Adobe | Q1-25 Earning & Call

Strong but punished.

I do not have an investment case written on Adobe but I will work on it over the next few weeks as I believe the company is worth one. Bit of patience.

Overview.

Quarter is nothing but good, confirming that the market’s worries are unjustified - my interpretation only.

Revenue. $5.66B | $5.71B | +0.95% beat

EPS. $4.97 | $5.08 | +2.21% beat

This isn’t the data of an unhealthy company. Adobe will present its new innovations during its Summit between March 18 & 20.

Business.

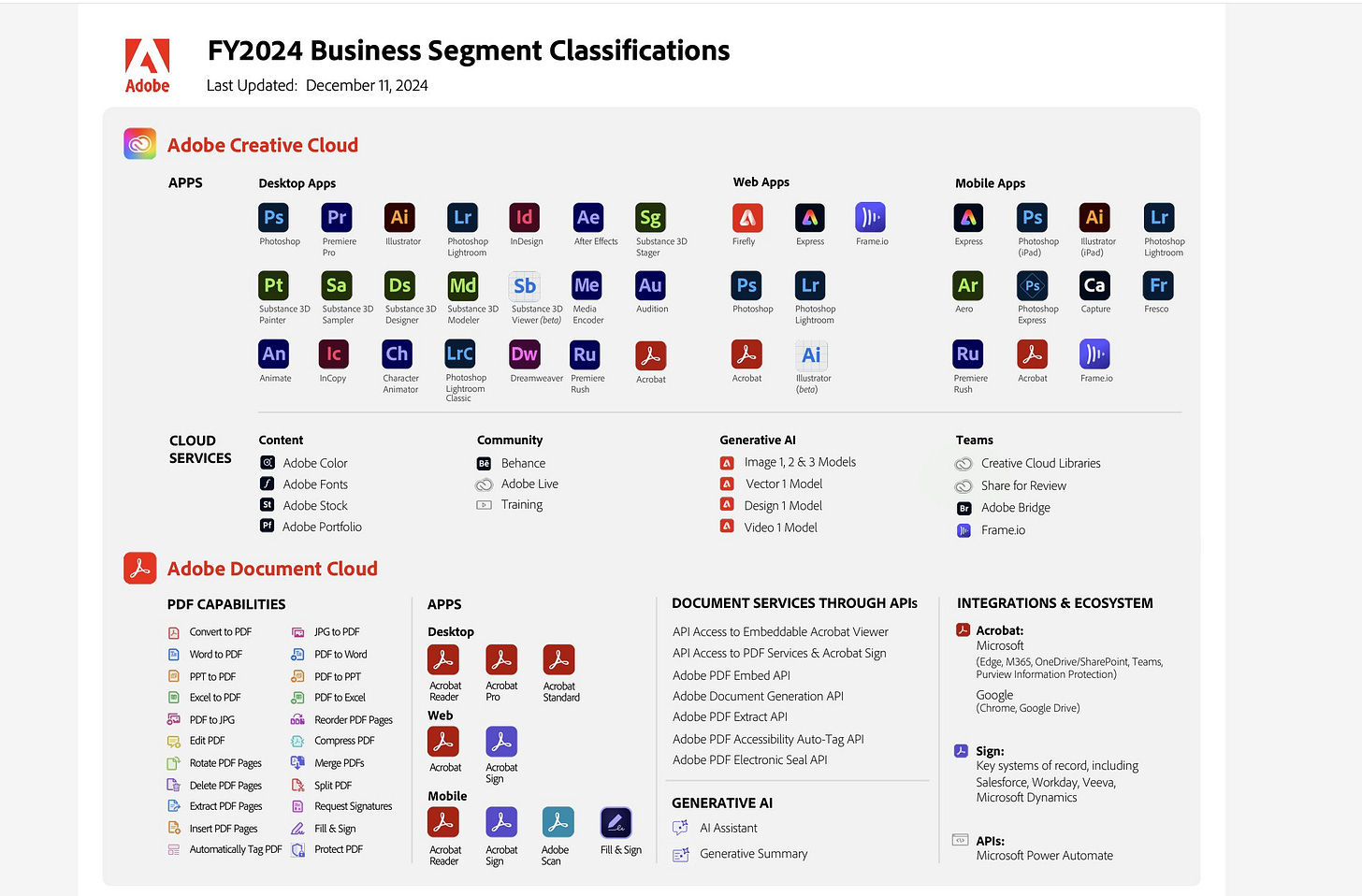

I assume you guys all know Adobe or at least a few of their creative application - at least photoshop. But they do much, much more than just this one.

The bull case is two folds. First, they deliver the best suite of applications there is for any creative work: photo, video, animation, visual effects, etc… Everything can be found at Adobe & their cloud system allows easy interactions between their apps.

“While the need for creative expression continues to grow exponentially, the real value is in integrating creativity and productivity in an all-in-one solution.”

As long as there is a demand for creativity, Adobe is the place to go, which is what we have to control.

Second, Adobe proposes tools to advertise & collect data from those advertising, in order to see what worked & what didn’t. Their services allow brands to create, share, collect feedback & reiterate. Pretty powerful, especially in the digital world we now live in, which is accelerating.

This is the bull case & most of the company’s revenues, but Adobe also owns the most used PDF reader software & is upgrading it with tons of AI functionalities, to please companies, students & any kind of users.

