Abercrombie & Evolution | Swing Trade

Swing trade argumentation & execution plan for both companies & portfolio review.

As we start the year, I will change a bit my approach to investment cases and will only write them for my biggest convictions. Some companies are meant to be bought and held for the long haul, others sometimes offer great medium-term opportunities but I don’t judge them worth being held for years.

So, going into 2025, I will call the latter swing trades, not investment cases anymore. These will include a review of the fundamentals & financials and a clear execution plan, detailing the how & why of the position.

Knowing that I do not put my money into assets which aren’t "worth it", meaning I will always look at great fundamentals & avoid complete brainless speculation - not that I don’t do brainless speculation, I simply avoid sharing it here. I’m only human & I like the thrills of good speculation.

We’re starting this year with two of them: Abercrombie & Fitch and Evolution AB.

Evolution AB.

Fundamental.

Evolution AB is an online casino software provider, the largest in the market, as they acquired most of their competition over the years. They now sell their services to casinos worldwide.

We are talking about very classic games like electronic roulette, slots, or blackjack, but also less classic like some versions of Monopoly, Deal or No Deal, and other known games like this.

The company has licenses to sell its software around the globe, most importantly in key regions where betting is widely consumed - United States, United Kingdom, Asia at large & countries like Malta or Spain, “party destinations”.

Revenues are pretty well distributed, which means Evolution isn’t impacted by one storng geography, with comparable revenues in Europe & Asiawhile the rest is here but only slowly improving.

Business Model.

The company develops & sell licenses to use their online casino software & take fees based on users’ activity.

“The majority of Evolution’s revenues consist of commission fees and fixed fees for dedicated tables, which are paid monthly by operators. Commission is calculated as a percentage of the operators’ winnings generated via the company’s Live Casino offering. Through commission, Evolution gains beneficial exposure to the general growth of the Live Casino market.”

This is usually the best business model as it benefits from both the need & usage of their software and provides a regular & predictable income stream, while, as the company says itself, allowing them to benefit from the growth of the sector.

Financial.

Evolution has done very well in recent years thanks to its large & growing market share in the sector, its acquisitions & very probably, Covid.

I am no psychologist & won’t go into the social aspects of the business, but data shows an uptick in the consumption of online betting & gaming during the period. Kinda unsurprising & users haven’t lost their betting habits afterward.

The quarterly reports show the same tendency, but Evolution AB had a small bump in H1-24 with lower growth than expected which resulted in a slow sell-off. The next quarter brought correct growth & expectations for Q4-24 seem to point toward a continuation, but this didn’t convince the market - yet.

In terms of balance sheet & cash flow, the company is very healthy with a net debt of €580M and an FCF margin above 55%, mostly due to its strong margins from its software business & a very profitable sector.

Valuation & Price Action.

This is where things get interesting. Up to now, we have a very healthy company with strong market shares in a demanded & growing sector, great financials & balance sheet. A good prospect.

It gets better when we look at valuation.

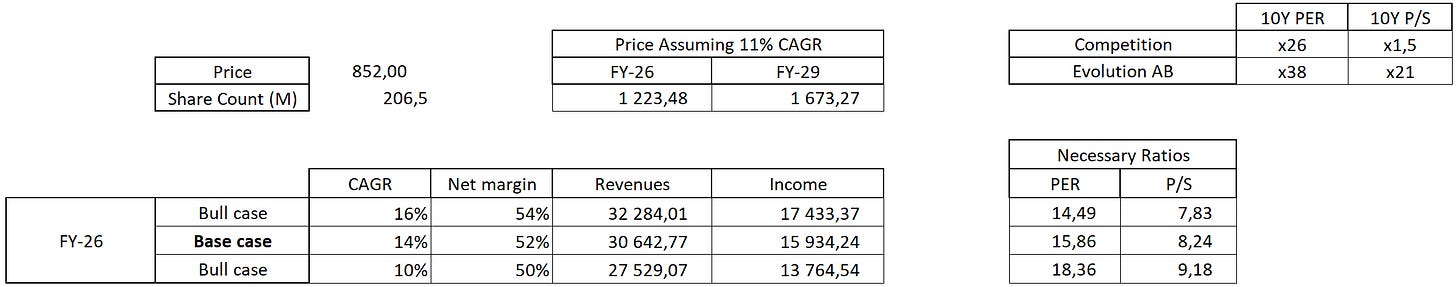

Most analysts expect the company to grow around 14% CAGR over the next 2 years - hence my base case, which would yield us our 11% CAGR if the company trades above 8x sales & 16x earnings, largely under its 10Y average & in line with the industry’s average multiples.

