Airbnb | Q1-24 Earning & Call

I won't present Airbnb as it is very known, and I already wrote my Investment Case. You will find everything you need here.

Overview. We have a very good quarter here which the market is apparently completely misunderstanding - to our advantage as we might be getting cheaper shares as yes, I plan to buy more under $150. Much more.

EPS: $0.22 | $0.41 | +86.4% beat

Revenue: $2.06B | $2.14B | +3.9% beat

$750M of buyback.

It should speak for itself, what should I even comment?

Maybe add that for Airbnb, every comparison has to be done YoY, the comparisons QoQ make no sense as their business is entirely dependent on seasonality. With that in mind, business is growing, margins are growing, financials are growing.

I have to add something else but I'll dive in later on; this quarter was impacted by the Easter weekend which is usually counted for Q2's earnings. Calendar is what it is.

Business. You can already see it in my overview screenshot, but the business is growing well. Airbnb has some nice data to show their progression over time.

Double-digit growth everywhere except for the ADR, which has to stay stable. It might be weird to hear, but we don't want Airbnb's ADR to skyrocket. This sure would bring more revenues but it would chase away users and hurt the competitive advantage Airbnb has over everyone else in the short-rentals market. I explained the mechanism in the Investment Case; here's an extract.

"[...] Airbnb which grows its competitive advantage on other rentals agencies thanks to very hard to compete pricing & offerings.

Hotels have a minimum price per night as they need to cover fixed costs. Hosts don't."

But Brian explains it better than I.

"Hotel prices are up year over year, and Airbnb listings on a like-for-like basis are down. So, today, the value of Airbnb versus hotel is better than it was a year ago"

What we want with Airbnb is to see bookings grow, and that's what we have with very strong growth coming from emerging markets where Airbnb is still establishing itself. It will take time to complete the playbook there but things seem to be going very well as listings and bookings are skyrocketing in those regions - bookings increased by 80% YoY in China, for example.

Supply. One metric which isn't precisely publicized by Airbnb is the host supply, which grew by +15% Yo0, mostly driven by Latin America & Asia Pacific where the playbook is going full speed, as I already mentioned above.

Besides supply, quality also rose as Airbnb canceled some offerings that didn't meet the minimum required

"We’re committed to keeping quality high as we grow supply, and in Q1, we removed thousands of listings that failed to meet our guests' expectations."

Updates. The company has released tons of updates over the years and is actually releasing its Spring version with some new valuable features - like group trips which will help immensely many vacationers. It's all here if interested.

https://www.airbnb.com/release

Some feedback about one important feature the company released some months ago.

"over 100 million nights booked at Guest Favorite listings since launch."

Airbnb created a system which automatically rewards excellence and good behaviors. It's normal that this kind of new feature works and shines a light on great hosts.

