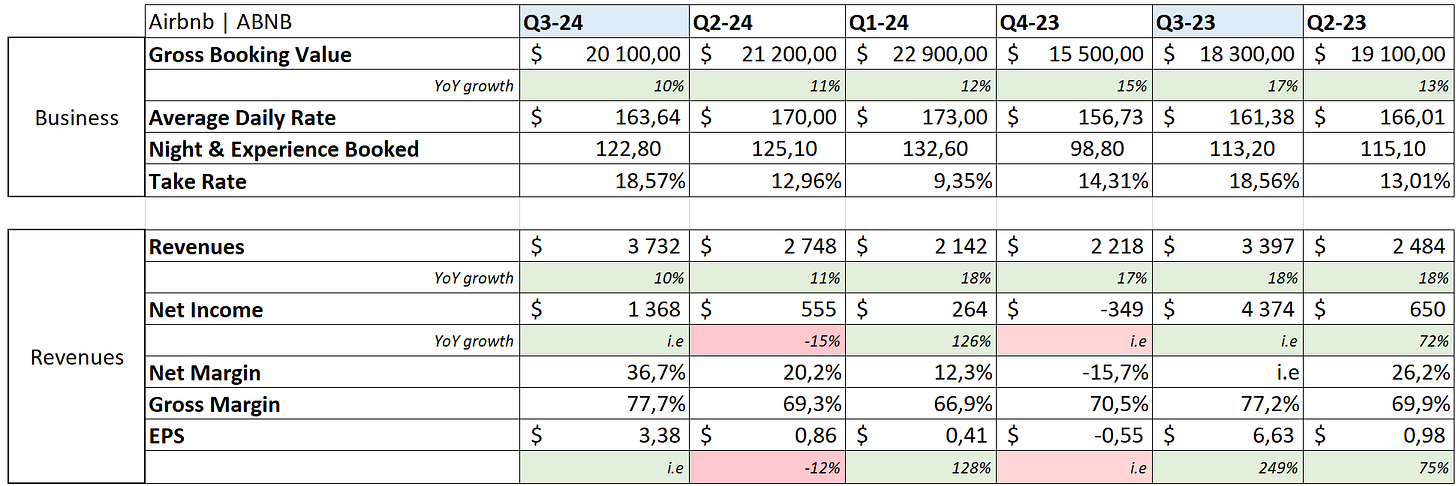

Revenue. $3.72B | $3.73B | +0.32% beat

EPS. $2.14 | $2.13| +0.47% beat

$1.1B of buybacks.

Far from being a glorious quarter, it gives what any long term mind would like to see.

Business.

We had another masterclass from Brian who showed again that every time he opens his mouth, he knows what he's talking about. Everything he & his management do & say is aligned with hosts & travelers' wishes, and they understand perfectly their products & what it needs to attract.

“Now reliability, reliability as I said, is probably the most important thing that we can do to drive more growth in our core business.”

Airbnb's scaling is dependent on two levers: geographies & overall quality while being impacted by consumers' health as traveling is expensive. This could have affected the quarter as Airbnb talked about hesitancy from travelers to book summer holidays, but things caught up.

“Despite a slower start to the quarter due to shorter booking lead times compared to last year, bookings grew steadily each month to return to double digit growth by the end of Q3.”

With continued growth with first-time bookers especially among young travelers, very positive data as Airbnb is a very sticky service. Nights & experiences booked growth came mainly from new geographies which reinforces the thesis & need to expand there, while EMEA & Americas saw moderate growth.

Some words on the co-host network we already covered in the October W3 weekly. The system is great to bring more listings & better quality while incentivizing good behavior, three key components to make Airbnb better in the long run.

“But the second thing we learned was that the number one reason people don't host is because a lot of people say they don't have the time.”

And it seems like it pleases a lot.

“Now when we announced this on October 16th, we launched the Co Host network with 10,000 co hosts across 10 countries. And in this 3 weeks since we launched, we've already received interest from over 20,000 potential new cohosts. This is huge.”

Everything about Airbnb is linked to its network effect and this is one more step in the right direction.

About the expansion, we had a few more hints & deadlines, with announcements coming for the spring release next year. Brian talked about releasing more than one new business, widely.

“When we launch some new offerings next year, they're going to be available immediately in more than 100 cities around the world.”

The first one will be the revamp of experiences, coming up in May but it won't stop there.

On other subjects, we had feedback on how things went after New York decided to ban Airbnb because the service made the costs of living unbearable. One year later, according to Brian, rent prices are up +3.5% & hotel prices are up +7%. I would temper this take as everything isn't entirely due to Airbnb's removal but what is for sure is that removing Airbnb didn't change anything, at best.

As Brian said “We are not the problem.”

Revenues.

Nothing exceptional here.

A 12% revenue growth YoY for the nine months ending which is correct, no fireworks, while operating margin decreased YoY as costs & expenses took a bigger portion of total revenues. A tendency which should continue as management wants to invest more aggressively in its expansion beyond the core & in marketing in less penetrated markets, accelerating growth over the long term.

“We see a huge incredible opportunity to invest in growth, both investing in growth in our core accommodations business as well as our new offerings. Speaker 3: And so as we head into 2025, we will continue to lean into our growth initiatives around core optimizations, global markets expansions and new products and services.”

The market didn't like this and I can understand but the entire investment thesis on Airbnb at today's price relies on them expanding, both geographically & in terms of services.

Comparing the revenues further doesn't make much sense due to the tax benefit received in 2023, although the net margin pre-tax is flatish, down only 1% YoY.

In terms of balance sheet, Airbnb is still very comfortable with around $8B of net debt and very strong FCF generation, with a margin around 38% and 25% of it coming from SBCs. Shares outstanding are slowly decreasing with excellent buybacks, especially this quarter with $1.1B spent at pretty low prices.

Guidance.

Outlook is correct.

A continuous growth in nights & experiences booked means a more used service overall although the Q4 growth should finally fall under 10% YoY, giving a FY-24 YoY growth slightly above 11%.

My Take.

There is a need for fresh air for Airbnb which is still a wonderful company, platform & service in my opinion, but slowing down lately while management is doubling on its new services. We might have a tough 2025 with slower revenue growth & growing expenses for both marketing & expansion, until those new services kick in & generate revenues and hopefully, a new burst growth.

We can add to this a tough economic situation in the west globally as the truth is that buying power of Westerners, where Airbnb is most present & used, is declining. Brian said that people will generally travel more in the future and I believe he's right… But those people need to learn to use Airbnb, because I don’t think Europeans are part of them, at least medium-term.

So there are a few concerns around Airbnb but the long-term thesis remains the same for me. They are expanding geographically, used more & more by young travelers & other geographies, upgrading the platform & service and soon, bringing in new products, all of this while being profitable and with very strong cash generation. I am not worried about the business, it's all about the stock.

I believe my assumptions were correct and still expect growth slightly under 10% up to 2026 as the new services will need time to roll out. I also believe net margin will decline as they invest in those and will continue to do so. Lastly, with slower growth comes lower multiples so I won't expect Airbnb to trade at 15x sales anymore in the future, under 10x would be more realistic.

My opinion is that at today's price, we're around a fairly valued business without including any of the new services' potential. Those should boost growth over the long term and if they succeed, we should see a double-digit CAGR up to FY-29. I wouldn't make this my base case for investing though, and would rather have a bit more safety, hence DCA at a slightly lower price, probably under $130.

But I will continue to DCA for the long term.