To detail a bit the difference with P/S & PE, competitors include companies which provide online casino software but also betting & physical casino services, with different business models & very different margins.

To my opinion, Evolution AB is around fair valuation at the moment. I wouldn’t call it cheap, but I certainly wouldn’t call it expensive & that is what matters in this case.

Execution.

The stock has been trading for years at pretty high multiples justified by its growth. As usual, the market anticipated and front-ran revenues, which made the stock stagnate for the last few years, time for the fundamental to catch up with the valuation.

And I believe that's where we are today. A great company, optimized, fundamentally sound with great financials. Trading around fair value which coincides with a strong support built through years of ranging.

Expectations are somewhat low after the last quarters & the mood isn't at partying, meaning potential good or even correct results could push the stock higher easily, while it would require really bad results to fall & break this multi-year support - although that, of course, is entirely possible.

But this isn’t a buy & hold situation. This is a swing which requires a plan. My plan would be to buy at market & to hold it through the next months, with invalidation if the stock were to break the support & profit taking if we go back up to that trendline.

We’re talking about a risk ratio above 4.5 with a potential loss around 10% for a potential gain around 45%.

Abercrombie & Fitch.

Fundamental.

An entirely different sector as Abercrombie & Fitch is a retail company focused on clothing, sport & casual, which was known thanks to its marketing strategies.

As you can expect, marketing has changed over the last few years for all the reasons we constantly hear about - inclusivity, body shaming, etc…

They say it themselves.

But it didn’t change the demand for the brand & the post-COVID period has been great for the company. Now present in most countries in the West, their biggest remains the United States, responsible for 75% of their revenues in 2023.

The company owns & operates two main branches, Abercrombie & Hollister, which combined result in around 650 stores, products for everyone - kids, teens, & adults, sportive, casual & chic for a 65/35 ratio of sales between online & offline.

Strong.

Financials.

As for any company in this sector, COVID was a big hit but the post-COVID period has been excellent - as for many other cases, Americans had too much money to spend, so they enjoyed life.

Altogether, financials have been great, and the company is now in its best shape with great growth, strong & expanding margins and growing EPS thanks to a combination of buybacks & financial execution.

The balance sheet is very good with a flatish net debt - including leases, for a positive FCF. A pretty good position altogether.

Valuation & Price Action.

A position which got better a few days ago as the stock tumbled 20% as the company didn’t raise their guidance high enough - true story. This led a strong brand with correct growth & strong finances to trade at very correct ratios.

Guidance for FY-24 is around 15% of growth & the company expects this to continue during 2025. I used lower growth targets to take into consideration the market's view of a potentially weak U.S. consumption - although everything points to the contrary. So, my assumptions are conservative but I wouldn’t call them bearish either. They’re correct.

And those conservative expectations lead to pretty correct ratios needed to reach our 11% CAGR on investment by 2026 - although again, this isn’t my timeframe target. Everything points to a fairly valued stock at the moment, slightly inclined to undervalued.

But again, the opportunity really comes from earlier this week when the stock fell 20% for no valid reason… back to the bottom of its range at the old breakout of its ATH.

The price action is really correct, a simple range depending on the market’s optimism at any given time. As of now, CPI was released lower than expected today and the holidays data have been good, optimistic. So, my personal take is that we could bounce back into optimism, short-term.

Execution.

The thesis is the same as the one shared above for Evolution AB. Great company & brand, strong demand for their products, notably in America, good growth & guidance, strong financials & correct valuation.

I bought in at open with a clear plan. Invalidation comes with a close under $125 or remain too long under the moving average. Profit taking comes at the top of the range for a R:R above 5.5, a potential loss around 5% & gain above 20%.

Conclusion & Portfolio.

I needed liquidity to start the position as I bought the crypto dump of the last weeks with what I had. So I had to cut positions & chose to cut the Chinese, the ones on which I do not have short-term confidence.

It doesn’t mean the investment thesis around Alibaba & the Chinese index changed. It means liquidity is, in my opinion, better in ANF for the next quarter than into Alibaba, as the narrative & liquidity still flow to the American market for now. Gotta be where performance is.

Time for China will come.

Thanks for sharing your impulse to do brainless speculation :p

Feel free to share those on your weeklies!