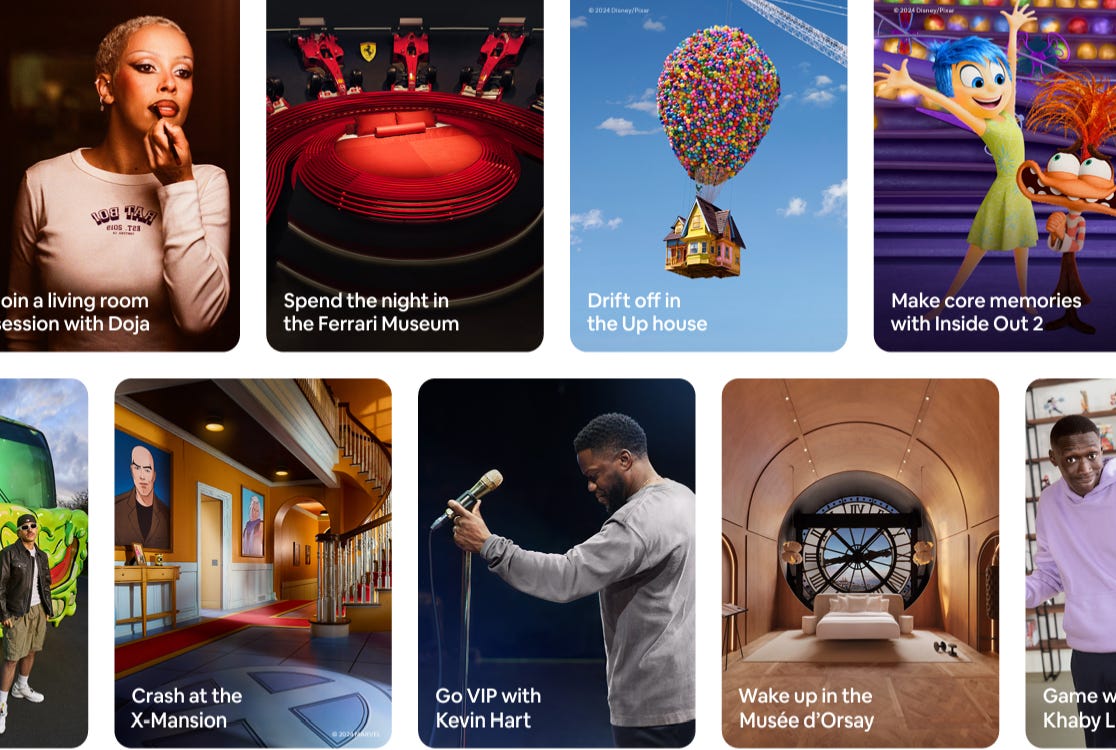

Icons. I'm personally a big fan of these programs and houses, which are helping the brand immensely. No one ever proposed this, and everyone loves Airbnb for it - even if they don't plan to book nights there. It's all about the brand and acquiring new consumers and hosts.

"And with a broad range of icons spanning various geographies, demographics, and fan bases, we'll be able to reach key segments in a more targeted way."

"In just one week, the Icon's launch has generated over 8,100 pieces of global media coverage and 371 million social media impressions. And the coverage has been overwhelmingly positive."

This is about growing their image and reach for the future.

"this is going to be critical as we expand beyond accommodations in the coming years."

Brian is always thinking few steps ahead.

App. This might look unnecessary to mention, but I highly disagree; this is proof of Airbnb's dominance and growth as mobile app downloads and usage are really growing - +60% in the U.S YoY. Global nights booked through our mobile app increased by 21% YoY, representing 54% of total nights booked in Q1-24.

Future growth factors. I also talked about it at length in the Investment Case, but another advantage of Airbnb is their offerings and geography, which allow them to be everywhere, for everything. You might have already seen this screenshot of Airbnb's occupancy during the eclipse this year in the U.S.

Who else can propose anything close to this? This was true then and still is true now for events coming like the Olympic games in Paris and the Euro Cup in Germany.

"nights booked for stays during the dates of the Olympics are over f ive times higher than they were in Paris the same time a year ago [...] We’ve also seen increases in supply to help meet higher demand, including nearly 40% more active listings in Paris in Q1 compared to a year ago."

This is another proof of Airbnb's business superiority. People can simply leave their home for a month to rent it, and those have to list it on Airbnb because... Where else?

Revenues. Logically, the finances are going well with such a quarter.

Revenues are up by +18% YoY due to a stronger business and the impact of the Easter weekend. Net income is up by +126% YoY thanks to both growth with net and gross margins, which shows great execution on the focus on profitability made by the team - and interest income, of course, as many companies lately.

In terms of cash and balance sheet, the company ended the quarter with $8B of net debt for $1.9B of FCF - including $295M of shares compensation.

Strong cash flows, a strong balance sheet, and a focus on profitability with high margins. The perfect cocktail to grow buybacks over the next years while Airbnb still has $6B available in their program - they might start to buy already after yesterday's dump.

Stock-based compensation. This has made a lot of noise as well as the company is planning to increase them. Is it an issue? I don't think so. Headcounts grew, and the team has been creating such a growing and qualitative business... Why would we complain? Yes, those are already high, and growing them above the headcounts growth might send wrong messages...

That's a matter of personal opinion; I won't complain as long as things stay reasonable and the company's still executing perfectly.

Guidance. I assume that's what triggered the market as I read lots of people complaining about "weak" guidance. This is a huge misunderstanding.

How is this weak? Yes, Q2-24 is guided to be under +10% growth, but it is also written that Q3 and Q4 should see a growth acceleration. And this slow Q2-24 is due to a calendar timing which has nothing to do with Airbnb; the business is growing perfectly.

Conclusion. You guessed it, I have been very convinced by this quarter from Airbnb and I expect the market to understand it misread them. There simply is nothing wrong and everything is promising although we will have a slower Q2-24, that's true. But expected & most probably caught up by Q3 & Q4.

I hope you enjoyed this review & remember, I do me, you guys do you!

Thank you for reading it all! If you like it, please consider subscribing to receive it all directly in your inbox and not miss a thing!

Everything I share here is free but if you found the content valuable enough, you can always leave a tip!