Creative Cloud.

The narrative over the last year, more precisely since the appearance of text-based image generation, was that Adobe would die because we wouldn’t need their softwares anymore, everything could be done by text-prompt.

I said many times that this couldn’t be more wrong and that on the contrary, having more content generated will require more of Adobe’s software as they aren’t creating content, they are refining it. Plus, Adobe has already worked to integrate its own AI tools, much more powerful than a classic image generation from any LLM.

And so far, I’ve been proven right as this portion of the company continues to grow double digits while ARR is even accelerating, up 12.6% YoY with a growing demand & usage of their in-house AI tools.

“Creative growth was driven by broad-based adoption across our routes to market and product portfolio with particular strength in new offerings like Firefly Services, an increasing number of “One Adobe” deals and a growing base of web and mobile users.”

And management is clear on the next steps to take.

Reader.

Rapid word on their PDF software which is rapidly growing in terms of usage - up 23% YoY & doubling QoQ, thanks to their new AI tools, which makes everything simpler & faster, for any kind of users. Their partnerships to integrate the software directly in Google, Edge & other webapps was the principal source of that usage growth.

Growth Plans.

Management has a pretty simple plan to continue on their growth trajectory for the next decade: to leverage their users to new services while attracting new ones by giving them the opportunity to try their new AI tools.

“In addition to Creative Cloud, we will offer new Firefly web app subscriptions that integrate and are an onramp for our web and mobile products.”

There isn’t much more to it and it seems to be the good strategy to me. Give anyone the taste of your best candy and they’ll come back for more. Management estimates that they already generated more than $125M of ARR in Q1 from those and they intend to double this by the end of the year.

“Our generative AI innovation is infused across the breadth of our products and its impact is influencing billions of ARR across acquisition, retention and value expansion as customers benefit from these new capabilities.”

There were some comments during the call, wondering if this was enough. Firefly was launched end of 2023 and was, still is, a freemium meant to convince users. Today, it represents less than 1% of the total Creative Cloud ARR which is indeed close to nothing.

But first, it means demand for their softwares outside of AI remains strong, a net positive. Second, management’s strategy isn’t to prefectly monetize those from day 1, but to boost adoption - give a taste of the candy.

“the AI journey as three parts. The first is ensuring that we innovate. The second is all about tracking usage then ensuring value and monetization.”

One of the company’s strengths to my opinion is their management of subscriptions. They offer different packages focused on certain usage or applications, allowing users to only access what they need and have some reductions if they grow their usage, compared to a single application subscription. They intend to continue down that path with AI services.

“We recently introduced and incorporated our new Firefly video model into this offering, adding to the already supported image, vector and design models. In addition to monetizing standalone subscriptions for Firefly, we will introduce multiple Creative Cloud offerings that include Firefly tiering.“

Customization is important for consumers, so they do not have the feeling of overpaying for things they don’t want.

In Brief.

There is a continuous demand for Adobe’s products, for all their branches & services while their new AI tools are accelerating this demand, for creativity, advertising but also simple PDF reading.

We are more than two years after ChatGPT’s & text-based image generation launch and the demand for those softwares isn’t slowing, on the contrary as the company isn’t late at all in terms of AI.

This is enough for me to conclude that creativity requires more than text-based app, and that even if those services are far from perfect yet, it shouldn’t be enough for most to reach their creative goals & their Adobe subscriptions. Keeping in mind that the company doesn’t just propose the best creative softwares, they also propose an optimized cloud environment for more than just image generation.

More news during the Adobe Summit!

Revenues.

Not much to comment here.

As we saw, revenues are pretty good with a 10% YoY growth & expanding gross margins YoY, while flat QoQ. Operating income is higher YoY mostly due to the acquisition fees & this impacts net income comparison as well. There would be improvement without those either way so data remains good.

In terms of cash, the company closes this quarter with $1.28B of net debt & $2.4B of FCF. They returned $3.25B to shareholders through buybacks & still have $14.4B left on their program, which would allow them to repurchase 7.5% of the company at today’s valuation. Buybacks at today’s price are a very good use of their cash to my opinion, nothing to complain about here.

Guidance.

Here neither as the company reiterated its FY25 guidance.

A low end slightly above 8% YoY revenue growth & 27% EPS growth. Market was disappointed but to be honest, its expectations were that Adobe would raise its guidance so… No comments.

My Take & Valuation.

The quarter is good to my opinion & continues to confirm that text-based prompts won’t disrupt Adobe so soon, while the company continues to propose valuable AI tools themselves in their cloud solution & integrated to their apps, hence more valuable tools.

In terms of valuation, things are getting interesting. The company is actually trading at its lowest multiples in years while fundamentals remain pretty strong to me - I know many continue to disagree there though. Management reiterates a very correct guidance & the actual tariffs mess do not impact their business at all.

I struggle to see why the market would sell off this name besides because of global concerns, unrelated to the company itself. A company that strong fundamentally, trading at lower forward ratios than its industry, is a pretty good opportunity to my opinion.

I am not a buyer in the aggressive portfolio though nor in the buy & hold yet, not because Adobe isn’t interesting but because there are even better companies trading at an attractive price, and I’d rather hold those. But Adobe is in my watchlist & I will attribute liquidity to it in the future as long as fundamentals remain & I do not have better stocks to buy.